Now that everyone has boarded the Nasdaq’s train to prosperity and new bull market, take a look at the chart above. See those massive gaps? They are making my mouth water with anticipation.

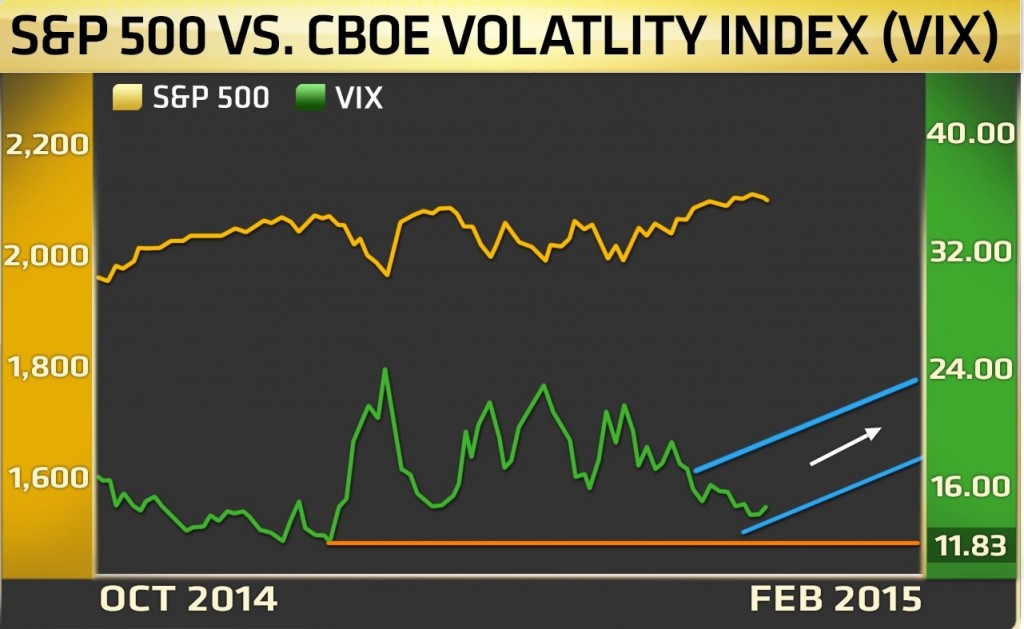

Plus, everyone is slamming VIX/VXX at exactly the wrong time. For instance, Fear not–VIX signaling all clear for stocks: Strategist

Did anyone stop for second to think that this might be super bearish for stocks?

Of course not and I guess I”ll have to repeat what I have said here right before VIX/VXX surged higher last time.

Previous Post:

We have talked about VIX/VXX before. First, there is a massive short position against the volatility index near its all time lows. Plus, consider this. According to the COT reports……

- Commercial Interests (smart money):70K Long Vs. 27K Short

- Leveraged Fund & Speculators (dumb money): 49K Long Vs. 33K Short

As I have indicated in my COT Weekend update, commercial interests tend to win. Although, the timing is not always exact.

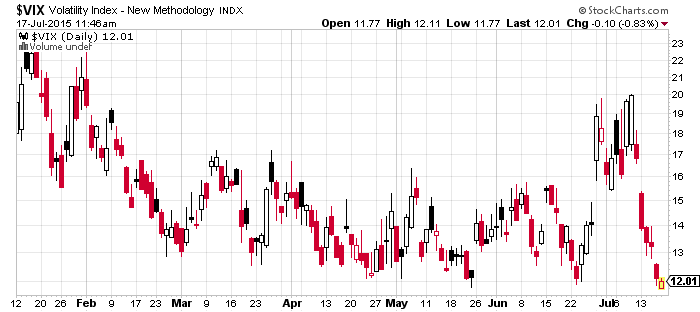

So, we have a massive “smart money” long position and a massive “dumb money” short position. And at the time when VIX/VXX hitting all time lows.

Something tells me that as soon as this period of low volatility ends, VIX will stage a massive rally to the upside. As much as 100% or more and within a short period of time. And I am not the only one who thinks that. You Can’t Keep the Panic Out of Stocks Forever, VIX Traders Say

So, is this the best trade out there today? Well, that’s for you to decide.