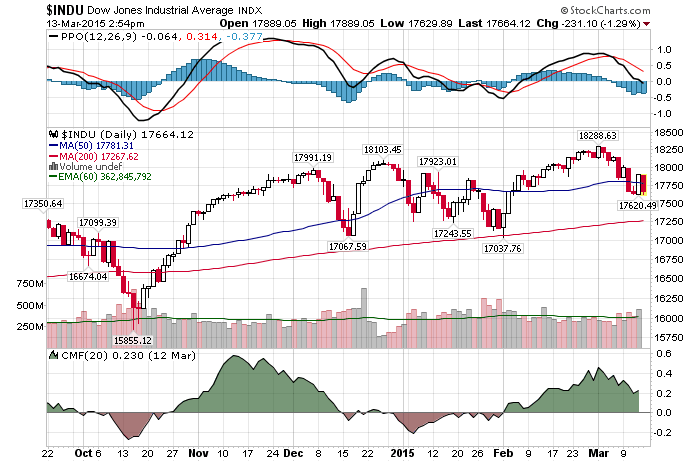

3/13/2015 – A big down day with the Dow Jones down 146 points (-0.81%) points and the Nasdaq down 21 points (-0.44%).

Going into the end of February my subscribers knew that we were facing a major turning point at the Dow 18,320 (+/- 50 points) and that it would occur on February 27th (+/- 1 trading day). If you are wondering, yes, +/- 1 trading day included March 2nd.

My advice was also rather simple, to go short right at the top. The actual top arrived on March 2nd at the Dow 18,285. In the final analysis I have missed it by 15-35 Dow points or 0.08%. Close enough. Since then, the Dow is down -3.7% Are we about to bounce or is this sell-off just getting started? Click Here to find out.

So, how was I able to predict the exact top well in advance?

I use two primary analytic tools and none of them have anything to do with technical analysis, fundamental analysis, quant, Elliot Wave, the Dow theory or the such. My unique mathematical and timing work took me over 10 years of trial and error to develop and I am not even done. Further, it goes well beyond all of the tools mention above. Let me give you an example and its application to March 2nd.

1. Cyclical Composition Of The Stock Market.

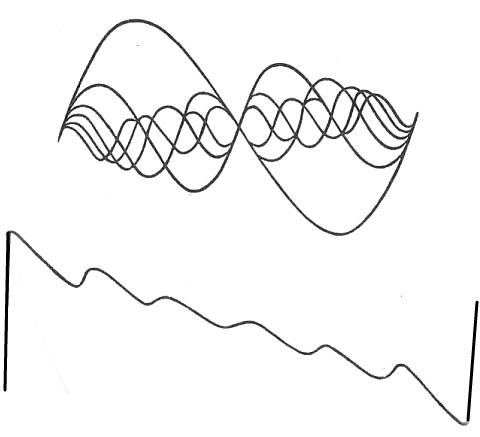

There are at least 50 cycles moving within the stock market at any one time. From long-term cycles spanning 100 years or more to cycles oscillating with 4 minute Intraday periodicity. What we see on a 2-Dimensional Price/Time chart is a shadow of what is really going on behind the scenes.

What we see on the stock chart is the summation of all cycles into a singular composite. As per example above. What complicates the analysis is the fact that these cycles are not continuous. They shift and jump according to their own DNA sequence type of a mechanism. Meaning, it is a dynamic system that needs constant adjustment. However, once you know how these cycles behave and their order, you should be able to predict the stock market with astonishing accuracy.

Now, a number of incredibly important TIME cycles were arriving on February 27th (+/- 1 trading day). That meant the market was likely to top out at that TIME. The next question was….. WHERE?

2. Mathematical Stock Market Composition.

That is where my mathematical work comes in. As I have suggested previously, the stock market has a mathematical structure that it traces out behind the scenes. It is hidden , unless you know exactly what to look for. Again, the market traces out this structure in 3-Dimensional space. Once you know how to measure it, you should be able predict exactly where the next turning point is. I describe the whole process in great detail in my Timed Value book.

For instance, this same work indicated that a powerful point of force was located at the Dow 18,320 (+/- 50 points). In my subsequent communications to my subscribers I have indicated that the exact hit would be at 18,310 and that I would go 100% short at 18,300. The Dow topped out at 18,285 (15 points away) on March 2nd and I went short soon after. It was as simple as that.

Now, the more important question is, are we about to bounce or will this sell-off accelerate down. Click Here to find out. If would you like to learn more about the process I use, you can start with two free chapters from my book Timed Value

Long-term, my work shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. March 13th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!