Take a look at this Nikkei 225 stock chart. The index is still 50% down from its top 25 years ago. In the past I have identified two even longer periods within the US stock market when inflation adjusted returns remained at zero. That is, 1790 to 1860, a 70 year period of time and 1899 to 1949, a 50 year market cycle.

That would be incomprehensible to most investors today. For instance, take a look at this typical write up of how 50% of Americans are somehow missing out on this magical wealth generating engine that is the stock market.

More Than Half of All Americans Could Be Set Up for Financial Disappointment — Here’s Why

More than half of Americans are set up for financial disappointment According to the Money Pulse survey released in April by Bankrate, a whopping 52% of adult Americans don’t have a single cent invested in the stock market. This includes individual stocks as well as stock-based investments such as a mutual fund.

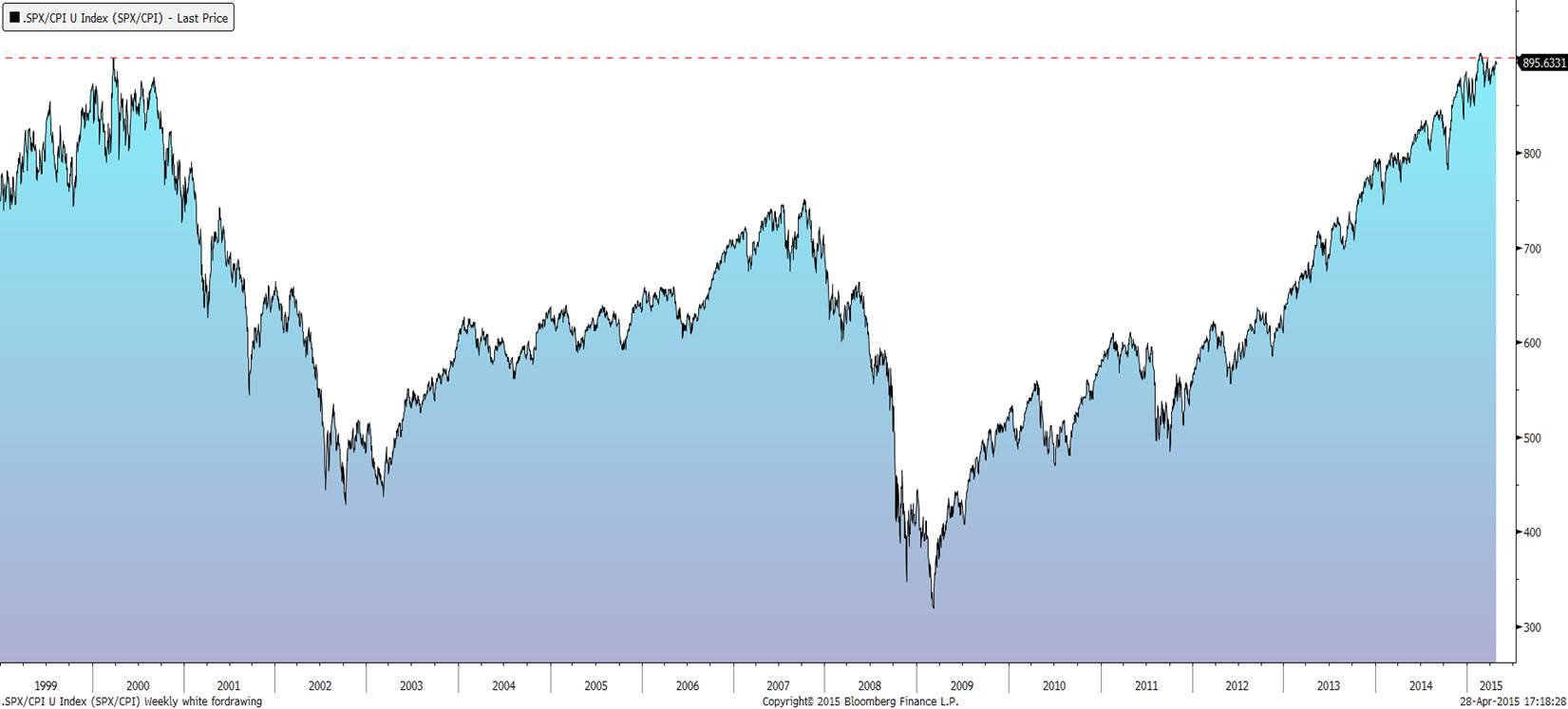

I would argue that they the smart ones, not the other way around. Take a look at the S&P chart below. That is an inflation adjusted return since 2000 or lack thereof. What’s worse, we are on a verge the next bear leg.

So, instead of trying to scare people into the stock market, financial professionals should spend more time on minimizing risk the “unlucky” 50% are about to suffer. If you would be interested in learning exactly when this bear market will start, please Click Here

Dispelling The Myth Of Long-Term Stock Market Prosperity Google