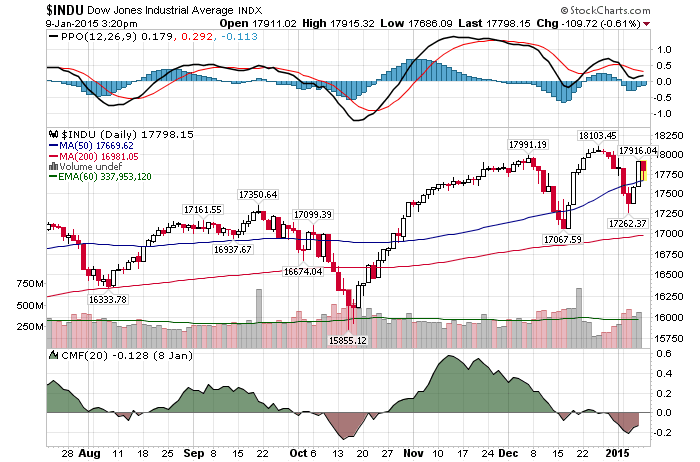

1/9/2014 – A down day with the Dow Jones down 170 points (-0.95%) and the Nasdaq down 32 points (-0.68%).

Despite the massive rally from Tuesday’s bottom, the Dow ended the week 90 points lower.

Plus, a lot of important stuff to consider over the weekend as we prepare for what happens next. Let’s start with….

Stocks Aren’t Done Getting Crushed

A fairly good look at the markets with one message to drive home. If you still believe that every sell-off is a buying opportunity you might want to reconsider. The sell-offs have been getting progressively larger. By about 250 points on the Dow. All while the Dow hasn’t really gone anywhere since the middle of September.

Stephen Roach Discusses Interest Rates & FED Stupidity.

Watch the video above as it is definitely worth your time. I couldn’t agree more. What the FED has done over the last 10-15 years is borderline criminal. It is unfortunate, but we now exit in an artificial environment where capital is being miss allocated on a massive scale while the stock market enjoys bubble level speculative valuations. An environment where any FED official can launch a massive stock market rally just by opening their mouth. And if you don’t think this will backfire, just as it did in 2000 and 2008, you are living in a fantasy land.

On the flip side…...Fed pays record $98.7 bn in profits to US Treasury

It’s a nice business model if you can get in on it. Print money out of thin air and buy assets at liquidation level prices. Sign me up. Still, this sort of intervention will never work. The amount of distortion in our economic system today is a clear evidence of that. An upcoming massive bear market in equities will be the eventual outcome.

Finally and for a good laugh 35% of workers say they’ll quit if they don’t get a raise

Yeah, good luck with that. Despite mainstream media’s propaganda of a red hot jobs market, a closer look at today’s jobs report reveals a completely different picture. Mostly due to the economic miss management by FED discussed above. Let’s take a closer look.

Hourly earnings plunged by 0.2% in December (a significant move) and it is estimated that about 75% out of 250,000 newly created jobs were in the low paying service related industries. Throw in a 38 year low for labor participation rate and this job report begins to stink. Particularly if you consider massive liquidity perpetuated by the FED. In other words, it’s not going to get better and good luck with that whole raise, quitting and eventual unemployment.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. January 9th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!