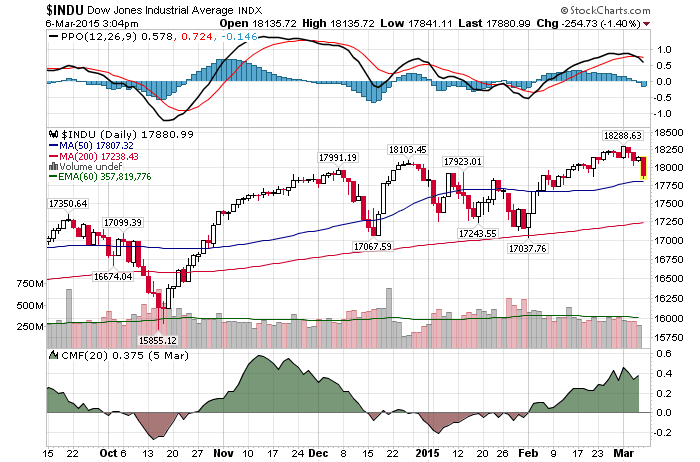

3/6/2015 – A big down day with the Dow Jones down 280 points (-1.54%) and the Nasdaq down 55 points (-1.11%)

I have been warning everyone since last week that low volatility at the time was coming to an end. We are starting to see the evidence of that this week. In fact, the stock market continues to perform exactly as forecasted (for our premium subscribers). If you would like to find out what happens next, please Click Here.

In the meantime, big/smart money continues to warn investors. As I do.

Ray Dalio, billionaire investor and founder of Bridgewater Associates states,

“It’s the end of the supercycle. It’s the end of the great debt cycle. Central banks have largely lost their power to ease… We now have a situation in which we have largely no spreads and so as a result the transmission mechanism of monetary policy will be less effective. This is a big thing… So I worry on the downside ’cause the downside will come.

Let me put it this way. The only thing that stands between investors and an outright market collapse is misguided faith in the FED. In their ability to control the economy and markets. I wouldn’t want to be in that situation.

“Corporate debt was $3.5 trillion– in 2007, arguably a period and– many would describe as bubbly. It’s 7 trillion now. So it’s gone from 3.5 trillion to 7 trillion. As you know, most of that mix has been in more highly leveraged stuff, Covenant-Lite loans– high yield, that’s where the majority of the rise has been. And if you look at corporations have been using it for, it’s all financial engineering.” -Stan Druckenmiller

Again, this is scary. Borrowing money and then buying your own inflated stock in share buybacks to perpetuate the cycle of speculation is insanity. Yet, that is exactly what most corporates are doing today. In other words, this is just a legal way of getting a Ponzi Scheme going. There is no other way to describe it. The consequences will be felt and seen as soon as the tide goes out.

“In the past 20 to 30 years, credit has grown to such an extreme globally that debt levels and the ability to service that debt are at risk, relative to the private investment world. Why doesn’t the debt supercycle keep expanding? Because there are limits. The implications are much lower growth, less inflation, lower interest rates, and less profit growth. We brought consumption forward and issued one giant credit card for the past 30 years. Now the bill is coming due. Investors need to get used to low returns, and low growth, inflation, and interest rates for a long time” – Bill Gross

BINGO. I couldn’t agree more. Yes, that probably means that you won’t see the Dow 20K or the S&P 2,500 for quite some time. Perhaps decades. Impossible? Here is a history lesson for you. Between 1897 and 1949, yes a 52 year period of time, the Dow compounded at less than 2% per year and below the rate of inflation. Don’t for a second think that this scenario cannot happen again.

“Notably, equities are not well supported by current valuations, while monetary policy is limited by high debt levels and interest rates that are already close to zero. We are now faced with a geopolitical situation as dangerous as any we have faced since World War II” – Lord Rothschild

Not only are our financial markets in a bubble territory, the current US Administration is hell bent on starting a war with Russia. As a result, invest accordingly.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. March 6th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Big/Smart Money Is Warning You About Upcoming Market Collapse. Are You Listening? Google