Right on the ball and we couldn’t agree more. Selling or shorting (SPDR S&P Homebuilders ETF (XHB)) real estate right now is a much better idea.

The Shocking Downside Of American Real Estate Bubble 2.0

As Wall Street Journal reports…. Half of Americans can’t afford their house

Over half of Americans (52%) have had to make at least one major sacrifice in order to cover their rent or mortgage over the last three years, according to the “How Housing Matters Survey,” which was commissioned by the nonprofit John D. and Catherine T. MacArthur Foundation and carried out by Hart Research Associates. These sacrifices include getting a second job, deferring saving for retirement, cutting back on health care, running up credit card debt, or even moving to a less safe neighborhood or one with worse schools.

If you need someone to blame I have got a few people for you. You can start with Greenspan, Bernanke, Yellen, Clinton, Bush, Obama and everyone in the US Congress/Senate over the last 20 years. All of them were, more or less, directly responsible for perpetrating this massive financial crime against the American people.

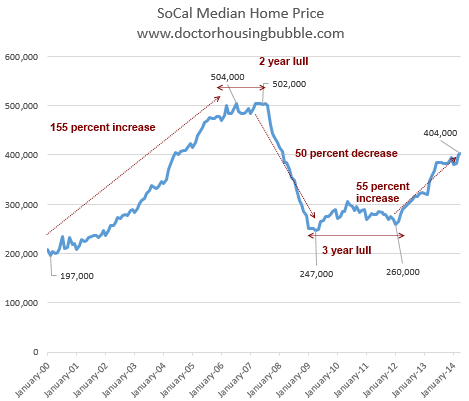

While you might have enjoyed your house going up in value 500% over the last 15 years you will not enjoy what happens next. As the chart above illustrate, the “Dead Cat Bounce” in real estate prices is almost over and the market is rolling over. As predicted here, Real Estate Collapse 2.0 Why, How & When the real estate market is about to suffer a massive Stage #3 correction. By the time it’s over, most Americans should be able to afford a house…again. I can’t wait.

The Shocking Downside Of American Real Estate Bubble 2.0 Google

Real Estate Disaster 2.0 Continues To Gather Pace

Real estate collapse 2.0 predicted here in October of 2013, when I called for the housing market (dead cat bounce) top, continues to accelerate. Back than most people thought that I had lost my mind and/or that I had just escaped from a mental institution. …..which is expected by now. In fact, the number of data points that confirm my original forecast is staggering. Here are a just a few.

Real estate collapse 2.0 predicted here in October of 2013, when I called for the housing market (dead cat bounce) top, continues to accelerate. Back than most people thought that I had lost my mind and/or that I had just escaped from a mental institution. …..which is expected by now. In fact, the number of data points that confirm my original forecast is staggering. Here are a just a few.

- U.S. house price gains seen moderating over next few years: poll – Moderating? “About to collapse” would be a more accurate description.

- The Most Overlooked Statistic in Economics Is Poised for an Epic Comeback: Household Formation – Yep, no one is getting married and no one (young people) has any money left after making payments on their student debt. Disaster.

- Borrowers Tap Their Homes at a Hot Clip – Who said that people learn from their mistakes?

- The Number Of California Real Estate Agents Collapses 30% – What about all of those investors buying hand over fist for cash? Don’t they need realtors?

-

“Pent-Up” Pending Home Sales Demand Missing; Down 9.4% YoY – Yep.

-

Zero Down Payment? China’s Developers Get Desperate – And let’s not forget about the biggest housing bubble on the face of the Earth.

Here is the bottom line. If you are thinking about buying a house, understand, you are buying at the very top. If you are thinking about selling…..you have about 3-6 months max before this real estate market trend really accelerates and becomes apparent to everyone else.

Shocking News: Real Estate Market Continues To Deteriorate.

A number of important articles on real estate.

- The growing wealth divide in the U.S. housing market

- Yellen Concerned by Housing Slowdown She Has Scant Power to Cure

- Is student debt hindering young people from buying homes or is it low incomes?

To quickly summarize, you got to be freaking rich to be able to afford a house nowdays, Janet Yellen couldn’t cure her own headache even if she tried and young people can either afford to jump on a “property ladder” with an overpriced shit box or start paying off their student debt.

Listen, today’s housing market is no different from the stock market. What was once a place to live and accumulate equity/savings, is now nothing more than Tesla Motors Inc (TSLA) high growth and highly speculative stock selling at 13 times revenue.

With the amount of speculation and debt out there, don’t have any illusions that the real estate market will behave in a different fashion. Expect the real estate market to crash……just as the stock market will as soon as this credit driven speculation party ends. Just as it did in 2007.

Need more information? Real Estate Collapse 2.0 Why, How & When

Shocking Truth: Why San Diego Real Estate Prices Will Decline By Over 50%

It’s official. My home base, San Diego, has done it. San Diego the nation’s second least affordable city for buying a home behind San Francisco.

“The report says a person in San Diego would need to earn $98,534 a year to buy a $483,000 home, the county’s median price in the first quarter.”

Well, I have good news and I have bad news. The good news? As advertised, San Diego is a beautiful city, the weather is nice and it’s a nice place to live. The bad news? Real estate prices will decline to the tune of 50% over the next 10 years.

Let me be crystal clear. Anyone…..anyone buying a house at today’s prices will lose a ton of money. Don’t worry, I know that most people (particularly in San Diego) will disagree with me. Yet, most of these people have no idea of where we are in the composition of the overall economic cycle, its application to real estate, real estate valuation work and so on.

Very briefly, what we saw in the real estate market between 2006-2010 was just the initial decline in the secular Real Estate Bear Market(stage 1). What we have witnessed since, 2010-today (stage 2) is a “Dead Cat Bounce”. What’s next?

Stage 3….a massive decline followed by another bounce and then by a final leg down. Now, these things don’t happen overnight. They take years to play out. My timing work shows the bottom in San Diego real estate prices arriving around 2022-2024…. at the earliest.

Again with 50% or more price haircut expected, it would be VERY wise not to touch real estate in San Diego with a ten foot pole. If you need more information you can read my comprehensive report here Real Estate Collapse 2.0 Why, How & When

Shocking News: Why 50% Of Households Will Be Underwater On Their Mortgages By 2018

According to Zillow 10 Million households are still underwater on their mortgages. On top of that over 10 Million households have 20% or less equity in their homes. While both numbers represent a significant improvement from their 33% peak in 2012, they don’t tell the whole story.

What’s Next?

Most of the research/commentary associated with the numbers above assumes that the housing market will continue on it’s recovery trajectory to eventually get everyone out of this predicament. Unfortunately, I do not share in their enthusiasm.

In fact, my mathematical work continues to show that things will get much worse for the housing market. In fact, I wouldn’t be at all surprised to see the number of underwater mortgages as high as 50% by the end of 2018. Why?

As I have suggested before, what we are witnessing in the real estate market now is a Stage 2 – Dead Cat Bounce before Stage 3 – massive decline. Basically, the real estate market has the same internal 17-Year structure as the stock market associated with it. In other words, the real estate market is about to repeat what you saw in the stock market between 2007-2009. Put your helmet on, it’s going to be an ugly ride. The real estate market is already rolling over.

You can learn much more about this here. Real Estate Collapse 2.0 Why, How & When

Will Lower Bond Yields Set The US Housing Market On Fire Once Again?

I had an interesting question from one of my subscribers last night. Quick summary:

“Won’t the lower yields in the bond market lower the overall mortgage rates and set the housing market on fire once again?” -J.V

Hell NO. Here is why.

If you haven’t noticed, the 10-Year Note has declined from around 3% at the beginning of the year to 2.35% today, going as low as 2% just a few weeks ago. This bond market action has, more or less, caught 95% of investors out there with their pants down. Not us.

As I suggested before, the reason the rates are declining is A. The bond market needs to set a secondary bottom and close the gaps at around 1.5-1.6%(It will do so over the next 2-3 years) and B. A more intelligent bond market is smelling out a severe US Recession over the next 2 years.

Long story short, here is why this WILL NOT have a net positive impact on housing.

- Even though the 10-Year Note is declining, mortgage rates are not. And even if they do, because the interest rates are essentially at ZERO, any future decline here will have very little impact on the overall housing market.

- The overall real estate market has already completed its “Dead Cat Bounce” and is currently in the process of a rollover into a massive stage 3 decline over the next few years. While lower interest rates might slow it down, its current overvaluation/speculation levels ensure its ultimate demise.

In conclusion, don’t expect anything short of 100 Million Rich Chinese landing in America and looking for a house to stop the upcoming real estate decline.

Are You Horny For A House? Another Scary Look At The California Real Estate Market

Another wonderful look at the California real estate market from our friends at Doctorhousingbubble.com. I continue to maintain that you have got to be a special kind of stupid to buy anything in California today. Well, that is unless you think that buying a 1,036 square feet shit box built in 1953 for $689,000 is a sound investment/financial decision.

Who is buying?

Chinese investors, hedge funds, flippers and straight up idiots horny for real estate, hardwood floors and granite counterparts. Yet, all of them are about to find out what Japanese investors found out in the late 1980’s after buying up half of Hawaii and California….real estate doesn’t always go up. In fact, according to my mathematical and timing work the real estate market is about to embark on the most vicious “Stage 3 Bear Market Leg” of its decline (similar to the one experienced in our equities market between 2007-2009).

You can learn more about what is to come in my comprehensive report: Real Estate Collapse 2.0 Why, How & When

California is slowly splitting up into two clear distinct market segments. A smaller segment of wealthy individuals with access to capital and debt and another larger segment of financially struggling households. People might think that the trend of Californians moving out of the state is fairly new but this trend has been going on for over a decade. The state gaining the most from this domestic out migration is Texas. Surveys looking at reasons for people moving out include lower housing costs and a lower cost of living. Yet the population is increasing. The big reason for the increase is international migration. As we have recently noted there is a heavy focus in prime California markets for foreign investors, largely from China. Young families have little chance of competing in many California markets. Because of this it is no surprise that you have 2,300,000+ adults living at home with their parents. This group is not the future home buyer, not at these prices. Most are at home because they have lower paying jobs, no jobs, or heavy levels of student debt. Many are unable to even rent, let alone buy a home. So when we look at Census data, it is no surprise that the homeownership rate for young Californians has taken the biggest hit since the housing market peaked in 2007. Is California a place for the young home buyer?

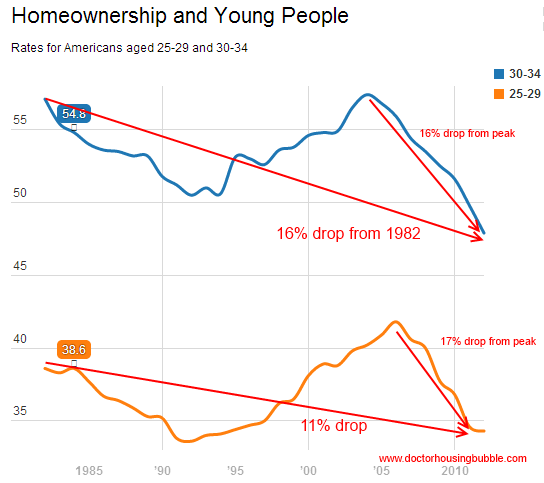

Falling homeownership rate for young in California and nation

The lower homeownership rate for young Americans is not only an issue hitting California. This trend is occurring all over the country. One big reason for this is student loan debt. The Federal Reserve just came out with their household debt figures this week and highlighted that total student debt is now up to $1.1 trillion. This is now the second biggest household debt sector behind mortgage debt. That is simply one aspect of the issue here. As we noted in a previous post, many younger potential buyers are also confronting a world of lower wages. Those 2+ million adults living at home in California are largely at home because of financial hardship. It is naïve to think that these younger adults are living at home because they want to reconnect with family. To the contrary, if we brought back no-doc no-income loans the market would spiral out of control once again as house horny buyers dive into incredible levels of debt. Since you have to document income in today’s market, the first-time buyer market has dried up in the California drought but large money investors from Wall Street and abroad have taken up the slack.

The homeownership rate for young Americans has taken a big hit over the last generation:

Source: Census data

I think the above chart is very telling. What it shows is that for the last generation, any gains in homeownership for younger Americans has been completely wiped out. The peak that was reached in the 2005-07 housing market was largely due to toxic mortgages and a predatory financial system. The end result of course is a graveyard of 7,000,000+ foreclosures (many purchased after the crash for rock bottom prices by large Wall Street investors with easy debt access from member Fed banks).

Student debt is merely one issue. If these young buyers had student debt but also high paying jobs, buying a home would be no issue. In California we see this trend as well:

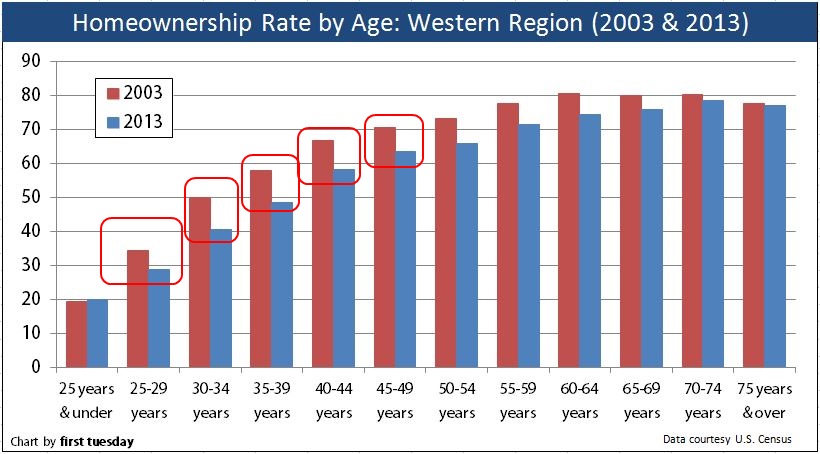

Source: First Tuesday

The homeownership rate took a big hit across all age groups but the brunt of this was felt by those in the 25 to 54 year old range. There was little escape here even for baby boomers. What is interesting is that the homeownership rate went up for those 25 and younger. This is largely due to big down payment gifts from parents and wealthy young buyers (this is also a very small percentage of all homeowners in the state by the way). The largest group of homeowners is from the baby boomer and older group.

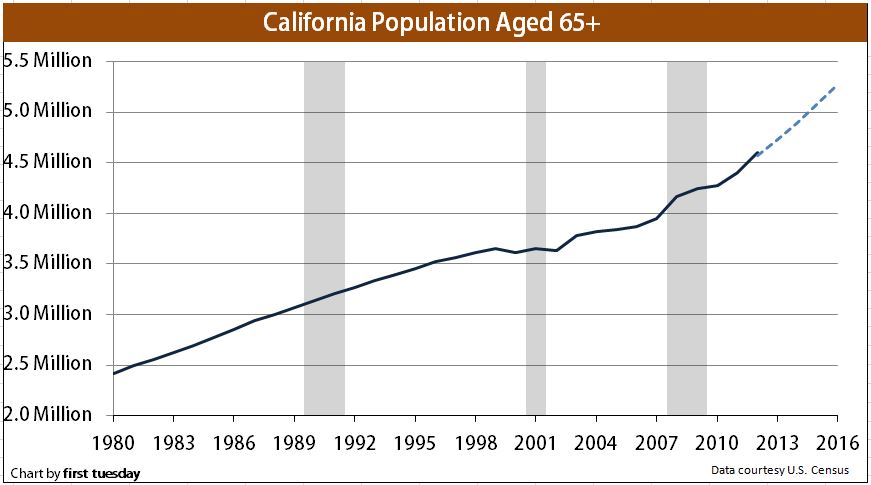

California is getting older

These dynamics are shifting how California will look. For example, California is quickly becoming an older state:

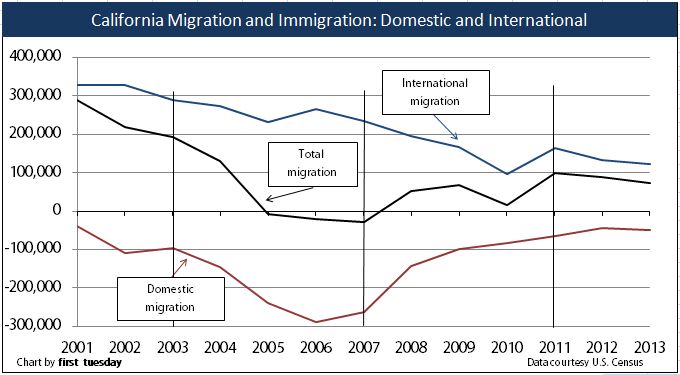

At the same time, domestic Californians are heading for the exits:

If it wasn’t for international migration, California’s population would actually be decreasing for well over a decade. In some markets a large portion of the recent price increases have come from international buyers. Young buyers are fully out competed here in combination with older households that may also have equity. Older home owners might live in a high priced home, but you have to sell or tap that equity out to generate income.

For example, let us take a look at a newer listing in Culver City:

11820 Juniette St, Culver City

Beds: 3

Baths: 1

Square feet: 1,036

I’ll first let the ad speak for itself:

“Location, Location, Location! This extraordinary area is called Del Rey and is next door to Culver City and The Playa Vista Development. Centrally located near Marina 90 FWY & 405 FWY. Just a short 12 minute bike ride to Playa Del Rey Beach & 4 minutes to Marina Del Rey Shopping Center.”

“This neighborhood also has a community garden to enjoy. Property needs a little TLC but has strong and solid bones.”

Solid calcium enriched bones baby! This home can also squat 600lbs on any given weekend. I always enjoy looking at the Google maps version of the street since it gives you a better feel of the area:Are You Horny For A House? Another Scary Look At The California Real Estate Market

What is the current price tag for this home? $689,000. This place was built in 1953, you know, when Dwight D. Eisenhower was President. A 3 bedroom and 1 bath home at 1,036 square feet is a starter home. Now tell me, how many young buyers do you think have enough to support a $689,000 home? No surprise that adjustable rate mortgage (ARM) usage hit a six-year high in the latest sales report for SoCal.

California is now dominated by investors, foreign buyers, and those leveraging every penny to buy to chase their house horny dreams of granite countertops topped off with a little hardwood floors. For the2.3 million adults living at home, I’m sure renting a home seems like a dream at this point.

National Association of Realtors: 30-Year Mortgage Is For Losers.

Let’s give each other a pat on the back. Americans are so freaking rich that 43% of us don’t even bother to get a mortgage. Instead, deciding to plunk down $200K, $500K or $1+ Mil on that house of your dreams in hard cold cash. In fact, according to most industry insiders you have got to be a special kind of stupid to bet against this trend.

We happily oblige. The reality is quite different. Instead of bringing joy, this number should cause panic. As we reported earlier, the number of all cash buyers is even higher in some parts of the country. For instance, in Las Vegas all cash investors (hedge funds, Chinese buyers, flippers, etc..) represent 75-90% of all real estate transactions.

In a nutshell, most of the demand from single unit families is gone. We are now left with investors, speculators and flippers playing the game of musical chairs. If that is not a clear sign of a market top, I don’t know what is.

When the music finally stops (already happening) expect this secondary real estate bubble to blow sky high. Just as predicted in this report Real Estate Collapse 2.0 Why, How & When

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Click here to subscribe to my mailing list

National Association of Realtors: 30-Year Mortgage Is For Losers. Google

MarketWatch: 43% of 2014 home buyers paid all cash

What the reliance on cash sales means for housing

Americans are still buying homes in all-cash deals, despite more investors leaving the market, according to a new report.

All-cash purchases accounted for almost 43% of all sales of residential property in the first quarter of 2014, up from almost 38% in the previous quarter and 19% in the first quarter of 2013, according to data released Thursday from real-estate data firm RealtyTrac. “It’s a surprising thing for us that cash sales have stayed high for so long even though the big hedge fund investors have pulled out of the market a bit,” says Daren Blomquist, vice president at RealtyTrac. “The high percentage of cash sales reveals the soft underbelly of the housing recovery.”

Experts say the high percentage of those paying cash won’t last much longer, though. “Cash buyers will become few and far between,” Blomquist says. So who does have the money to buy a home outright? Wealthy Americans and downsizing empty nesters make some of these all-cash deals, he says. Investors who are eager to make a profit by buying low and renting those properties — or flipping them — also drive up the number of all-cash deals, he adds.

4 in 10 home buyers in 2014 paid in cash

Americans are still buying homes in all-cash deals, despite more investors leaving the market, according to a new report. MarketWatch’s Quentin Fottrell discusses what cash deals means for the housing recovery on MarketWatch.

Institutional investors — people or companies that have purchased at least 10 properties in a calendar year — appear to be gradually pulling out of the housing market. Investors accounted for 5.6% of all U.S. residential sales in the first quarter, down from 6.8% in the fourth quarter of 2013 and 7% in the first quarter of 2013. But while the share of institutional investor buyers declined in 18 of the top 20 markets for institutional investors, home prices continued to appreciate in most of those markets, although at a slower pace. “But price appreciation will definitely flatten out,” he adds.

The top five markets for cash sales were in Florida, which experienced one of the biggest property crashes after the 2008 recession: Cape Coral-Fort Myers (74%), Miami (67%), Sarasota (65%), Palm Bay (64%), and Lakeland (62%). Other major metro areas where over half of all property sales were done in cash included New York (57%), Columbia, S.C., (56%), Memphis, Tenn. (55%), Detroit, Mich. (53%), Atlanta (53%) and Las Vegas (52%). Many high-end homes are also purchased with cash and buyers in competitive areas where inventory is low are more likely to offer cash.

Not everyone agrees that the housing market is so reliant on cash. The National Association of Realtors says its data suggests the rate of cash sales is lower and on the decline. All-cash sales comprised 33% of transactions in March versus 35% in February and 30% in March 2013, according to data released last month. Individual investors purchased 17% of homes in March, down from 21% in February and 19% in March 2013, the NAR found. But existing home sales were flat in March, the report found. The pool of potential buyers is limited due to tight lending standards and rising interest rates, experts say.

Is It Time To Short Homebuilders? This Answer Might Surprise You

According to Jeffrey Gundlach, chief executive and chief investment officer of DoubleLine Capital, it is time.

“Investors should bet against the SPDR S&P Homebuilders ETF because he does not see the expected rebound in single-family housing occurring”

We like the idea as this ETF is likely to yield about a 50% return on the short side over the next few years. Why? For the following reasons.

- As we have outlined so many times before, the housing recovery is over and the entire real estate market is about to embark on the most vicious bear leg of it’s decline. Stage 3. You can read everything you need to know about this here. Real Estate Collapse 2.0 Why, How & When

- Our advanced mathematical and timing work predicts a severe bear market between 2014-2017. Under such circumstances the real estate market will not be able to maintain its upward trajectory. On the contrary, it might be one of the sectors leading the market lower.

- SPDR S&P Homebuilders ETF (XHB) is showing early signs of a technical price breakdown.

When you combine the points the above, SPDR S&P Homebuilders ETF (XHB) becomes a very good short investment opportunity.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Click here to subscribe to my mailing list

Is It Time To Short Homebuilders? This Answer Might Surprise You Google

Reuters: DoubleLine’s Gundlach recommends shorting homebuilders ETF

NEW YORK, May 5 (Reuters) – Jeffrey Gundlach, chief executive and chief investment officer of DoubleLine Capital, said on Monday that investors should bet against the SPDR S&P Homebuilders ETF because he does not see the expected rebound in single-family housing occurring.

Gundlach, speaking at the Sohn Investment Conference in New York, said that problems dogging the housing market include expected rises in mortgage rates and the amount of student loan debt carried by young adults, which makes saving for a down payment difficult.

He also said that if mortgage financiers Fannie Mae and Freddie Mac were wound down by the government, mortgage rates would rise.

California is no place for the young home buyer: Homeownership rate for young buyers takes biggest hit in California. Domestic migration out, international migration in.

California is no place for the young home buyer: Homeownership rate for young buyers takes biggest hit in California. Domestic migration out, international migration in.