BusinessWeek Writes: Corporations Are Swimming in Cheap Cash. So Why Aren’t They Investing?

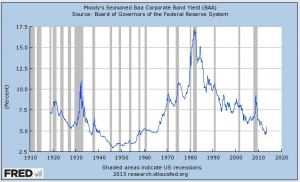

The difference is that back then, businesses were actually spending that cash they were able to borrow so cheaply, buying equipment and building factories and hiring workers. Today they’re just hoarding it. The pile of corporate cash on the balance sheets of nonfinancial companies has grown to $1.48 trillion, according to Moody’s. That’s an 81 percent increase since 2006. “Corporations are flush with cash coming off a huge profit cycle,” says David Rosenberg, Rosenberg points out that despite this abundance of cheap money, “we’re in the midst of one of the weakest investment cycles ever.”

Until Congress parts the clouds and gives businesses some bit of certainty as to spending and tax rates, let alone an assurance that the U.S. won’t default on its debt and the government won’t shut down, expect more of the same. Slow growth, weak demand, and more and more cash being piled onto corporate balance sheets.

Read The Rest Of The Article Here

The article claims that the lack of US fiscal clarity is the biggest culprit behind corporations not investing their huge cash piles and/or borrowing at cheap rates and investing it.

I respectfully disagree. First, the notion of huge stockpiles at corporate level are highly questionable at best. Now, in terms of borrowing and investing, the issue has nothing to do with US Fiscal clarity and everything to do with the fact that everything is significantly overpriced and there is technically nothing left to invest in.

What I mean is, due to a flood of readily available cheap capital over the last decade, most corporation have already heavily invested in and have streamlined the majority of their production capacity. When most of them look around today, there is literally very little for them left to do or invest in. This is the synopsis of the problems I have been talking about here this entire time.

Too much credit, overcapacity and slowing velocity of credit. Even though credit is readily available it will have even less impact on propping up our economy going forward. Just another falling vital sign of a dying patient.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!