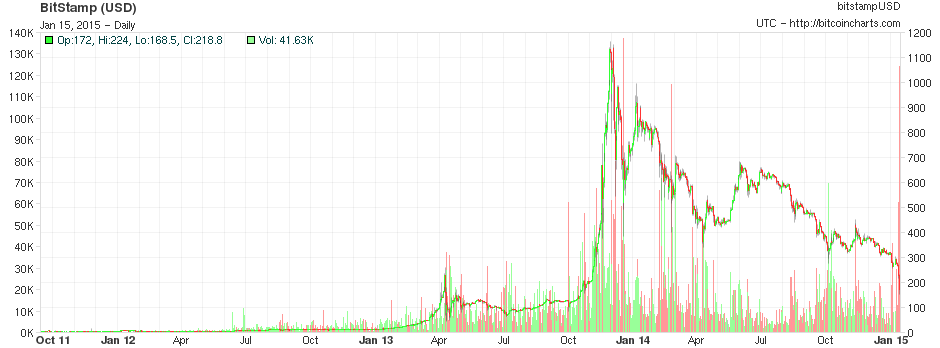

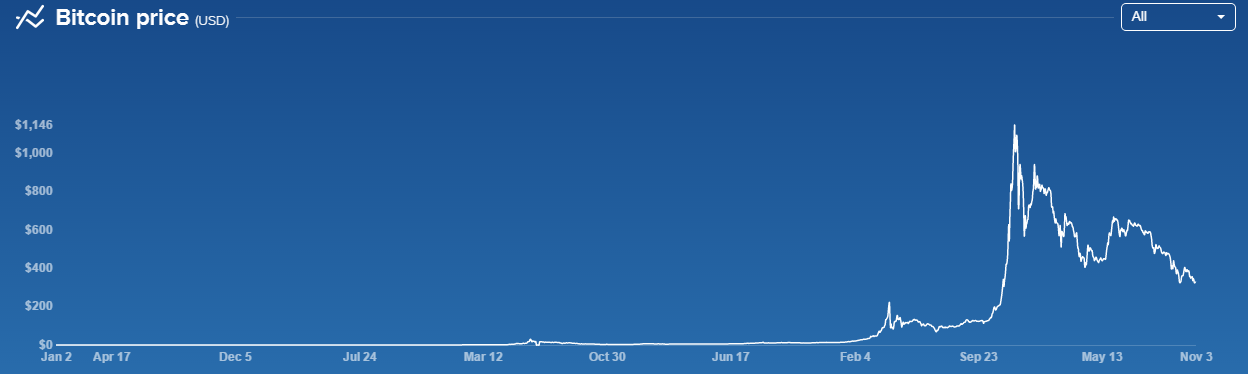

After its spectacular run up in 2013 and subsequent crash, Bitcoin has somewhat stabilized at around $250 (although the trend is still down). So much so that mainstream media is once again picking up the coverage Silicon Valley banks on Bitcoin as a way to overtake Wall Street

Yet, my opinion about it hasn’t changed. At the end of the day Bitcoin still has a real possibility of going to ZERO. Let’s take another look.

Is Bitcoin a legitimate currency, a speculative investment or the future? This is a complex matter to discuss as there could be an infinite number of arguments made for or against it. However, here are some basic points to understand….

- Understand that Bitcoin is still a pure speculation at this stage. There is nothing to back it up and there is nothing to assign any sort of fundamental value to it. As such, speculate away, but know that while it can appreciate significantly it can also go to zero in no time.

- The US Government can crush it at will and at any time. Yes, I know that it cannot be controlled by the government, it is independent and out there on the net. However, don’t be a fool. The US Government, if it really wants to, can destroy Bitcoin in a matter of hours.

- There is very little volume and the total value as a currency is very low. While that can be an advantage when the currency is going up, good luck trying to get out of it while it is heading down. Plus, the fact that people in China see it as an investment vehicle now is a huge negative red flag.

Basically, there is no fundamental value to invest in Bitcoin at this stage. While it can appreciate significantly, know that all gains would be out of pure speculation. I repeat, there are no fundamentals to back it up. On the flip side, it can go to zero either because of speculation or if the US Government decides (for whatever reason) to pull a plug on it. In other words, continue to stay away.