Continuation From Monday………Unfortunately, Livermore did not follow his own advice and strict trading rules. He claimed that his lack of adherence to his own rules was the main reason for his losses. After losing his billion dollar fortune in the mid 1930’s, he was never able to bounce back. Faced with the prospect of never again recovering his losses and after publicly admitting to his failure, he committed suicide in New York in November of 1940.

Continuation From Monday………Unfortunately, Livermore did not follow his own advice and strict trading rules. He claimed that his lack of adherence to his own rules was the main reason for his losses. After losing his billion dollar fortune in the mid 1930’s, he was never able to bounce back. Faced with the prospect of never again recovering his losses and after publicly admitting to his failure, he committed suicide in New York in November of 1940.

What does any of this have to do with STRESS and associated energies?

Everything. The reason Livermore lost both of his fortunes had very little to do with his abilities as a speculator and everything to do with his emotional state and his inability to control his STRESS energies.

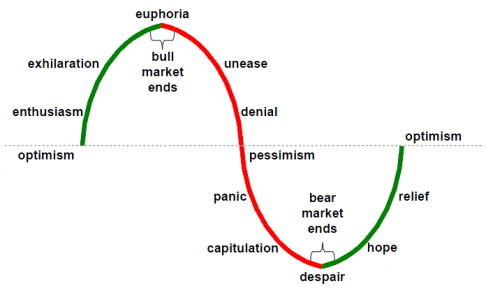

For instance, the example below represents a typical trader’s mindset and various STRESS emotions associated with unsuccessful speculation. Please note, the same STRESS emotions are present in everyone’s life. In one way or another. It is just that the stock market example below gives us the ability to look at the subject matter in a compressed fashion. In other words, while an adverse stock price movement can take 6 hours to play out, your STRESS filled situation at work might take 2 years to play out. Yet, the underlying energies and pressures associated with both are the same.

EXAMPLE: Let’s assume for a second that the chart above represent the movement of the stock (XYZ) over a 15 day period of time. Let’s also assume that a hot shot traded named Jimmy J. has been following this stock for two months. The stock has been doing incredibly well, gaining 50% in value over the last two weeks alone. Jimmy is “exhilarated” as he plunks down a cool million to buy 100,000 shares at $10 each.

- Day 1-5: The stock price goes up another $2 or 20%. Jimmy J. cannot contain himself. He is walking around the office and telling everyone that he just made a sweet $200,000 in 5 days. His ego is overinflated and there is no whiff of STRESS around him. On the contrary, Jimmy is so confident in his stock picking ability that he fancies himself as a genius on par with Einstein.

- Day 6-10: The stock price tops out at $13 a share and begins to decline rapidly. By day 10, the stock price hits $7 a share. Jimmy has now lost $600,000 since the stock topped out and $300,000 of his original capital. Jimmy is now in “denial”. Instead of running around the office and telling everyone how successful he is and what color his new Ferrari will be, Jimmy J. is freaking out. He is stressed out beyond belief. He cannot afford to lose another penny. The amount of pressure, fear and stress he now feels is unreal. After all, Jimmy borrowed that million from a Russian mobster Ivan Petrovich Zubov and he knows all too well what happens to those chumps who do not pay. After double checking his fundamental and technical research Jimmy is sure the market is wrong. Its Friday night, Jimmy J. feels a little bit better as he is now sure the stock price will recover next week.

- Day 11-15: A SEC investigation is announced. The stock price quickly collapses from $7 to $3 a share. Jimmy J panics and then finally sells his position at the bottom or $2 a share. The amount of STRESS & FEAR Jimmy feels at this juncture is unimaginable. After double checking his account, Jimmy is $800,000 in the hole. As he contemplates his next move, his cell phone rings. It’s Ivan Zubov and he needs his money back +50% next week. Jimmy J is so STRESSED by this point that he is now seriously considering one of two options. A quick jump out his 27th story office window or a one way ticket to go live in the mountains of Zimbabwe.

To Be Continued Tomorrow…….(Why Am I Seeing This On A Financial Website?)