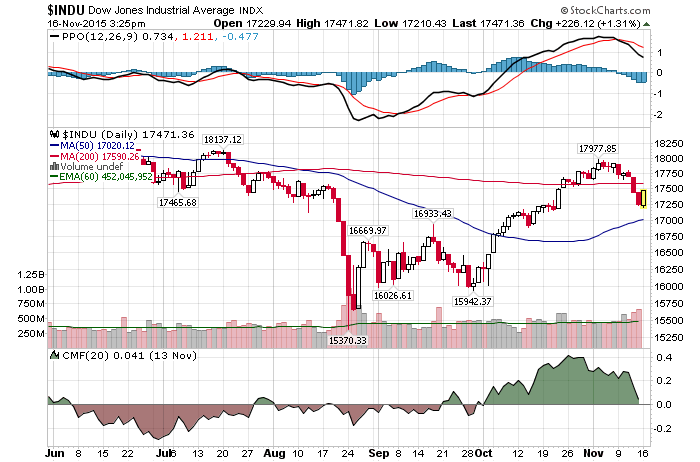

11/16/2015 – A positive day with the Dow Jones up 238 points (+1.37%) and the Nasdaq up 56 points (+1.15%)

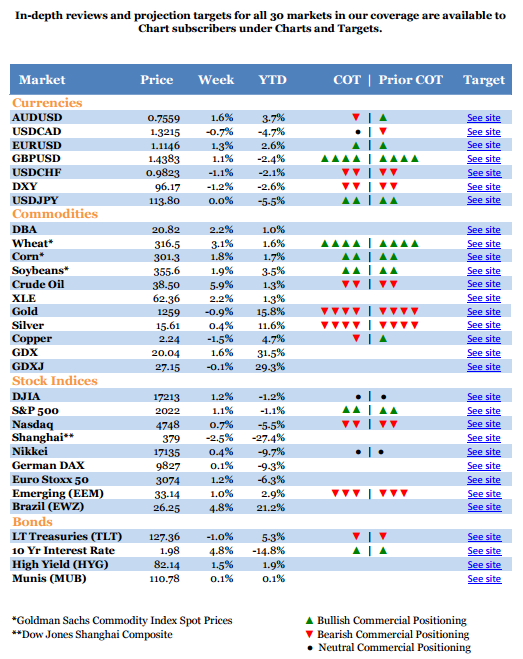

COT Reports: If you are not familiar, the Commitments of Traders (COT) reports provide a breakdown of each Tuesday’s open interest for markets in which 20 or more traders hold positions. In other words, it gives us a preview of what commercial interests are buying or selling. As the theory goes, we want to be on the same side of the trade as the big guys.

While not a good timing tool, currencies, commodities and the stock market (to a lesser extent) tend to move in the direction of the bets made by the commercial players. Not always, but often enough.

Latest data, as of November 11th, 2015

Currencies:

- USD: 3K Long Vs. 58K Short – No changes. Substantial short interest remains.

- Canadian Dollar: 43K Long Vs. 14K Short – Slight decrease in short interest. Significant long interest remains.

- British Pound: 76K Long Vs. 6K Short – Slight decrease in net short interest. British pound remains bullish.

- Japanese Yen: 135K Long Vs. 6K Short – Slight increase in net long exposure. Japanese Yen is now very bullish.

- Euro: 127K Long Vs. 30K Short – Slight decrease in net short exposure. Euro is now bullish.

- Australian Dollar: 115K Long Vs. 3K Short – Slight increase in net long exposure. Significant long position remains.

Conclusion: Based on the information above, commercial interests expect the US Dollar to decline while Canadian Dollar, British Pound, Euro Japanese Yen and Australian Dollar rally. This is consistent with our view that the FED won’t raise rates.

Markets/Commodities/Volatility:

- E-Mini S&P 500: 529K Long Vs. 377K Short – Net neutral position remains.

- Nasdaq 100-Mini: 26K Long Vs. 220K Short – Sizable short position. Slight increase in net short position.

- VIX: 58K Long Vs. 64K Short – Slight decrease in net short exposure. Neutral

- Gold: 62 Long Vs. 64K Short – Descrease in net short exposure. Gold is back to being neutral.

Conclusion: Based on the information above, commercial interests are now net neutral the S&P, VIX and gold. We have also witnessed a decline in net short exposure in VIX. At the same time, commercials now have a very large short position on the Nasdaq. That is important.

Next Week’s Market Calendar:

- Q-3 Earnings

- Tuesday: CPI Index

- Wednesday: FOMC Minutes

COT Reports & Weekly Market Calendar – November 16th, 2015 Google

![]()