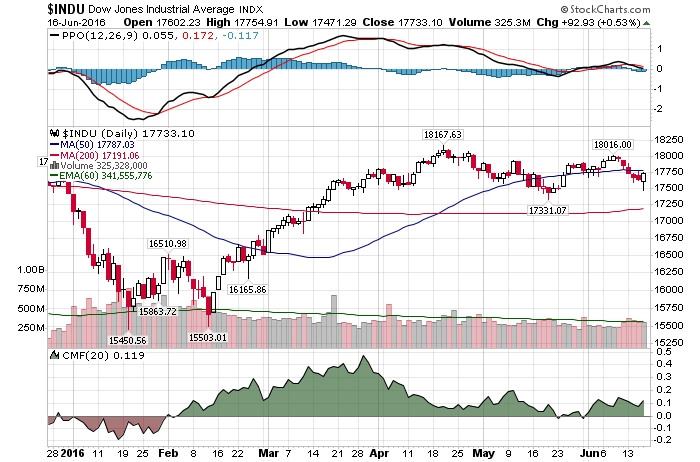

6/16/2016 – A positive day with the Dow Jones up 93 points (+0.53%) and the Nasdaq up 10 points (+0.21%).

What was unheard of in January and February is once again back on the table. Various bullish commentators are once again out in force calling for new all time highs. For instance….

“We’ve got inflation picking up; which is good, we’ve got commodities bottoming. The dollar isn’t gaining anymore. High yield probably is the most important thing to focus on; it’s telling us that the stock market should have double-digit gains this year,” the founder of Fundstrat Global Advisors told CNBC’s “Squawk Box.”

Economic growth, not only in the U.S. but around the world, is picking up in a “synchronized” fashion, and deflationary concerns are fading, the chief investment strategist at Wells Capital Management told CNBC’s ” Squawk Box .”

Fair enough. Since the market is close to new all time highs it is fairly easy or convenient to make the prediction above. In essence, it is a 50/50 shot at being right.

But don’t be too eager to load up on stocks here.

U.S. stocks are making yet another run at all-time highs—at least for the S&P 500 (^GSPC) and Dow Industrials (^DJI). But even if that were to happen, that’s no reason to get uber-bullish on risk markets, as there are three significant headwinds facing the markets right now.

Here is the bottom line. The NYSE (largest index by capitalization) trades today just about where it was 2.5 years ago. And if we take recent lows into consideration, lows we are likely to revisit, nearly 3.5 years of market gains vanish into thin air.

Plus, numerous indicators are not confirming the most recent rally. For instance, we are experiencing low volume melt up days while the leadership is lagging. Neither of the leaders or supposed leaders (Nasdaq, Russell or Biotech) are confirming today’s rally. The Dow theory is certainly not giving a buy signal, with Transports barely moving off of recent lows.

The conclusion here is therefore simple. Today’s bullish market remarks are caused by recent market gains or bullish sentiment and should not be used as indicators for future performance. New highs or not. After all, the sentiment above can just as easily swing negative.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. June 16th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!