Continuation from yesterday…….(Short-Term Cyclical Composition Of The Stock Market)

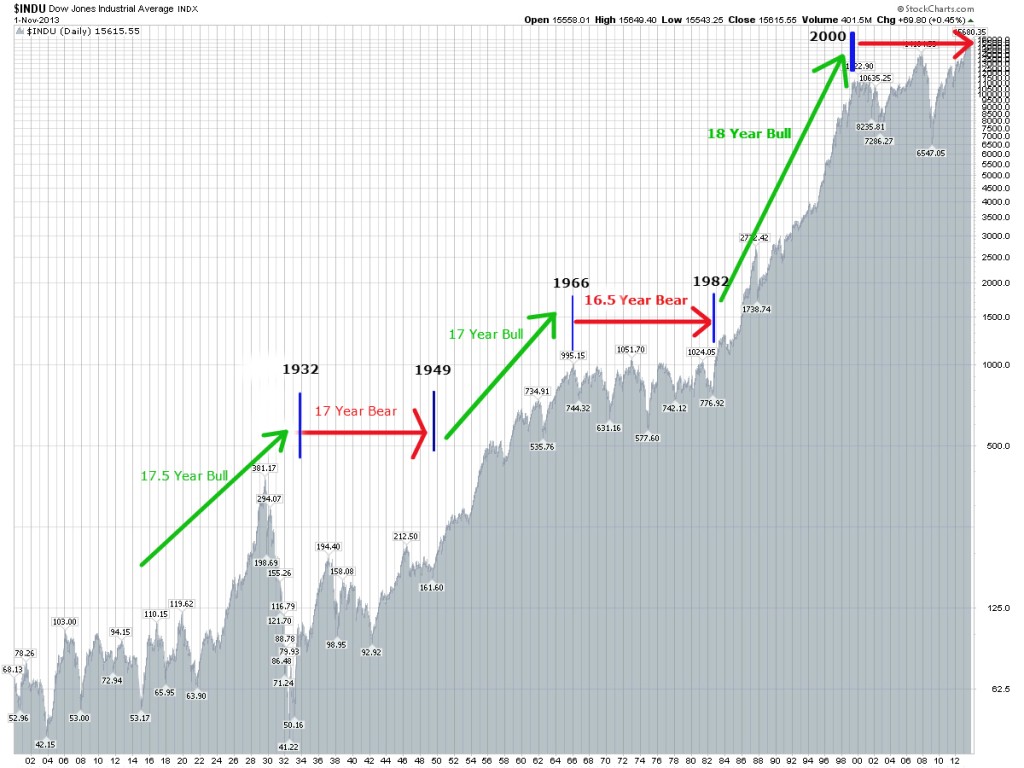

Once the 2000 top was reached the market was doomed to repeat the next secular bear market cycle ending in 2017. This bear market was kicked into high gear with a sell of 2000-2002, during which the Dow lost 40% of its value and the Nasdaq crashed 80%. The initial sell off was followed by an exact 5 Year and 1 trading day bull market cycle. Terminating on October 11th, 2007.

What followed was a mid-cycle sell off of 2007-2009. Such sell offs typically represent the fastest and the deepest moves down during any secular bear market cycle. We saw the same mid cycle sell offs develop in all previous bear markets. For instance, the crash of 1907 was the mid cycle panic of 1899-1914 bear market, the crash of 1937 was the mid cycle sell off of 1929/32-1949 bear market and the massive sell off of 1972-1974 was the mid cycle point of 1966-1982 bear market.

When the mid cycle panic bottom was reached in March of 2009 the market turned around to stage the next 5 Year rally of 2009-2014. Thus far, this 5 year bull market cycle has lasted 5.5 years, the longest since the 5.5 year cycle of 1924-1929. Leading many to conclude that a secular bear market ended in 2009 and we are now in a long-term bull market.

Unfortunately, there is no evidence that secular bear markets last only 9 years. On the contrary, since the stock market first started trading in May of 1790 all bull/bear market cycles repeated in a clearly defined 15-20 year patterns. Today’s environment is not very different. In fact, most bear markets end with 2-3 year bear legs. For example, 1912 to 1914, 1946 to1949 and 1980 to 1982. When we combine this information with the overall composition of the stock market described earlier, it becomes clear that a bear leg of 2014-2017 is essentially imminent.

Once again, the cyclical composition background above in necessary for understanding today’s environment and its application to various investments strategies one could have implemented during the time.

In November of 1994 (our starting bottom) the Nasdaq was trading at approximately 720. Let’s now take a look at 3 different outcomes or investment strategies to determine which one was the best.

Investment Strategy #1: Buy and Hold. (Middle Path).

If you would have invested in November of 1994 and held though today (September of 2014 with the Nasdaq is at 4,500), you would have generate a ROI of 525%. Representing an annualized compounded rate of return of approximately 9.5%. Not bad.

However, if we are to account for an upcoming bear market of 2014-2017, in the best case scenario the Nasdaq ends at 3,000 by 2017. Yielding a ROI of 316% or just 6.5% a year. Still not bad, but it seriously underperforms buying and holding a 30-Year US Treasury Bill that was yielding 8% in November of 1994.

To Be Continued Tomorrow…….