Is The FED Planning To Abolish Cash?

In an attempt to gain complete control of our financial system the FED needs an additional tool. The ability to set negative interest rates in order to tax the currency. We might as well be a stone throws away from someone at the FED actually proposing this notion as CITI’s own economist believe it’s a splendid idea.

In an attempt to gain complete control of our financial system the FED needs an additional tool. The ability to set negative interest rates in order to tax the currency. We might as well be a stone throws away from someone at the FED actually proposing this notion as CITI’s own economist believe it’s a splendid idea.

Citi Economist Says It Might Be Time to Abolish Cash

Their plan entails…..

- Abolishing currency.

- Taxing currency.

- Removing the fixed exchange rate between currency and central bank reserves/deposits.

I am truly speechless here. Apparently it is not enough that we are already suffering through the worst FED induced Ponzi Scheme in human history. They now want the FED to abolish cash in order to induce negative interest rates. To fight deflation, to induce even larger asset bubbles, to gain full control control of the population, etc…

Just imagine how high the stock market will go if the fools above are able to set interest rates at, let’s say, -6%. Yet, as we are about to find out, the bigger the bubbles the bigger the eventual consequences will be. You cannot rewrite the laws of physics and that is precisely what they are trying to do here.

Perhaps I will end this with the following statement, echoing the NRA. I just hope that most Americans are smart enough to realize the same.

I’ll give you my cash when you pry it from my cold, dead hands.

Why The FED Has No Clue

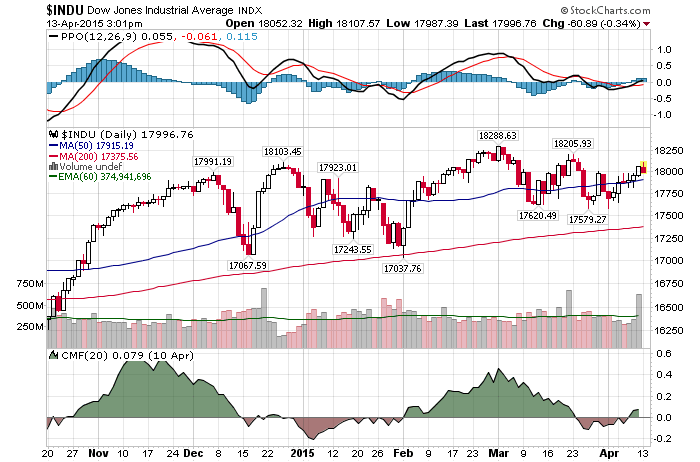

4/13/2015 – A down day with the Dow Jones down 81 points (-0.45%) and the Nasdaq down 8 points (-0.15%).

The stock market continues to behave as forecasted. If you would like to find out what happens next, please Click Here.

Despite the appearance of having complete control over our financial markets, the FED might lose that power of perception fairly soon. And once the FED trade goes, the markets should implode. I have long argued that the FED has no idea of where we are and what their reckless QE and zero interest rate policy has done. Case and point…..

Exclusive: Fed’s Williams sees less risk of rate retreat after lift-off

“So even if the economy got some bad shocks, really you are probably just talking about flattening that path out a bit, or maybe raising rates more slowly.”

Economic lift-off……what economic lift-off? See, I told you they were clueless. Over the last few months I have presented at least a dozen data points showing that the US Economy is rolling over and accelerating down. (Ex: chart below). Plus, forward earnings and guidance are expected to be adjusted lower due to the strong dollar and the same economic issues. We should see the evidence of that in Q-1 reports.

Finally, no matter what the FED says, asset bubbles do not translate to strong economic growth. The view Mr. Williams has is identical to the view Mr. Bernanke held in Q-1 of 2008. As the FED minutes revealed, Mr. Bernanke was concerned about overheating the economy and the housing sector. The 2007-2009 bear market was pushing into its 6th month by that point.

That is to say, don’t rely on the FED to make your investment decisions. And if you do, you will pay dearly for it.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 13th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Druckenmiller: Time To Bet Against The FED To Earn Huge Returns

Stan Druckenmiller made over $1 Billion by betting against the bank of England with George Soros in the early 1990’s. In other words, when he talks, you better pay attention. And what does he have to say today? The exact same thing I have been yapping on this blog for quite a while now.

I know it’s so tempting to go ahead and make investments and it looks good for today,” the retired founder of Duquense Capital Management said, “but when this thing ends, because we’ve had speculation, we’ve had money building up four to six years in terms of a risk pattern, I think it could end very badly.

There is nothing more deflationary than creating a phony asset bubble, having a bunch of investors plow into it and then having it pop.

I feel more like it was in ’04 when every bone in my body said this is a bad risk/reward, but I can’t figure out how it’s going to end. I just know it’s going to end badly, and a year and a half later we figure out it was housing and subprime. I feel the same way now.

When you have zero money for so long, the marginal benefits you get through consumption greatly diminish, but there’s one thing that doesn’t diminish, which is unintended consequences.

When this thing ends, because we’ve had speculation, we’ve had money building up for four to six years, in terms of a risk pattern, I think it could end very badly.

Then again, feel free to listen to your Charles Schwab financial adviser and go long on margin.

Druckenmiller: Time To Bet Against The FED To Earn Huge Returns Google

Shocking: The Same Price Buys You Either A 9 Bedroom Castle Or A 1 Br Apartment

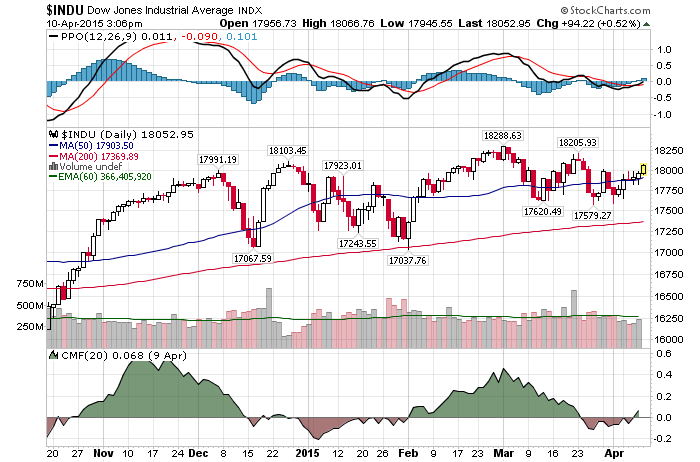

4/10/2015 – Another positive day with the Dow Jones up 99 points (+0.55%) and the Nasdaq up 21 points (+0.43%).

The market continues to behave as forecasted. If you would like to find out what happens next, please Click Here. A lot of stuff to to cover this Friday.

First, here is a question……for the same amount of money, would you buy a 9 Br Castle in France or a 1 Br crappy apartment with no balcony in Sydney?

Don’t for a second think that I have forgotten about our persisting Real Estate bubble. Nothing new on that front. The dead cat bounce off of 2010-2011 bottom is now over, the market is rolling over and it will accelerate down over the next 5 years. Most likely in conjunction with the upcoming recession and a bear market in equities. Our friend MISH has a jaw dropping post on 10 French Castles that are Cheaper than Sydney Units. Check it out.

Second, Einhorn Says Too Much Easy Money Is Holding Back U.S. Economy

Greenlight Capital’s Einhorn makes his point by discussing the pros and cons of jelly donuts. “My point is that you can have too much of a good thing and overdoses are destructive. Chairman Bernanke is presently force-feeding us what seems like the 36th Jelly Donut of easy money and wondering why it isn’t giving us energy or making us feel better. Instead of a robust recovery, the economy continues to be sluggish. Last year, when asked why his measures weren’t working, he suggested it was “bad luck.”

The problem is, the damage has already been done and it is now impossible to avoid the consequences. In this case, the consequences being a severe bear market in equities and a deep recession within the US Economy. Current weakness and collapsing economic variables, despite zero interest rates and a massive liquidity infusion, is a clear evidence of that.

Finally, Dimon, now Summers: There’s a liquidity problem

Both Dimon and Summers believe there might be a liquidity problem in the bond market. An issue that concerns both of them very much. I am beginning to hear anecdotal evidence that is the case within the stock market as well. While my positions are not large enough to trigger liquidity concerns, some of the bigger guys out there are starting to have problems liquidating their postions.

Or so I hear. In terms of press, Crispin Odey of Odey Asset Management talks about just that in The Secret Behind This Hedge Fund Manager’s Market Collapse Prediction. That is to say, should the market start a significant decline, we might see liquidity vanish overnight. We saw a little bit of that in October of 2014. Point being, if/when things get ugly, they will get ugly fast.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 10th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Shocking: The Same Price Buys You Either A 9 Bedroom Castle Or 1 Bedroom Apartment Google

Good Luck Finding Something To Invest In

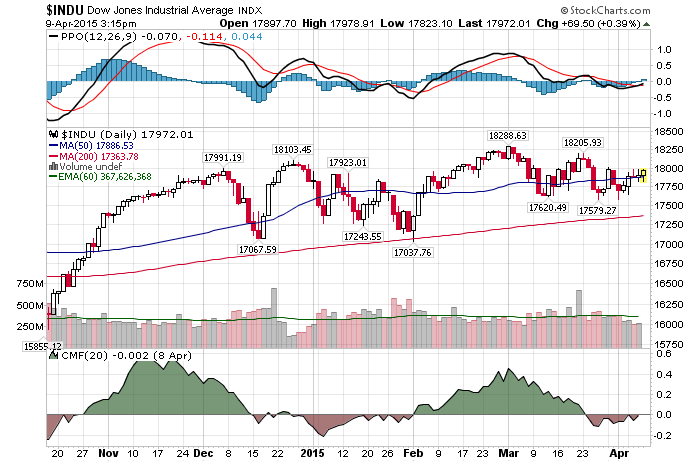

4/09/2015 – A positive day with the Dow Jones up 56 points (+0.31%) and the Nasdaq up 24 points (+0.48%).

4/09/2015 – A positive day with the Dow Jones up 56 points (+0.31%) and the Nasdaq up 24 points (+0.48%).

The stock market continues to behave as forecasted. If you would like to find out what happens next, please Click Here.

I continue on with my relentless drive to suggest that today’s market environment is about as close to 2000 and 2007 tops as one can get. And just as back then, very few people are listening or paying attention. Today’s analysis deals with the lack of investment opportunities. (take a look at the article….it is worth 2 minutes of your time).

Managers say they haven’t changed, the market has. The easy money climate of near-zero interest rates engineered by the Federal Reserve has artificially inflated prices of lower-quality U.S. stocks, they say, punishing those who focus on businesses with the best fundamentals. At the same time, the relentless climb of prices across equity markets has left them with few chances to sniff out bargains or show what they can do in more-volatile times.

“In straight-up markets you don’t need active managers,” D’Alelio said in a telephone interview. “If the next five years are the same, there won’t be any active managers left.”

Not only do I agree and sympathize with the sentiment above, I find myself in the same boat. There is nothing to invest in. Now, pay attention. I didn’t say to “speculate in”, I have said “to invest in”.

Proper investing demands initial undervaluation in growth or value as a starting point. With most stock being excessively overvalued, finding a reasonably priced investment opportunity at this juncture is just about as tough as finding Hillary Clinton’s lost emails.

At least at 2000 top most of the money flowed into technology and there were a multitude of cheap and unknown investment opportunities laying by the way side. That is not the case today. Everything, and I mean everything has been driven up to excessive levels. We all know how this ends.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. February 24th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Why Apple (AAPL) Watch Will Be A Disaster

While Apple’s growth remains incredibly strong for the time being (iPhones, iPads, etc..), I have a few questions for Apple (AAPL) investors…..

- How long before investors realize that Apple Watch is a complete failure?

- Further, how much of a haircut will Apple stock get once investors realize that Apple’s innovative drive died with Steve Jobs?

Apple Watch….give me a break. Watch the video below. While intended as a promotional piece, it outlines every single reason as to why most people will not get it. Conversation starter….good at filtering……sure, and some guy from Nigeria just told me that my dead uncle left me $25 Million.

But you have got to give it to Apple’s PR machine. Apple Watch reviews don’t matter to early adopters and Apple says smartwatch demand to exceed supply at launch. Real world translation, outside of a few geeks, Apple diehards and hippies, very few people will get Apple Watch.

Finally, as soon as all of the above becomes evident, how much of a haircut will the Dow Jones (recently added Apple) get?

You Know You Are Rich When – Investment Grin Of The Day

Stockman and El-Erian: Delusional Or Smart?

As yours truly, David Stockman and Mohamed El-Erian continue to warn their followers that a big stock market decline and a severe recession are coming down the pipeline.

As yours truly, David Stockman and Mohamed El-Erian continue to warn their followers that a big stock market decline and a severe recession are coming down the pipeline.

David Stockman:

- “The worldwide central bank money printing spree of the last two decades has generated massive excess capacity and mal-investment all around the planet.”

- “What is coming, therefore, is not their father’s inflationary spiral, but an unprecedented and epochal global deflation.”

- “So the central banks just keep printing, thereby inflating the asset bubbles worldwide. What ultimately stops today’s new style central bank credit cycle, therefore, is bursting financial bubbles. That has already happened twice this century. A third proof of the case looks to be just around the corner.”

Mohamed El-Erian:

- Financial markets have grown addicted to central bank easing, and that addiction could cause a heap of trouble when central banks tighten the credit spigot.

- “It reminds me a little bit of 2007 and 2008,” when investors tried to discern when the turn would come away from easy credit conditions, El-Erian said. “I’m not so confident that I will see the turn coming, and turns tend to happen quite quickly.”

I couldn’t agree more. The only remaining question is…….are the US Equity markets currently going through a 9 month distribution or consolidation period? If distribution, the time to pay the piper may be soon at hand.

The Secret Behind This Hedge Fund Manager’s Market Collapse Prediction

I firmly believe that the only people investors should be listening to right about now are the people who got 2000 and 2007 meltdowns right. Everyone else is just blowing smoke. Crispin Odey, the founder of London-based Odey Asset Management, is one of those people. He does not hold back….

“I just think that you and I have got grandstand seats here [to an imminent market shock] and my point is having found myself in the second quarter of last year selling a lot of equities and starting to go short, I found out just how illiquid it all was. You never actually see it until people try and get out of these things.”

That’s quite a powerful statement and I wholeheartedly agree. A lot of gold in this The Sydney Morning Herald article and it is definitely worth 5 minutes of your time. He goes on to say…

“For me, what I find very interesting is given the risk of recession, how is it the West stock market can be hitting all-time highs? History tends to be not very generous in this regard. If you get a recession in a low inflation environment it tends to impact the ratings of stocks dramatically. It was akin to “watching the markets take drunken bow after drunken bow. It’s amazing that nobody else is on the same page.”

The upcoming recession and the approaching stock market meltdown are so easy to see, I am not sure why the 99% go on missing it. The attitude was exactly the same at 2000 and 2007 tops. Greed or stupidity? I am not sure, but it is amazing indeed.

The Secret Behind This Hedge Fund Manager’s Market Collapse Prediction Google