Our Subscriber section clearly states whether or not we have seen a major top in the stock market.

Now, most people in the financial world would argue that such projections are impossible due to a complex association between fundamental inputs and their subsequent impact on the stock market (or individual stocks). From our experience, this is view is equivalent to the proverbial “putting the cart before the horse”.

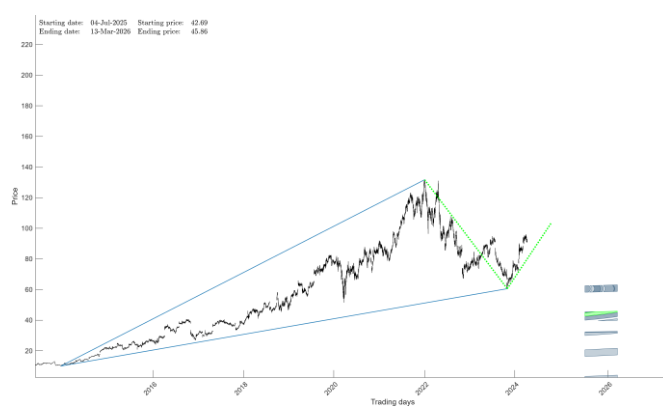

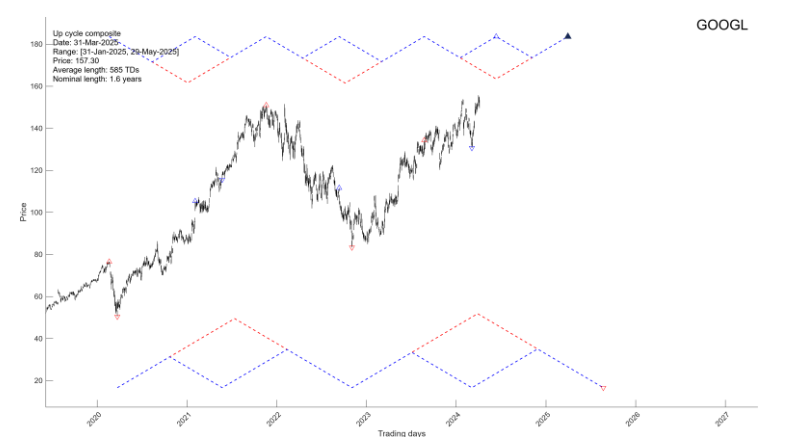

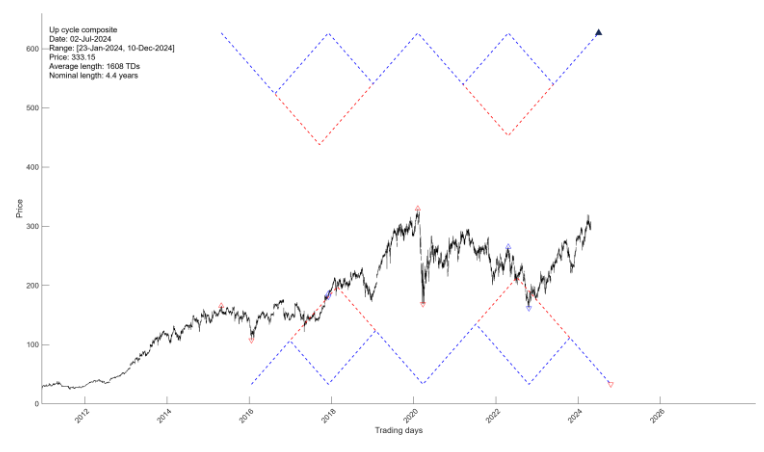

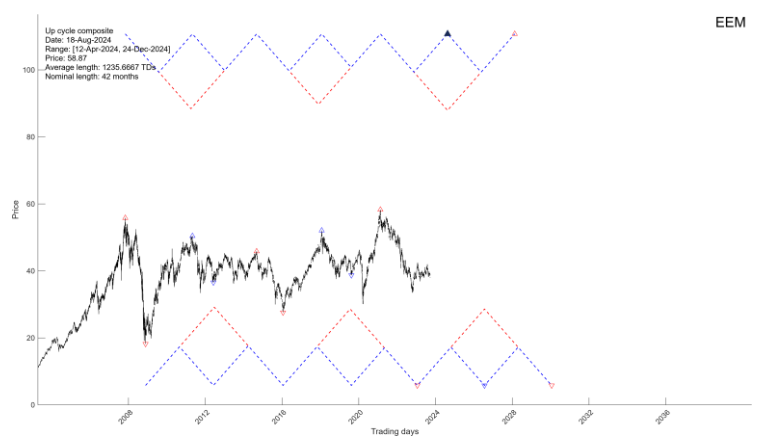

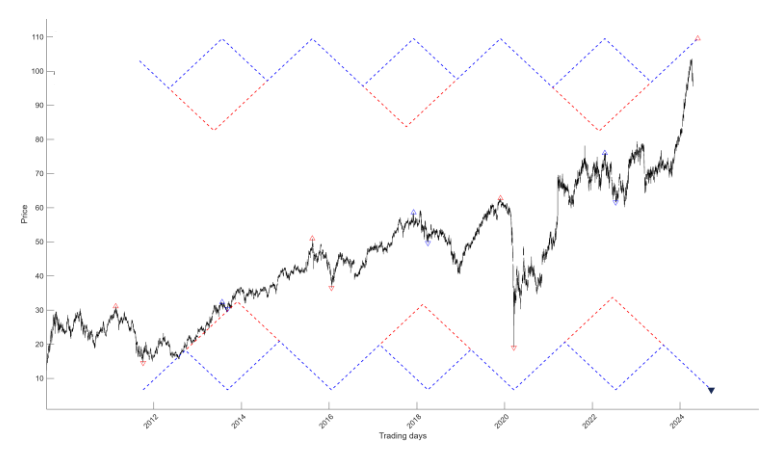

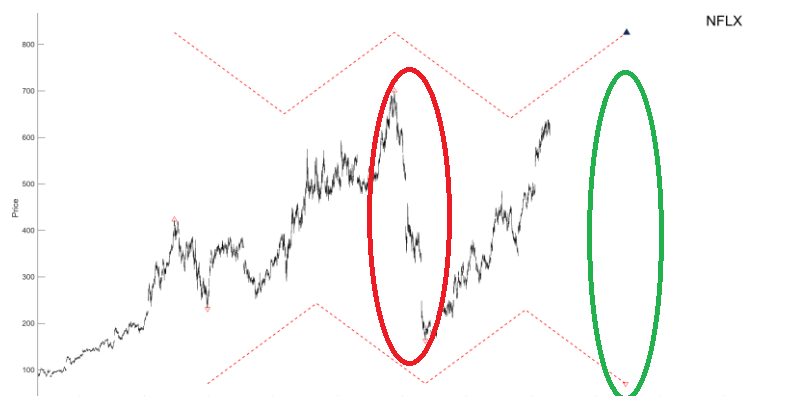

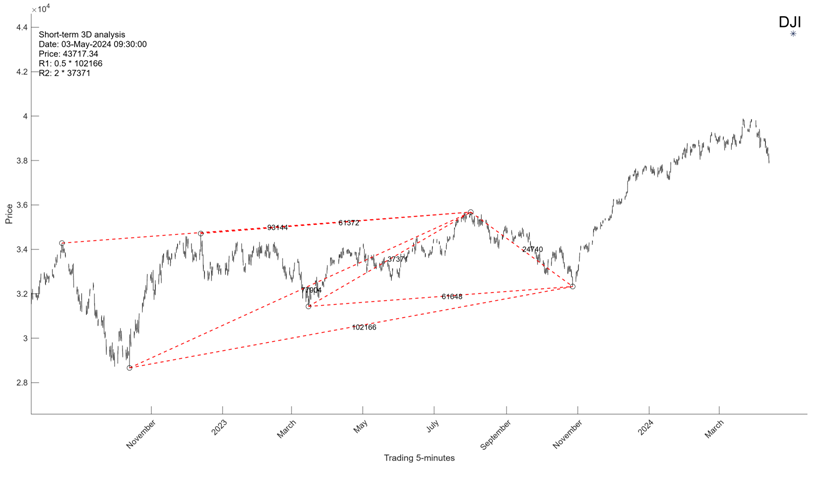

Allow me to explain. Every individual stock, commodity, market, etc… has a certain “DNA” type mathematical sequence associated with it. Further, just as every individual has a unique DNA sequence, so does every individual stock. Now, if you apply certain mathematical principals you can decode this sequencing and make exact future time/price projections.

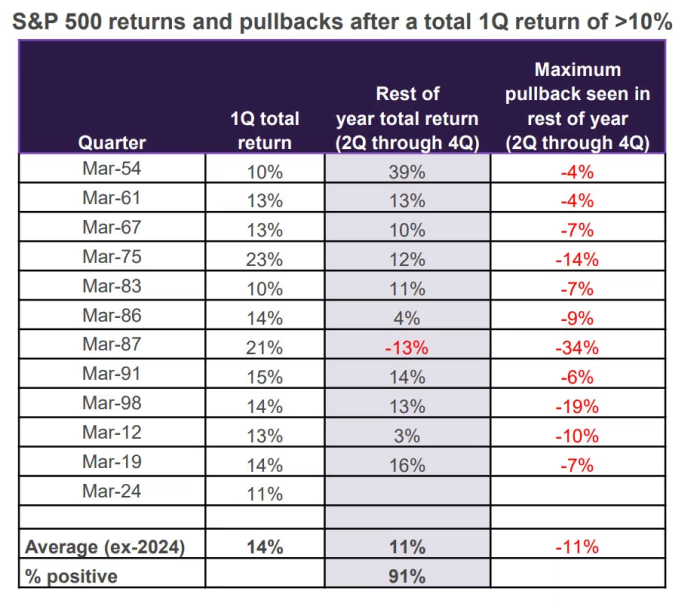

This week’s market action is a perfect illustration of that. Most money managers following traditional fundamental and technical metrics would argue that “no one could have seen this coming”. I mean, who would have have guessed a few weeks ago that Iran would strike Israel. Obviously, this unforeseen event and its macro impact is the primary reason behind this most recent sell-off. At least according to the MSM. Right?

Wrong.

First, the stock market XXXX. Then, things began to happen in the “real world” that were interpreted as fundamental drivers behind this recent move. Yet, these fundamental events are secondary at best. We all know the feeling of utter frustration when the underlying stock moves in the opposite direction of its fundamental driver. You see, this is caused by the underlying stock tracing out its mathematical composition as its primary and not acting on its secondary fundamental/technical factors.

Let me give you a few market examples. We have been saying for a long time that Crude Light has bottomed, Gold is about to run and the US Dollar will go to an all time high. All of this was based on our mathematical work identifying important tops/bottoms. Yet, only now do various fundamentals are showing up to confirm these projections.

Another example………At the moment of conception, your DNA structure already has the imprint of your entire development cycle. Outside of a few slightly impactful environmental factors, your DNA structure has already predetermined your height, hair/eye color, what you will look like at 20, 40 or 80, etc…… You get the idea. It has been coded into existence and now it is just a matter of time before it unfolds.

.

The overall stock market and individual stocks work in exactly the same fashion. Each stock moves in 3D Space, tracing out its own DNA sequence while the shadow representation of its true nature/moves are being portrayed on a 2D chart.

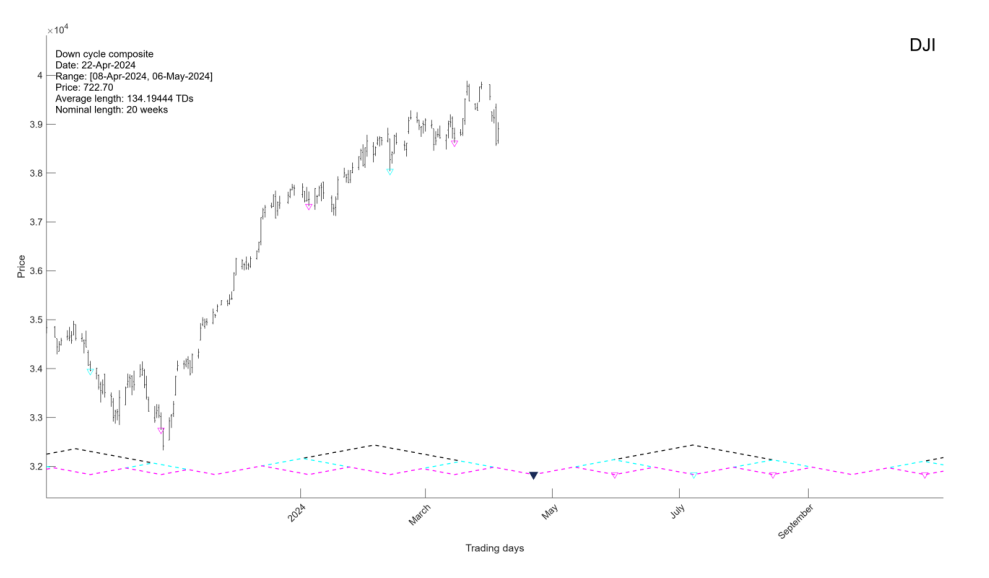

That’s what we have been concentrating most of our work over the past few years. Sequencing this work and developing tools that would shed light on upcoming turning points in both price and time. As to the latter we have incredibly excited news. Over the past few months we have made a number of programming breakthroughs that allows us to computerize the entire process. Not only that, we can now overlay the entire process with the layer of AI. More on that next week as this e-mail is quickly turning into a small book.

Meanwhile, if you would like to find out exactly what the stock market will do next, please Click Here

Our daily report for the Dow Jones Intraday analysis has been posted. To see it, please

Our daily report for the Dow Jones Intraday analysis has been posted. To see it, please

Our daily report for the Dow Jones Intraday analysis has been posted. To see it, please

Our daily report for the Dow Jones Intraday analysis has been posted. To see it, please