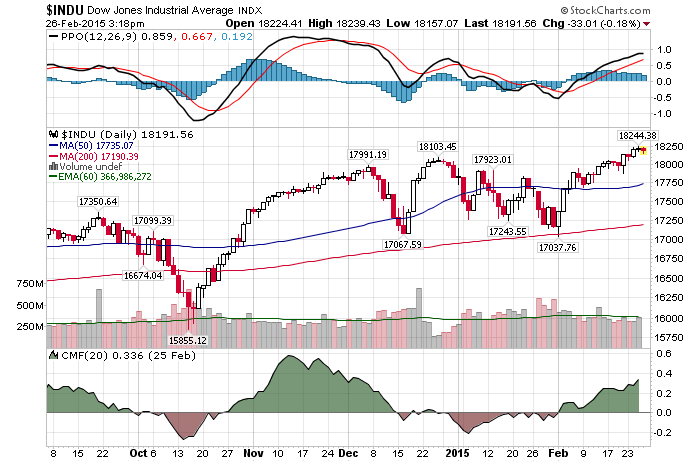

2/26/2015 – Another mixed day with the Dow Jones down 10 points (-0.06%) and the Nasdaq up 20 points (+0.42%)

It is not often that someones comes out and calls like it is. Societe Generale’s notoriously bearish strategist, Albert Edwards, did just that.

The US recovery story is a fraud: SocGen bear

“The downturn in U.S. profits is accelerating and it is not just an energy or U.S. dollar phenomenon – a broad swathe of U.S. economic data has disappointed in February,”

I couldn’t agree more. We have covered this in great detail over the last few months. There is a massive disconnect, for now, between the real US Economy and the stock market.

“The reality is that the vast bulk of economic, as well as earnings, data (even outside the energy sector), has been simply dreadful. The economic cycle will be brought down by asset bubbles bursting long before ‘tight’ policy has any effect. Lessons were learned from the global financial crisis, but not that one.”

Last quarterly report is a perfect illustration on that. Corporates are guiding down in both revenue and earnings. All while the P/E ratios continues to expand due to speculation, buybacks, QE and accounting tricks. If there was ever a recipe for a disaster, this is it.

“With equity markets galore hitting record highs clearly I must be missing something big!” he said. “I’ve been here before though and know full well how this story ends and it doesn’t involve me being detained in a mental health establishment (usually).”

I have been called all sorts of things in the early 2007 by various market participants. Boy who cried wolf, stupid idiot and my personal favorite, short selling a hole and unbeliever. Yet, the reality remains just as vivid today as it was back then. The stock market is in a massive bubble and it will eventually implode.

In other words, even Bernie Madoff must be amazed at how far the FED took our Ponzi driven economy. Most importantly, that 99.5% of people out there still believe them.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. February 26th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!