Call options are dirt cheap.

The price of bullish call options on the S&P 500(^GSPC) has fallen to historical lows. That means that from a historical standpoint, it is remarkably inexpensive to make a bullish bet on stocks by buying on the options market.

“In terms of how much money it costs you to have exposure in the S&P 500, we’re looking at historic lows,

Dennis Davitt of Harvest Volatility Advisors agrees that call options have “never been more economical.” On the other hand, he said, “The puts [options to sell] are all-time expensive relative to the calls.”

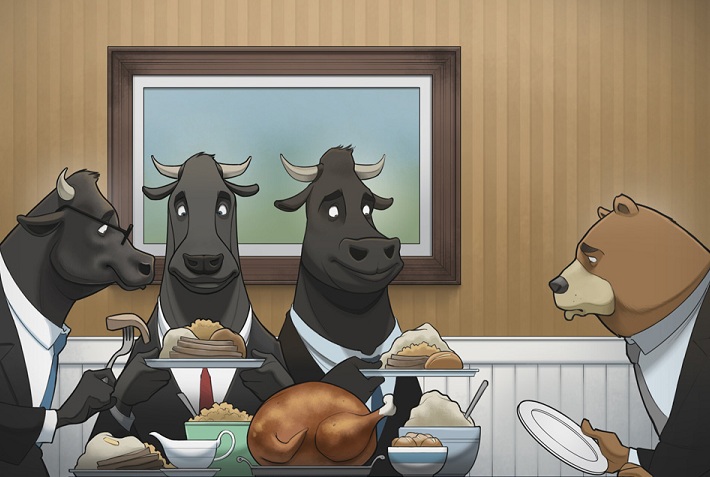

Hmm…. So, let me get this straight. The stock market is sitting near all time highs. Plus, we have a clearly defined bull trend and most people believe we are in a secular bull market. Yet, the options market is not buying it. This can only mean one of two things. This is either a buying opportunity of a lifetime, as most sell side advisers out there would surely point out, -OR- we might be on a verge of a bear market.

Call me crazy, but I think the options market is loud and clear here.