Mainstream financial media has pinned this week’s sell-off on China. Proclaiming that it is a termporary mattern and that the US Economy is good and getting better.

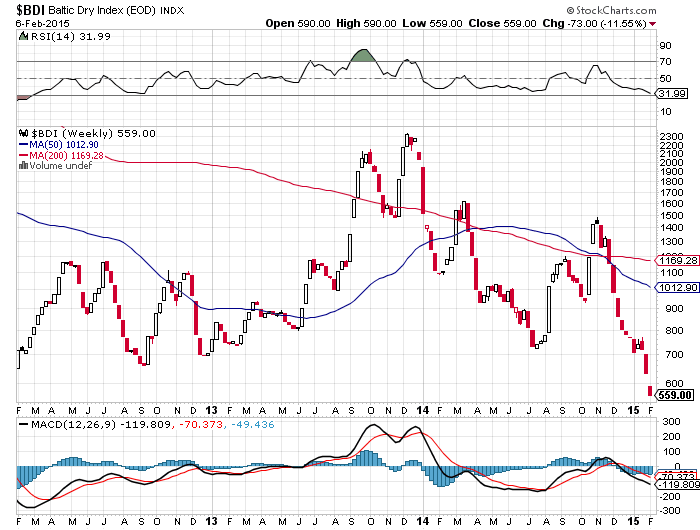

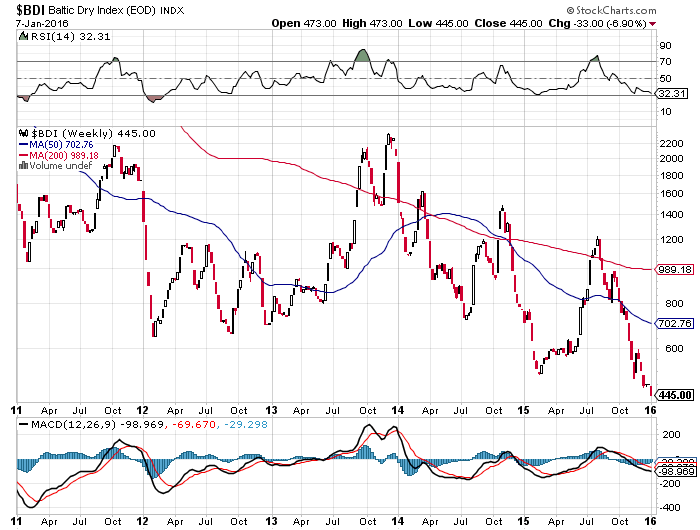

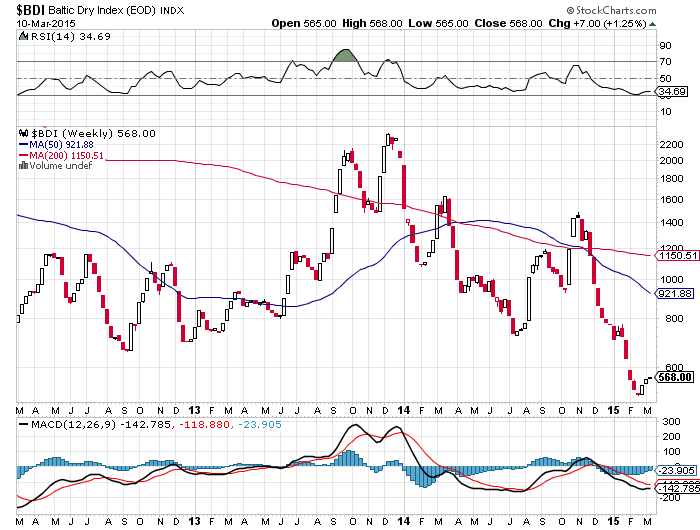

Perhaps. Yet, one doesn’t have to look further than the Baltic Dry Index chart above to realize that we are in deep trouble. The index continues to crash to new lows and is now down a stunning 80% from its October 2014 intermediary top.

This is a rather simple question. If the global economy is doing fine, why are shipping rates collapsing?

I think you know the answer to that question. And that is the situation we are faced with today. Rising interest rates, slowing economy and who could forget, an outrageously overpriced stock market. As has been shows on this blog so many times before.

I wonder how long it will take the stock market to catch up to this fundametal reality.

Baltic Dry Index Screams “Recession”. No One Is Listening. Google

I am scratching my head here (not really). According to most people in the mainstream, political and financial media the US Economy is on fire. At the same time, despite the appearance of this debt driven economic miracle happening in front of our eyes, at least the Baltic Dry Index (the index of global shipping costs) is not buying it.

I am scratching my head here (not really). According to most people in the mainstream, political and financial media the US Economy is on fire. At the same time, despite the appearance of this debt driven economic miracle happening in front of our eyes, at least the Baltic Dry Index (the index of global shipping costs) is not buying it.