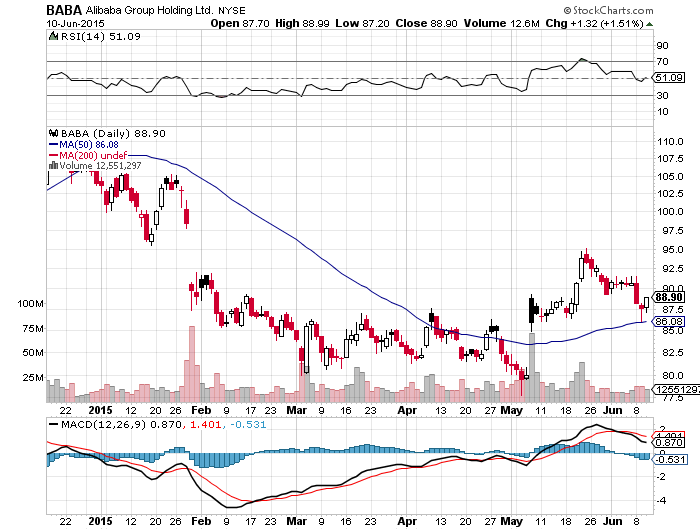

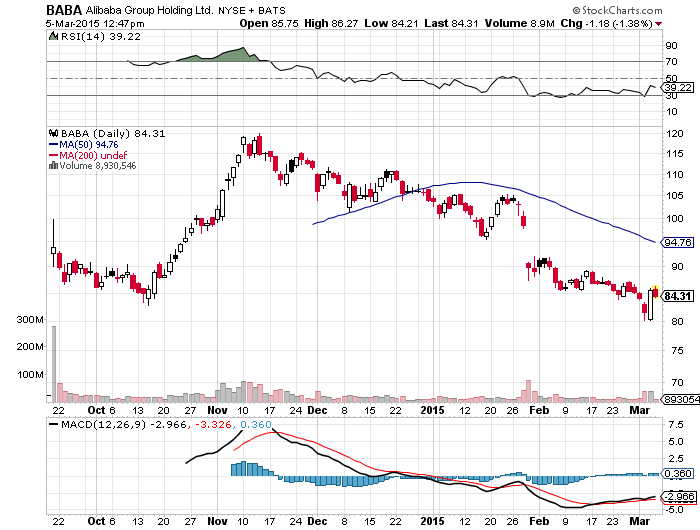

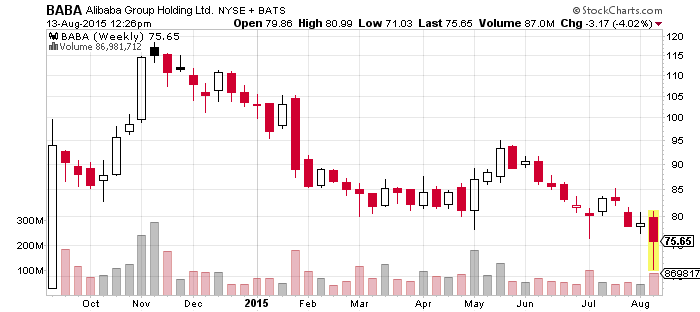

Alibaba (BABA) is down 38% in 9 months. Something that was predicted on this blog on numerous occasions. For instance…..

Is Alibaba (BABA) Getting Desperate?

Alibaba (BABA): More Money Than Brains?

Alibaba (BABA) Time To Buy Or Go Short?

Another Idiotic Advice From Jim Cramer

You get the idea. Alibaba is a giant piece of overpriced crap. That is not to say that we won’t or can’t get a bounce here. That is to say that Alibaba is just starting its long-term descend. Here is why.

- Alibaba is excessively overpriced. Click on the links above or search BABA on my blog. I have explained it previously.

- China is accelerating its collapse. As we saw with Yuan devaluation and their stock market collapse over the last few days/weeks. Don’t forget, most of Alibaba’s business comes from China.

- When bear markets hit, something we anticipate soon, overpriced and overhyped stocks like Alibaba tend to lose 50-90% of their value.

That is to say, if you have the guts to hold though the volatility, Alibaba is a great short. Even at today’s levels.