Weekly Update & Summary: June 7th, 2014

A strong up week with the Dow Jones up 207 points (+1.24%) and the Nasdaq up 79 points (+1.86%). All markets left a large downside gap on Friday, June 6th. That is in addition to a gap on May 27th, two large gaps on May 21st/23rd and two large gaps on April 14th/16th. Suggesting an eventual correction.

Further, there are a number of smaller gaps left leading all the way down to February 5th low. We continue to believe that the Dow will close such gaps when the next bear leg develops at below mentioned time frames (please see mathematical analysis & timing section below).

WEEKLY REVIEW:

The Shocking Downside Of American Real Estate Bubble 2.0

As Wall Street Journal reports…. Half of Americans can’t afford their house

Over half of Americans (52%) have had to make at least one major sacrifice in order to cover their rent or mortgage over the last three years, according to the “How Housing Matters Survey,” which was commissioned by the nonprofit John D. and Catherine T. MacArthur Foundation and carried out by Hart Research Associates. These sacrifices include getting a second job, deferring saving for retirement, cutting back on health care, running up credit card debt, or even moving to a less safe neighborhood or one with worse schools.

If you need someone to blame I have got a few people for you. You can start with Greenspan, Bernanke, Yellen, Clinton, Bush, Obama and everyone in the US Congress/Senate over the last 20 years. All of them were, more or less, directly responsible for perpetrating this massive financial crime against the American people.

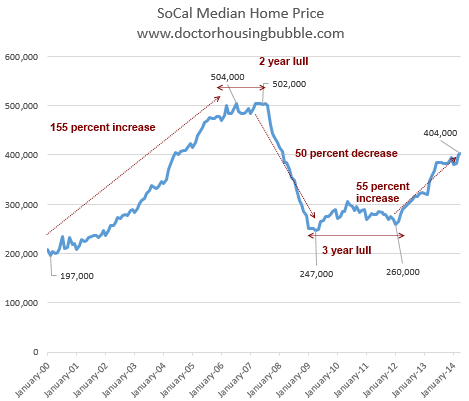

While you might have enjoyed your house going up in value 500% over the last 15 years you will not enjoy what happens next. As the chart above illustrate, the “Dead Cat Bounce” in real estate prices is almost over and the market is rolling over. As predicted here, Real Estate Collapse 2.0 Why, How & When the real estate market is about to suffer a massive Stage #3 correction. By the time it’s over, most Americans should be able to afford a house…again. I can’t wait.

Is Gold Dead Or Is It Bottoming?

According to most market pundits, Gold is dead and you should buy stocks and real estate.

Gold is hitting new multiyear lows relative to the Standard & Poor’s 500 Index. J.C. Parets, a technical analyst at Eagle Bay Capital, notes: “This downtrend has been very strong over the past 30 months and is hard to fight.”

Yes, Gold is in a technical downtrend, likely to test $1,200 (maybe even lower) and the time to buy it is not quite here. Yet, to look at it from such a perspective is like looking in a rear view mirror.

Here is what I believe to be the best way to look at Gold and it’s price. Forget about the fundamental factors such as supply/demand and geopolitical events. From our vantage point, Gold’s technical/structural setup is identical to the one in 2007 when Gold went from $600 to $1,800 an ounce.

With our mathematical and timing work predicting a severe bear market between 2014-2017, the FED will have no choice but to introduce further stimulus in order to try and re-inflate our markets and the economy. When that happens, I would expect Gold to be surging higher, not setting new lows. In fact, I continue to believe that Gold will be one of the better investments out there over the next 3-5 years.

All you have to do now is wait for Gold to bottom, break out above $1,420 and we should be off to the races. Be patient now. Our timing work shows that the next stage of the bull market in Gold is just around the corner as it will be surging higher by around this time next year. If you would like more precise timing please Click Here.

Peter Schiff Capitulates: Are Markets About To Collapse?

Peter Schiff, one of the most “in your face” perma bears has basically capitulated. After years of predicting US Equity market collapse, appearing on various TV/Radio shows and writing a few books on the subject matter, Peter now believes the FED will be able to delay any such collapse….. “The air is already coming out of the bubble” but Fed can delay collapse: Peter Schiff

A contrary indicator?

You bet. Listen, Peter Schiff is a very intelligent man. Yet, one of the hardest things out there is to be a bear in an ever increasing bull market. Even though your research might be right, your timing might be off by as much as a few years. And the market makes you pay for it by making you look like an absolute idiot. I had the privilege of experiencing this in 2006-2007 when my call for 2008 collapse was a few years early.

This is something that all investors should be aware of. I call it an emotional detachment from a proposed outcome. While it is important to have a very well researched position, it is even more important to be able to change your view when need be. Very few people can do that and that is why most people buy at the top and sell at the bottom. Unfortunately, Mr. Schiff is giving up at exactly the wrong time.

MACROECONOMIC ANALYSIS:

I am just as tired of this as you are, but Ukraine/Russia/USA/EU/NATO continue to be the most important issue.

On a positive note, despite heavy fighting in East Ukraine it appears the situation is starting to die off. The upcoming week is critical. There is a real possibility the situation will work itself out and disappear from the international stage. At the same time and as in any conflict, the situation might re-escalate quickly.

Further, I no longer believe that Russia will get involved in this conflict directly. There is just too much downside and not enough to gain for Russia to get militarily involved in East Ukraine at this stage. Basically, the next few weeks will tell us if the situation dies off or re-escalates. Let’s hope for the latter.

TECHNICAL ANALYSIS FOR THE DOW JONES:

Long-Term: The trend is still up. Market action in January-February could be viewed as a simple correction in an ongoing bull market. Same applies to the market action over the last few months. Yet, that in itself can be misleading as per our timing analysis discussion below.

Intermediary-Term: Since February 5th, intermediary term picture shifted from negative to positive. Giving us a technical indication that both the intermediary term and the long term trends are up. Yet, that in itself can be misleading as per our timing analysis discussion below.

Short-Term: Short-term trend remains positive for the time being. The Dow would have to break below 16,000 for the short-term trend to shift from positive to negative.

Again, even though all 3 trends are bullish for the time being, that might be misleading. Please read our Mathematical and Timing Analysis to see what will transpire over the next few weeks.

MATHEMATICAL & TIMING ANALYSIS:

It’s going to be a long one.

First, a re-cap. Particularly for our new subscribers. Over the last few months we have maintained that the DOW will…..

(*** Please Note: This time around about 90% of the information contained within this section has been deliberately removed as it contain too much technical information. Particularly, exact dates and prices of the upcoming turning points. As well as trading forecasts associated with them. I deem such information to be too valuable to be released onto the general public. As such, this information is only available to my premium subscribers. If you are a premium subscriber please Click Here to log in. If you would be interested in becoming a subscriber and gaining access to the most accurate forecasting service available anywhere, a forecasting service that gives you exact turning points in both price and time, please Click Here to learn more.Don’t forget, we have a risk free 14-day trial).

In conclusion, xxxx

Longer-Term Overview:

The next turning point is located at……

Date: XXXX

Price: XXXX

TRADING:

I am now fully committed to the XXXX side of the market with 11 individual positions taken at the prices outlined below. A lot of them have done incredibly well thus far and I hope you were able to benefit as well. I will be updating you of any changes or anticipated changes before they take place.

Remember, you should have an exact strategy and entry/exit points based on the forecast above.

The list below is for your reference point. It entails my investment strategy for my own investment purposes. While you are free to follow me, please do so at your own risk. Do not take this as a trading advice. Please note, all of the positions below have been triggered.

| Stock | Entry Point ($) | Action Taken | Stop Loss @ |

| xxxx | xxxx | xxxx | 91 |

| xxxx | xxxx | xxxx | 1250 |

| xxxx | 110 | xxxx | 121-123 |

| xxxx | 74 | xxxx | 80 |

| xxxx | xxxx | xxxx | 260 |

| xxxx | xxxx | xxxx | 460 |

| xxxx | 35 | xxxx | 39 |

| xxxx | 65 | xxxx | 70 |

| xxxx | 120 | xxxx | 120-130 |

| xxxx | 100 | xxxx | 108-112 |

| xxxx | 112 | xxxx | 120 |

Otherwise, I suggest the following positioning over the next few days/weeks to minimize the risk while positioning yourself for a forecasted market action. (This is continuation of our previous positioning).

Weekly Stock Market Update & Forecast. May 17th, 2014. InvestWithAlex.com

If You Are A Trader: XXXX

If No Position: XXXX

If Long: XXXX

If Short: XXXX

CONCLUSION:

An incredibly important week is coming up. We are now looking for our forecasts above to be confirmed over the next few trading days/weeks. I have also described what to anticipate over the next few months and exactly what you should do now. With increased volatility, multiple interference patterns and an incredibly important long-term turning points coming up over the next few months we must be very careful and risk averse here. Those anticipating the moves and those who can time them properly will be rewarded appropriately.Weekly Stock Market Update & Forecast. May 31st, 2014. InvestWithAlex.com

Please Note: XXXX is available to our premium subscribers in our + Subscriber Section. It’s FREE to start.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Weekly Stock Market Update & Forecast. June 7th, 2014. InvestWithAlex.com Google