3/15/2016 – A mixed day with the Dow Jones up 22 points (+0.13%) and the Nasdaq down 22 points (-0.45%)

It’s a little odd that the master himself, Warren Buffett, wasn’t able to answer the question, but we do find ourselves in a very complex market environment. With most traders and investors having a reasonable argument for whatever case may come into their minds. Before we get to Mr. Buffett let’s explore some of them.

Here’s the 2-hour bar chart of the SPDR S&P 500 ETF Trust (SPY) , an exchange-traded fund that tracks the benchmark S&P 500 index. It has been rising strongly since the February double bottom at $181, which was also the low of Jan. 20. The problem, from a pattern-recognition perspective, which is something we monitor in ourlive-market Trading Room, is that after a huge double bottom, the historic expectation would be for a monster rally that conforms to the guidelines of Elliott Wave theory (a five-wave rise with orthodox intrawave symmetry).

A very good look at the subject matter indeed. Now…..

Demand for U.S. shares among companies and individuals is diverging at a rate that may be without precedent, another sign of how crucial buybacks are in propping up the bull market as it enters its eighth year.

This shouldn’t come as a surprise. We have talked about this before. I can tell you one thing, I am certainly not buying anything at today’s levels.

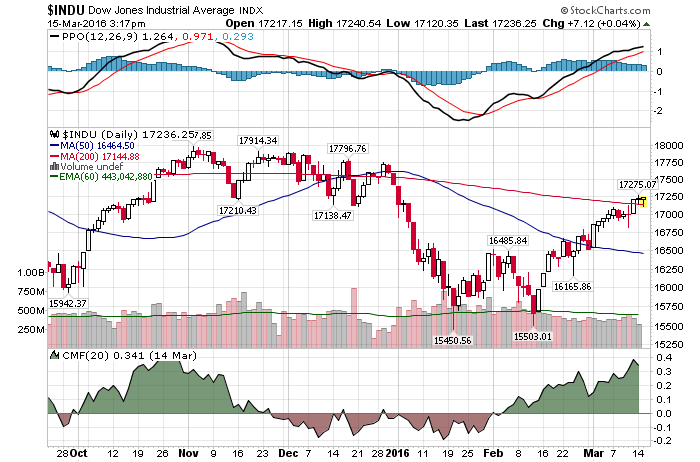

After a huge market rout this year that sent stocks tumbling, the S&P 500 (INDEX: .SPX) has regained the majority of its losses and is down only 1 percent year to date. Now, as the S&P approaches its 200-day moving average, its ability to break above that technical resistance will determine whether or not stocks can keep gaining ground, said Craig Johnson of Piper Jaffray.

I couldn’t agree more. Another good look at the market. And finally……

When you have a sound premise, you may also have a “This can’t go wrong” mentality. And when you add money to that equation, the price action quickly takes over. Bubbles continue to be obvious only in hindsight, largely because something based on a “sound premise” surely couldn’t be a bubble. Unfortunately in the markets, a premise is sound until it isn’t.

I very good look at the subject matter, but I find it interesting that Mr. Buffett does not identify today’s market environment as a bubble. Further, his premise that bubbles can only be identified in hindsight is a false one. Plenty of people, including your truly, have been able to identify both the 2000 tech and 2007 mortgage/real estate bubbles.

And I assure you, we are in one today. Call it the “FED Bubble”, “Criminal Monetary Policy Bubble”, “QE Bubble” or what have you, but we are in one. Today’s extreme valuation levels, as I have illustrated here over the last few days, clearly point to that conclusion. In other words, it might be time to expect the worst.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. March 15th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!