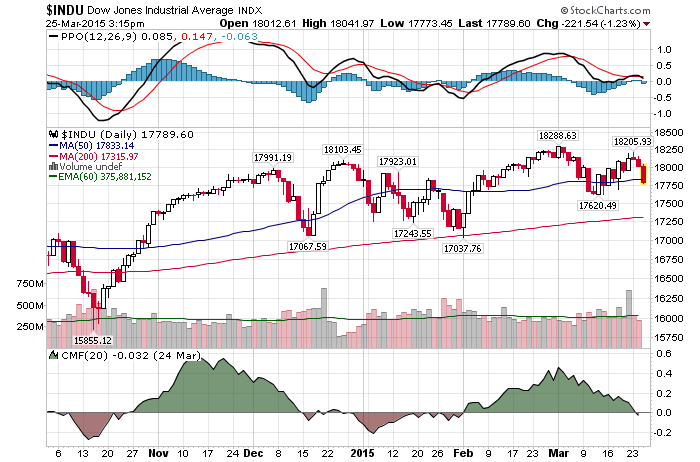

2/25/2015 – A big down day with the Dow Jones down 290 points (1.62%) and the Nasdaq down 118 points (-2.37%).

Jim Stack was fortunate enough to pick the 2009 bottom. Now, the president of InvesTech Research, which is on the Hulbert Financial Digest’s Honor Roll of top newsletters over the past 15 years, and Stack Financial Management, which manages more than $1 billion of investors’ money, believes we are on the verge of a bear market.

Here is what concerns him.

- Rising interest rates,” he explained, “can provide significant headwinds to a bull market,” which he calls “one of the more interest-rate-sensitive bull markets in our lifetime.”

- Margin debt has peaked and begun to fall. “Past peaks in margin debt have led or coincided with the start of past bear markets,” he wrote in InvesTech Research.

- Professional investors are extremely bullish, with bearish sentiment under 14%, “the fewest bears since 1987, just before the crash,” he told me.

- Corporate profits topped out more than a year ago, but S&P 500 earnings per share continued to rise until recently. That discrepancy is often an early-warning sign.

- Although the S&P 500’s current multiple of 19.9 times earnings is slightly below the average when interest rates are below 3%, that will make stocks especially vulnerable when rates do rise. And the median U.S. company trades at its highest valuation of the past 65 years, according to the noted finance scholar Kenneth French of Dartmouth College.

Nothing that I haven’t covered here before, but it nice to hear the same thing from somebody else. The question is, if a bear market does start, how low will it go? Jim suggests the following

A more likely outcome, he said, was for the S&P 500 to retrace about half of its bull market gains. If March 2 was the peak, that would mean it could fall to around 1,400, roughly a 35% decline.

I would say that is a fairly good estimate. And as I have suggested before and despite the fact that I am bearish, I don’t anticipate the markets to collapse as they did in 2007-2009. That was a mid-cycle panic. The upcoming decline will be more reminiscent of 2000-2002 decline on the Dow. Still, it wouldn’t make sense to be long here.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. March 25th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!