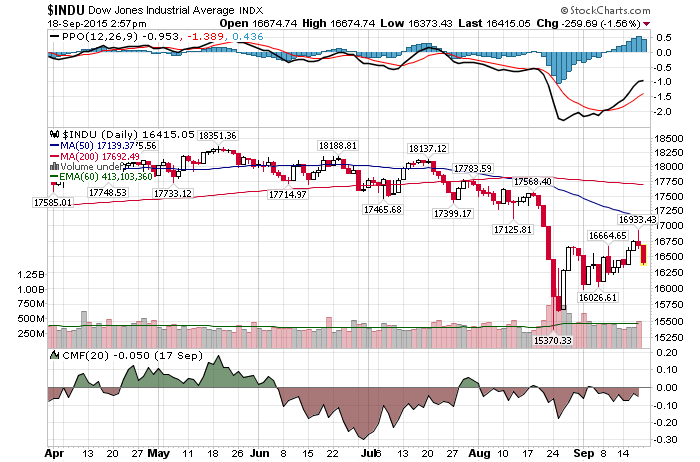

9/18/2015 – A big down day with the Dow Jones down 292 points (-1.75%) and the Nasdaq down 67 points (-1.36%)

As you already know by now, the FED has refused to raise interest rates. Further and thus far, most investors and financial expects assume one of two scenarios

- Due to this loose monetary policy and the possibility of further easing, the stock market will stage a massive rally.

- We will remain in this range bound market until the Economy improves and the FED is forced to raise rates. The stock market will eventually push higher (there are a number of variations of this scenario).

Yet, there is another possibility that no one is talking about. As far as I know.

- The Fed’s refusal to raise interest rates will lead to an outright crash.

Let’s explore this a little bit further. You will certainly find Jim Cramer in the “Massive Market Rally” camp. Cramer: Phew! Fed gets it. Prepare for high prices This is a reasonable view and that is how at least 75% of market participants view today’s environment. I encourage you to at least review this outlook.

And since no one cares about a trading range, let’s explore our last scenario or the possibility of a market crash.

Immediately, a question comes up. Why would the market crash if the FED continues on with their “easy” monetary policy, even suggesting that the rates might go negative if they have to? Plus, there is always QE-4…..

I can give you at least four reasons.

- The stock market is massively overpriced. Still. Only 1929 and 2000 Nasdaq tops were higher. I have outlined this notion on this blog a number of times before. Click Here for one of the previous articles.

- The US Economy is rolling over into a recession while interest rates are at ZERO. This is the worst possible case for the FED. What are they going to do now since everything has failed? All of their credit cards are already maxed out. Another round of QE? Negative interest rates? Sure, maybe. But don’t expect such steps to have a net positive impact. They have already taken this Ferrari (the US Economy) to its speed limit and any further attempt to go faster might result in an engine blow out. Well, unless the idiots in power go the route of an all out monetization.

- The FED is losing credibility.

- Investors are beginning to realize all of the above.

Let me put it this way. Today’s stock market is like a 40ft container full of TNT with a lit fuse disappearing inside of it. Will it go off? That is anyone’s guess. Two cases were presented above. One calls for new all time highs while the other explores the possibility of an all out market crash. Perhaps the truth is somewhere in between. Perhaps not. That is for you to decide.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. September 18th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Can The Stock Market Crash Due To The FED’s Inability To Raise Interest Rates? Google

One Reply to “Can The Stock Market Crash Due To The FED’s Inability To Raise Interest Rates?”

Comments are closed.