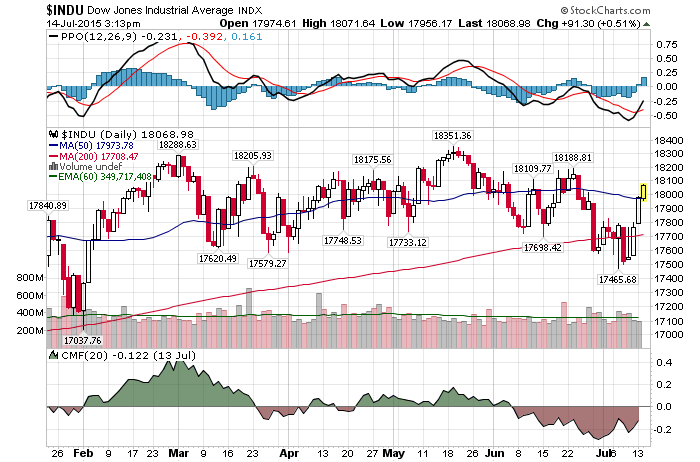

7/14/2015 – A positive day with the Dow Jones up 72 points (+0.42%) and the Nasdaq up 33 points (0.66%).

The stock market continues to perform as per our forecast to subscribers. A massive and rather rapid stock market decline is coming later on this year. And while we won’t have a crash, considering the amount of margin debt out there, quite a few people will get wiped out. If you would like to find out exactly when this move will develop, to the day, please Click Here.

As of today, the FED is facing the following set up.

- Massive stock market, bond market and other asset bubbles.

- Slowing economy and collapsing macro data. We are a stone throws away from an “official” recession. I can argue we are already in one.

- Zero interest rates and limited options to stimulate the economy further.

As a result, the FED has only two options.

- Raise interest rates NOW in order to reload their recession fighting toolkit before the next recession hits. Again, we are nearly there.

- Cancel rate hikes and eventually introduce QE4 to further “stimulate” the economy. Also known as, maintaining financial market stability. This scenario includes postponing interest rate hikes until we are in a recession.

You don’t have to be a genius to figure out which scenario the stock market is betting on. And while it would be prudent for the FED to reload now, in reality, no one really knows what they will do. I don’t think they know.

At the same time, it is a no win situation for the FED. There is no guarantee that the stock market won’t crater even if the FED introduces another round of QE while cancelling interest rate hikes. And I am not the only person who thinks that way.

While most are focused on the risks around a withdrawal of liquidity, we believe the biggest hit to confidence could be the opposite: if another round of US QE is necessary to prop up the economy. While the market could have a knee-jerk rally on an indication of forthcoming stimulus, we think this would likely be short-lived and could end in the red. QE fatigue is already evident: each subsequent round of QE has seen diminishing risk rallies.

Bingo. That’s how complex today’s macro economic setup is. We are at the end of this massive credit expansion cycle and there is nothing that can save this market now. Not even another round of QE. Well, unless the FED goes into a full monetization drive. But that’s entirely another matter.

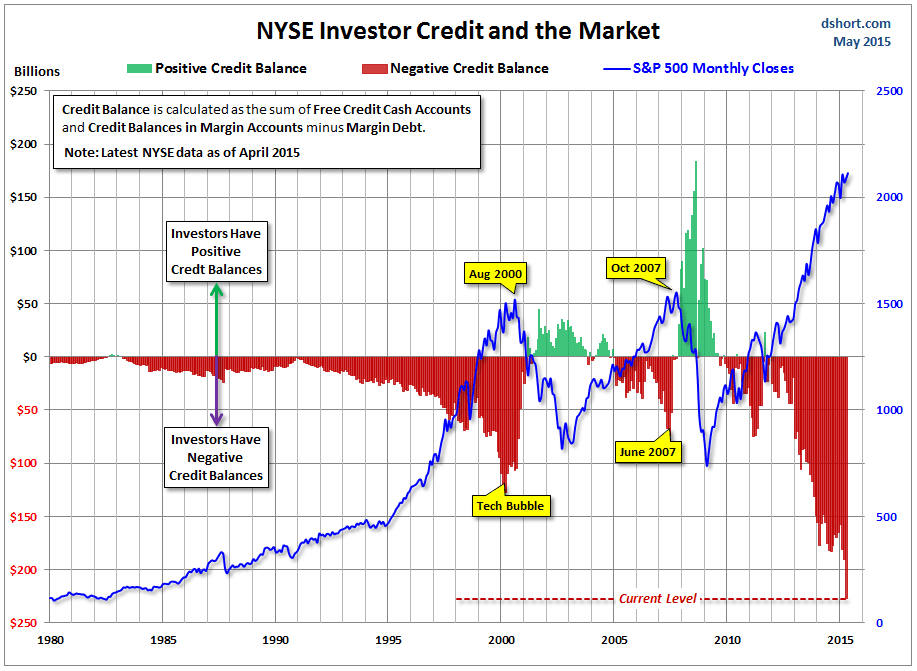

Now, to margin debt. A few weeks ago I displayed this chart of skyrocketing margin debt and why it is yet another bearish indicator. That is to say, most investors are extremely bullish at the precise moment when they shouldn’t be.

Not everyone agrees with my assessment above. Traders are borrowing tons of money to bet on stocks … and it’s just not a big deal

“Margin debt does not, by any statistical measure, lead equity prices. They are, essentially by definition, coincident. As stock prices move higher, outstanding margin debt does as well. If and when stock prices move lower, margin debt will follow.”

While I would have to agree with the statement above, they are looking at the wrong metric. It’s not the fact that margin debt moves in tandem with the stock market, it is the fact this metric is now 33% higher than at 2000 and 2007 tops. All while the stock market hasn’t gone anywhere over the last 12 months (NYSE). In other words, the market is storing a tremendous amount of fuel for a correction. And given how much margin debt is out there, any such correction can very quickly turn into a violent sell-off.

Further, I would have to agree with the following sentiment. The stock market is becoming a ‘lose-lose’ situation

Investors are in the grip of “Stockholm syndrome” because there is a trust that central bankers don’t want to hurt markets, which more or less forces investors to maintain a “risk-on” positioning, buying things like stocks and lower-rated bonds.

I couldn’t agree more. I continue to maintain that this is the worst trade out there today. The problem is, everyone is in it. By the time most investors realize the FED is not in control and cannot backstop the market, it will be too late. At least 50% of the down move will be over by that point. Oh well….

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. July 14th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!