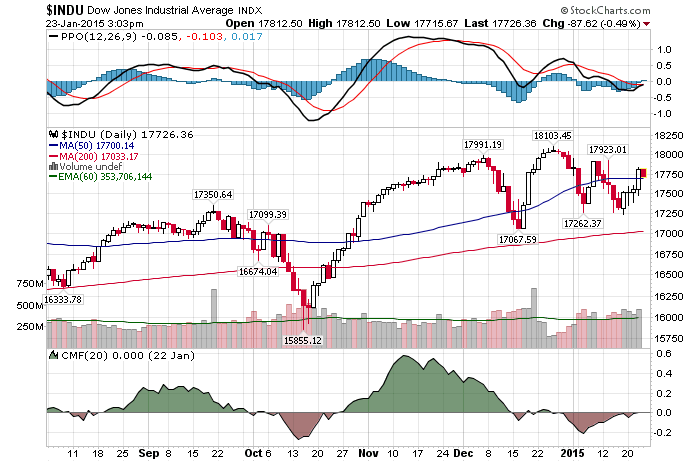

1/23/2015 – A mixed day with the Dow Jones down 142 points (-0.80%) and the Nasdaq up 7 points (+0.16%)

In Part 1 below, Nouriel Roubini did a fairly good job explaining the economic mess we are all in. Let’s now take a closer look.

Soros: ECB QE means inequality and asset bubbles

The sheer size of the massive injection and the duration, and so on, will have undoubtedly an effect…If I were still active in the business I could see some fairly substantial moves coming and financial stability can create dislocations and turmoil from time to time. It will benefit the owners of assets and actually wages will remain under pressure through competition and unemployment. My main concern that it will make divergence between rich and poor bigger than it already is.

Soros is right on the money. If you haven’t noticed, with most industrial nations trying to debase their currencies, a major currency war is now a reality. As a result, a stronger dollar in addition to a weaker US Economy might force the FED to postpone any and all interest rate increases. As central banks surprise, Fed may have to throw in the towel

That’s great……right?

Traditional thinking would lead you to believe that this is great for all asset prices. After all, lower interest rates, debased currencies, everyone being on the same side of the trade and massive QE can only lead to surging stock market prices. Perhaps. Yet, the biggest question no one is asking is…….

At what point does this financial fraud of enormous proportions blows up?

Meaning, at what point does the stock market rolls over and begins to head south, way south. No matter what kind of nonsense the FED/ECB is proposing at the time nor how much the next round of QE is.

Well, I’ll go out on the ledge and propose that we are already at this juncture. With the FED being backed into a corner in terms of interest rate increases and with the ECB finally blowing their 1 Trillion, the jig might be up. In other words, watch the stock market very carefully. Should it decline despite all of the intervention above, investors will very quickly lose confidence in the FED. It is at that point that the bottom will fall out.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. January 23rd, 2015 InvestWithAlex.com

The Shocking Truth Behind Currency Wars, Soros, QE & The FED (Part 2)