That’s right….. the United States Dollar.

That’s right….. the United States Dollar.

Yeah, yeah, I know what your are thinking. Dollar is a piece of shit and this Alex dude has lost all of his marbles. The FED is printing $65 Billion a month, interest rates are technically negative and hyperinflation is just around the corner.

Americans will soon need to use barrels of cash just to buy anything at the local supermarket. If you are to listen to Gold Bugs or PermaBears you would soon believe that the US will soon turn into Zimbabwe and that only gold and shotguns will save you.

Clearly, there is no love for the dollar, but hear me out. There is a couple of reasons to love the USD.

Reason #1: Everyone hates it. What do I constantly try to teach you here? To generate huge profits you must buy what other people hate. So, instead of buying Google at over $1,000 you buy Stinky Fertilizer, Inc (STINK). Assuming the company is fairly priced and has good fundamentals.

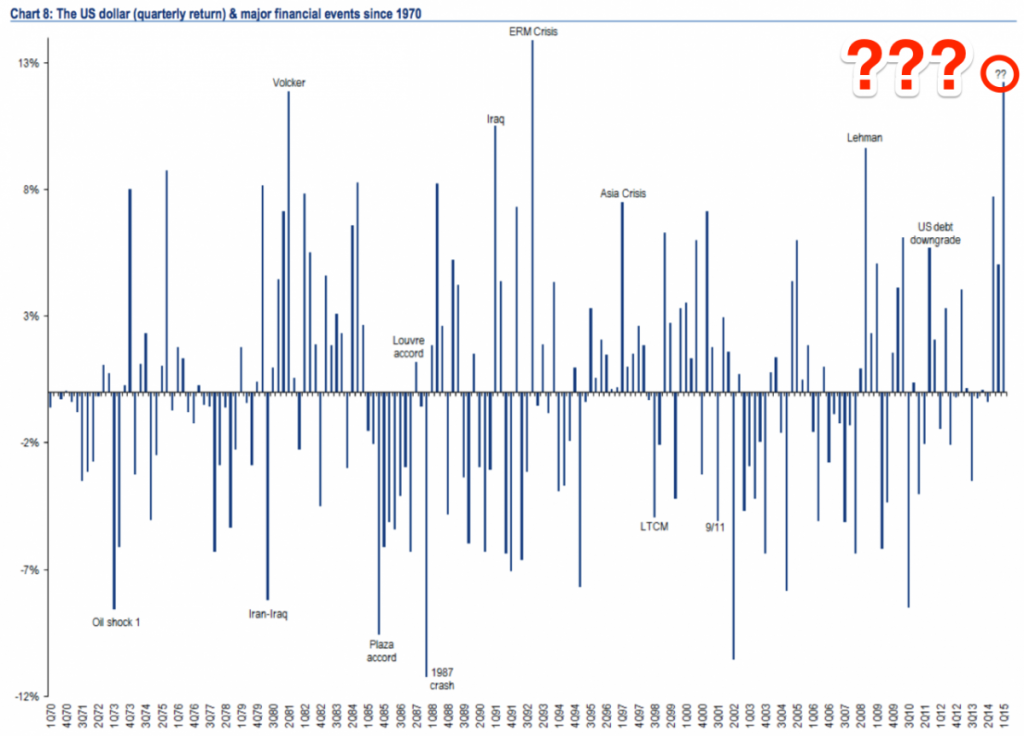

Reason #2: The USD has nothing to do with all the credit being generated at the present moment. There is a distinction between a balance sheet transaction between the FED/banks and the actual “physical” dollars. There is only a few of the real dollars to go around compared to the credit outstanding. That is why when the credit collapses the USD typically surges higher.

That is exactly what happened during the 2007-2009 credit crisis. The dollar index shot up from 71.30 in 2008 to 89.20 in 2009. When credit collapses, people scramble for dollars as there isn’t enough to go around. Typically, driving the value of the USD higher.

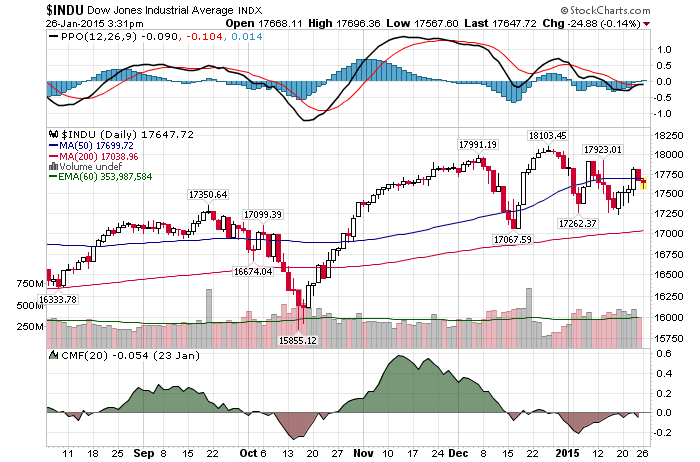

Reason #3: From the long-term technical perspective the USD is setup for a large move here. The long-term chart (from 2005…not provided here) shows that the currency is about to break out. Either up or down. Since everyone hates the currency and since my mathematical work predicts the credit crunch as well as the significant stock market decline, I would anticipate the dollar to break out to the upside.

CONCLUSION:

The best investment you can make right now is to accumulate dollars. Worst case scenario is that the dollar stays around the same levels while the stock market declines. Giving you the ability to buy great companies at significant discount.

The best case scenario? Dollar zooms up while the market goes down to the tune of 40%. Giving you a higher purchasing power, no risk and massive returns down the road. Of course, this scenario would work wonders for foreign investors in particular.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

The Best Investment You Can Make Today. It Will Shock You To Your Core. Guaranteed. Google

As discussed in our weekly podcast (Saturday’s post), it is highly probable that the dollar is approaching a major turning point for the following reasons.

As discussed in our weekly podcast (Saturday’s post), it is highly probable that the dollar is approaching a major turning point for the following reasons.