What do Carl Icahn, Marc Faber and Stanley Druckenmiller have in common? The were all dead on in terms of predicting 2000 and 2007 disasters. And even though they are warning again, unfortunately, no one is paying attention.

Carl Icahn warns of a Fed ‘minefield’ ahead

“There are going to be real problems. We’re walking into a minefield of what’s going on with the Fed,” Icahn said. “I could go on and on here, but I think we have problems.”

Druckenmiller: Here’s how Fed ‘bubble’ will end

“All you do when you’re doing this is you’re pulling demand forward to today,” Druckenmiller said Tuesday at the annual DealBook conference. “This is not some permanent boost you get. You’re borrowing from the future. I think there’s been such a misallocation of resources that this has gone on so long and unnecessarily (and) the chickens will come home to roost.”

Dr. Doom calls bubble, adding to gloomy calls

“The Fed has basically created with their colleagues in Japan and at the European Central Bank (ECB) and the Bank of England (BOE), they’ve created a colossal asset bubble. And the returns going forward will be disappointing.”

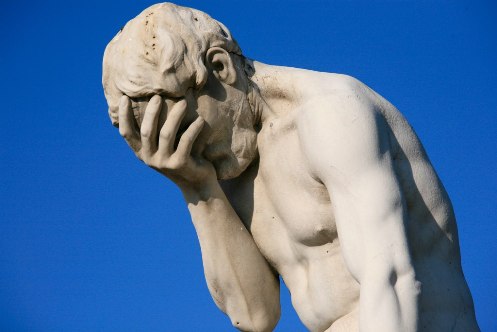

The question you have to ask yourself as an investor is……Have these successful money managers lost their minds -OR- maybe, just maybe, they are once again seeing things that other investors do not. Things that will lead to an outright bloodbath in stocks in not so distant future. Read all of the above links and decide for yourself.

Icahn, Faber, Druckenmiller Warn….No One Pays Attention Google