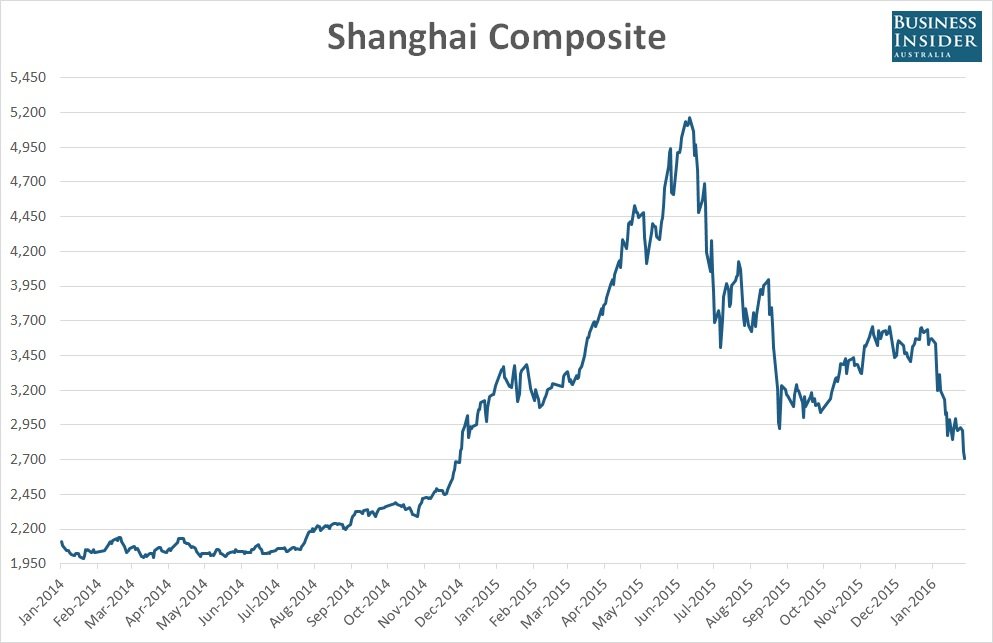

I wrote about China quite a few times last year. Suggesting that their stock market bubble is unsustainable and will collapse. In addition to warning people not to touch China with a ten foot pole at the present moment. Here is a small sample….. China’s Nasdaq 2000 Crash Is Set For A Bounce and Is China Beginning To Collapse?

But wait, there’s more……much more. And when you thought you have heard it all China takes it to the next level.

Chinese officials announced plans to lay off roughly 1.8 million workers in the coal and steel industries, as part of president Xi Jinping’s politically difficult effort to restructure the world’s second-largest economy. It’s unclear as to the time frame for the cuts, which were announced by Yin Weimin, China’s minister for human resources and social security.

My only question is……how do you spell “revolution and social unrest” in Chinese?

I also wrote about exactly that two years ago……Will China’s Economic Collapse Force A Revolutionary Change?

But wait, there’s more….

If you think China’s stock bubble was nuts, look at what’s now happening in its property market

FOMO, or the fear of missing out, has become an increasingly popular acronym of late, joining the ranks of QE, POMO, ZIRP and NIRP in the everyday vernacular of people in financial markets.

FOMO? Ladies and gentlemen ….sometimes there is nothing left to do. Just shake your head, get some popcorn, get comfortable and watch this insanity blow sky high. I would assume sooner rather than later.

China Hands Out 1.8 Pink Slips As Financial Engineering Insanity Continues Google