Bloomberg Writes: The Enduring Mystery of Financial Markets

Unfortunately, decades after the three economists had their groundbreaking insights, the crucial question remains unanswered: Can policymakers know with any certainty when markets are dangerously out of line, and is there anything they can do about it?

Economists can’t be expected to predict the future. But they should be able to identify threatening trends and to better understand the conditions that can turn a change in prices into a financial tsunami.

Read The Rest Of The Article Here

Once again, I do not understand why everyone claims that it is so hard to do. The Economy and its bubbles are very easy to see and predict. For example, you could have looked at 2002-2007 period and have easily determined or came to a conclusion that there was a huge real estate and mortgage finance bubble developing. When it would collapse, it would take down the entire economy, multiple financial institutions and our financial markets.

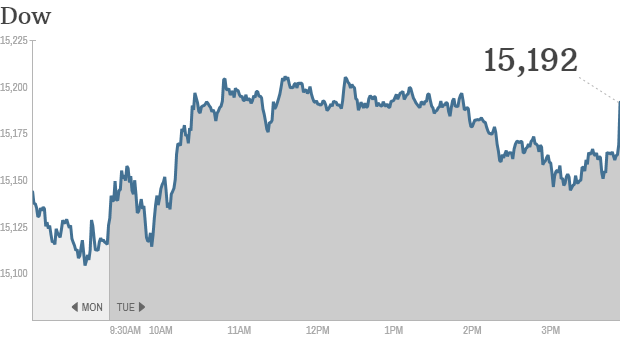

No crazy or complicated economic models needed. This is fairly basic and common sense stuff. Same thing applies to today’s environment. While the majority of the economist do not see any present issue either in the economy or the financial markets, they are there. The majority of economic growth and market recovery over the last couple of years has been driven by an insane amount of credit pumped into our economy by the Fed through a multitude of channels.

Now the economy and the financial markets will have to pay for such a mismanagement by dropping over the next few years (as my timing work indicates). As the Fed perpetuates this cycle of boom and bust by dumping a lot of credit into the economy I remain puzzled why it is so hard to see by most economist and others participating in the financial markets. If you take conflict of interest out of the picture, this becomes very basic.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Warning: The Markets Can Easily Be Predicted