BusinessWeek Writes: D.R. Horton CEO: Somebody Please Tell Home Buyers Rates Are Still Low

The Texas-based builder’s new home orders dropped 2 percent from the year-earlier period, which Horton Chief Executive Officer Donald Tomnitz attributed to consumers’ high sensitivity to tiny interest rate changes. “I don’t mean to date myself, but … no one around this table can remember mortgage rates being higher than 6 percent or 7 percent,” he said. “And I think one of the factors that we are dealing with, quite frankly, is most analysts, and most young buyers—especially first-time home buyers in the market today—have been accustomed to low rates for all their lives.”

The difference in sales price is only $34,096, but the 2013 buyer will end up paying about $104,000 more over the life of the loan, including an additional $64,000 or so in interest payments. That’s not an insignificant amount of cash. It’s enough to cover a bare-bones Tesla (TSLA); it’s also roughly 25 percent more than the median household income in the U.S.

Read The Rest Of The Article Here

Just as I have said many times before we are continuing to see signs that the Real Estate Market is beginning to roll over. This latest whining from D.R. Horton CEO is a clear indication of that.

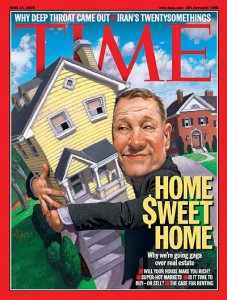

A few weeks ago I went out on a limb and called for a housing market top. I gave you the exact reason why the real estate market is topping and what you should anticipate going forward. Once again, you can read the article here… I Am Calling For A Real Estate Top Here As one of the signs and as anticipated we are starting to see crazy talk from industry insiders. Even though interest rates are still historically low Mr. Tomnitz is blaming buyer perception of interest rates for slow down in his business. As if buyers are waiting for interest rates to come down again. Maybe that is the case, but I highly doubt it.

The real reason behind the slowdown is un-affordability of real estate in this country and a massive (unsustainable) speculative bubble that has been created in the sector once again. If I could, I would tell Mr. Tomnitz get ready for the 3rd leg down in the real estate market.

If history teaches us anything, it will be much more violent than the 2006-2010 decline in real estate prices.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Warning: Real Estate Implosion Is Starting