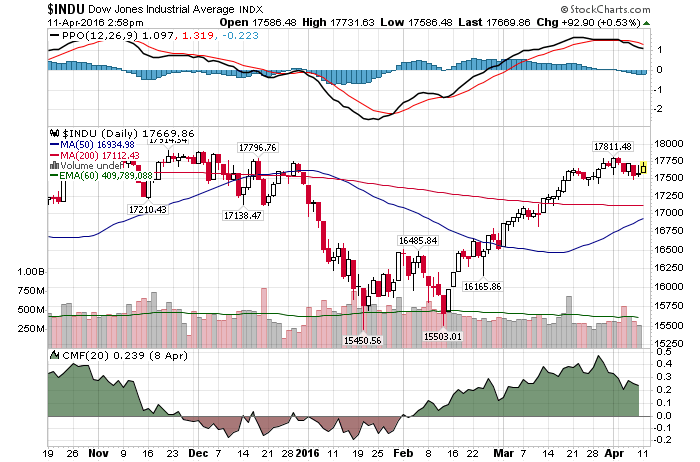

4/11/2016 – A negative day with the Dow Jones down 20 points (-0.11%) and the Nasdaq down 17 points (-0.36%).

According to the mainstream media the market is about to surge higher. No matter what the Q-1 earnings are. In fact, the worse these earnings are, the higher we will go…..

- Earnings season will be awful — Here are 2 reasons why you shouldn’t panic

- Standby for terrible news from Wall Street …

“With the big fall in oil and big dollar appreciation behind us and with manufacturing ISM rebounding there are good reasons to believe that the slowdown in S&P500 earnings is temporary and we should over the coming quarters see a rebound is overall earnings,” Slok said in an email on Sunday. “So yes, earnings have been slowing but given the turnaround in oil and the dollar, earnings are likely to accelerate again over the coming quarters.”

I have to admit, in their own twisted way, their login appears to be solid. If the earnings are not as bad, if the forward guidance is positive, if the bad news is out, etc….stocks are likely to accelerate to the upside.

That is true. Yet, here are a few more considerations we have to add into the mix….

- GAAP earnings are already down 18% from a year ago. Thus far, the stock market hasn’t priced that in.

- There no evidence that either earnings or the US Economy are about to improve. Oil, USD or not. On the contrary, a solid argument can be made that we are at a major deceleration point.

- I doubt very many companies will issue positive or aggressive guidance in today’s market environment. They are likely to guide down again.

- With Shiller’s Adjusted S&P P/E is at 26, the market is priced for perfection. To say the least.

When we drop all of the above into the Q-1 earnings mix, a different picture emerges. While it is entirely possible the market will rally, it is just as likely the market will snap back in a violent fashion to cover today’s massive “earnings Vs. valuations” divergence. Invest accordingly.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 11th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!