Twitter just reported earnings and most investors are the happy. Thus far, the stock is up 16%. With that in mind, here are the reasons investors should consider either getting out of this stock or going short.

- I don’t understand Twitter and its business model. And while millions of people love Twitter, I don’t see the company being around 5-10 years from now. That’s just my personal opinion.

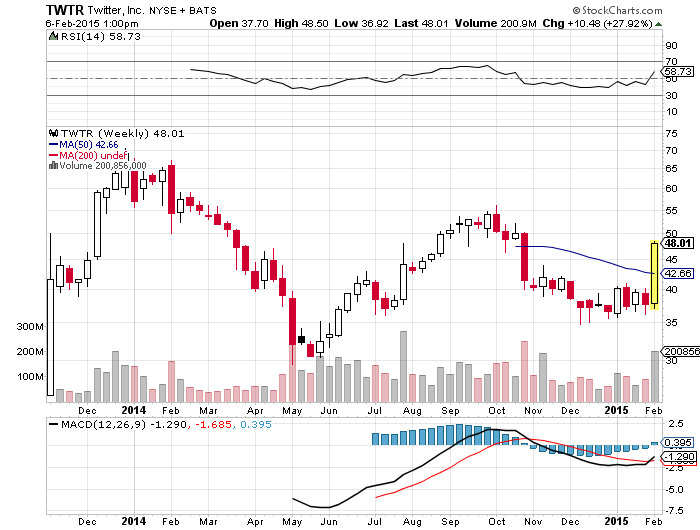

- Connect the tops and bottoms on the chart above. Twitter’s chart is forming a perfect long-term wedge. It is highly probable TWTR will break below support at around $35 at some point later this year and head lower. Much lower.

- Short-term, TWTR just closed a massive up gap at around $48. Plus, it touched the wedge resistance. That is to say, it is highly probable that the stock will soon head lower to close the down gap opened today and to test the wedge support.

In conclusion, I believe Twitter should be put on your “Stocks To Short” watch list. Should a short-term downtrend develop here, a short position would make sense. Considering a bear market of 2015-2017, a break below $35 can result in a quick 50% gain on the short side.

Why Twitter (TWTR) Should Go On Your “Stocks To Short” List Google

6 Replies to “Why Twitter (TWTR) Should Go On Your “Stocks To Short” List”

Comments are closed.