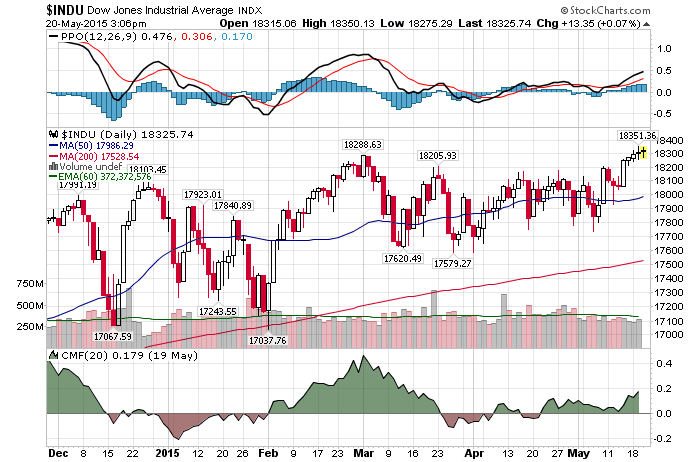

5/20/2015 – Another mixed day with the Dow Jones down 26 points (-0.14%) and the Nasdaq up 1.71 (+0.03%).

A massive and rather rapid stock market decline is coming later on this year. And while we won’t have a crash, considering the amount of margin debt out there, quite a few people will get wiped out. If you would like to find out exactly when this move will develop, to the day, please Click Here.

Today’s FOMC Minutes had a little bit for everyone. Bulls, bears, day trading retirees and as Jim Cramer calls them, financial unbelievers. To be more specific, Q-1 weakness was temporary, maybe they will raise rates in June, maybe not, etc.. With that in mind, let’s look at the subject matter from a rational point of view.

As of today, the FED is facing the following setup.

- Massive stock market and other asset bubbles.

- Slowing economy and collapsing macro data. We are a stone throws away from an “official” recession. I can argue we are already in one.

- Zero interest rates and limited options to stimulate the economy further.

As a result, the FED has only two options.

- Raise interest rates NOW in order to reload their recession fighting toolkit before the next recession hits. Again, we are nearly there.

- Cancel rate hikes and eventually introduce QE4 to further “stimulate” the economy. Also known as, maintaining financial market stability. This scenario includes postponing interest rate hikes until we are in a recession.

You don’t have to be a genius to figure out which scenario the stock market is betting on. And while it would be prudent for the FED to reload now, in reality, no one really knows what they will do. I don’t think they know.

Finally, here is something to think about. There is no guarantee that the stock market won’t crater even if the FED introduces another round of QE while cancelling interest rate hikes. That’s how complex today’s macro economic setup is. I can come up with at least a half a dozen fundamental cases where such an outcome would play out.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. May 20th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!