Bloomberg Writes: Pending Sales of Existing Homes Slump by Most in Three Years

Fewer Americans than forecast signed contracts to buy previously owned homes in September, the fourth straight month of declines, as rising mortgage rates slowed momentum in the housing market.

The index of pending home sales slumped 5.6 percent, exceeding all estimates in a Bloomberg survey of economists and the biggest drop in more than three years, after a 1.6 percent decrease in August, the National Association of Realtors reported today in Washington. The index fell to the lowest level this year.

Mortgage rates last month reached two-year highs and some homeowners are reluctant to put properties up for sale as they wait for prices to climb, leading to tight inventories. Those forces are pushing some would-be buyers to the sidelines and slowing the pace of recovery in real estate, giving Federal Reserve policy makers reason to delay reducing stimulus when they meet this week.

Read The Rest Of The Article Here

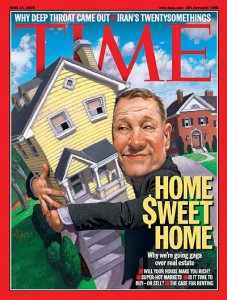

On October 3rd, 2013 I put my foot down and made a gutsy call. I have called for a housing top at the time. You can read the article here. I Am Calling For A Real Estate Top Here

Even though most people have dismissed this forecast I continue to stand by it. As new data points for the real estate market continue to come in, it looks as if I have made the correct and exact call. Yes, certain markets will roll over and start going down a little bit later, but the overall market is starting to look top heavy here. I would expect to continue seeing weakness over the next few quarters until we begin to see clear indications that the real estate market is heading down. At that time a lot of people will freak out and we should see a real inventory spike followed by even lower real estate prices. Of course this cycle will feed on itself for a long time.

Remember, this will be the 3rd leg down for the real estate sector. The first one was the initial decline between 2007 and 2010. Typically, 3rd legs down are longer and steeper. As such one shouldn’t be surprised to see large drops in housing prices over the next few years. As my previous valuation work here showed, overpriced markets like So. Cal should and could go down as much as 50%.

For now we wait and see as the housing market continues its rolling over process.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!