Here is the latest.

- S&P 500 Profits Fall $25 billion in First Three Quarters of 2015

- Earnings haven’t done this since the financial crisis

- Fed is playing a ‘dangerous game’ with Wall Street

Excuse my language, but the FED continues to BS the market. And as far as I can tell, the FED is attempting to maintain the market within a certain range. At the same time, it is now crystal clear what their actual game plan is. It goes something like this…..

- Can’t raise or won’t raise. Today’s economy or financial markets won’t be able to digest any rate increases at this juncture. Period. As talked about on this blog so many times before. Why The FED Will Not Raise Interest Rates in any meaningful way. If the FED members have even an ounce of intelligence, and I believe they do, they realize the same.

- If the market declines, issue a “Dovish” statement. Bring it up.

- If the market recovers, issue a “Hawkish” statement. As they did last week. Remember, they don’t want things too overheated.

- Rinse and repeat while praying the market and/or the US Economy won’t implode on their own.

That about covers it. There is only one fatal flaw with the plan above. It only works until it doesn’t. It only works until the FED has any credibility left. The problem is, more and more people are beginning to realize all of the above.

And while the stock market continues to rally for the time being, the real economy (Global/US) is accelerating down. Steel demand ‘evaporating at unprecedented speed’

But hey, who needs steel demand for as long as iPhone sales are strong and/or Facebook user growth goes parabolic….Right??? Point being, FED or not, the economic/earnings/overvaluation reality will catch up to this market sooner rather than later.

Now, to multiple market non-confirmations.

Investors should concentrate on what the market charts are telling them.

Before we get there, let me ask you something. What has changed between September 29th bottom and today? NOTHING FUNDAMENTAL, only investor sentiment. Where on September 29th investors were freaking out and numerous commentators were calling for an all out market crash, today it’s the opposite. Apparently, the bear market is over and we are getting ready to surge higher.

Yet, fundamentally speaking, we are still in the same conundrum. I continue to maintain that we are witnessing a major slow down in earnings and the US Economy. Most corporates missing and guiding lower is a clear evidence of that. Forward guidance is down 2%. Sure, some companies like Google, Amazon, etc…. are outperforming, but they are an exception, not the rule. The FED remains between the rock and a hard place. Unable to raise interest rates or stimulate the economy further.

If anything, we are getting numerous confirmations that earnings and the US Economy are falling apart.

As they say, a picture is worth a thousand words. The charts below should at least give bulls indigestion. Please note, some of the charts below are a few days/weeks old. Yet, their meaning or composition have not changed.

Chart #1: Hey everyone, look at all of those gaps. If you think the market won’t come back to close them, sooner or later, you are living in a fantasy land. But listen, we are all adults here. Who am I to tell you NOT to buy Amazon, Facebook, Google, etc….at today’s ridiculous valuation levels. As Citigroup suggests, “Be brave and go long”.

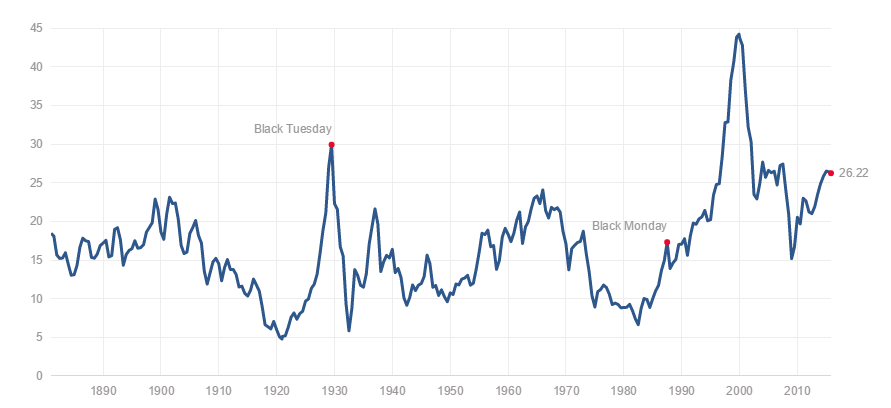

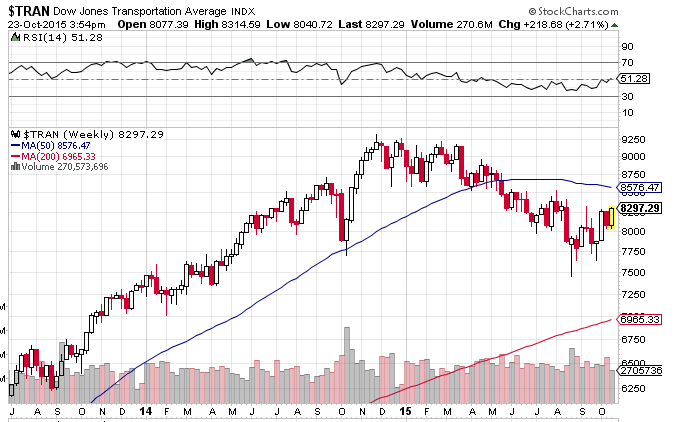

Chart #2: Oldie but goodie. Again, overall earnings/economy are slowing down while Shiller’s adjusted S&P ratio is at its 3rd highest level in history. Investors have paid more for stocks on two other occasions. In 1929 and 2000. But, unlike yours truly, most bulls don’t mind paying the same premium today. Chart #3: Look at all of these non-confirmations from Russell 2000, Dow Transports and Biotech (IBB). These are just a few. There are many other. New Bull market??? Yeah, sure…..to infinity and beyond.

Chart #3: Look at all of these non-confirmations from Russell 2000, Dow Transports and Biotech (IBB). These are just a few. There are many other. New Bull market??? Yeah, sure…..to infinity and beyond.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

Year End #4 – What The FED Will Do & Multiple Non-Confirmations Google