On May 18th, just a day before Apple (AAPL) set in an important top, I have warned people on this blog about the big boys initiating a distribute sequence on the company. Here is the link: Alert: Smart Money Is Trying To Distribute Apple (AAPL) To Fools

Now, Tesla (TSLA) is getting the same treatment. Morgan Stanley Hikes Price Target on Tesla

In a note this morning, Jonas has increased the price target for Tesla to $465 from $280 (the stock is currently at about $243). The key reason behind this is what he calls “Tesla Mobility, an app-based, on-demand mobility service.” The race for autonomous driving is nothing new, with tech giants such as Apple and Google also making a push in this realm, but the report says Tesla is well positioned to get large market share. Jonas is telling clients that “Tesla is uniquely positioned, in our view, to solve the biggest flaw in the auto industry, <4% utilization, via an app-based, on-demand mobility service.”

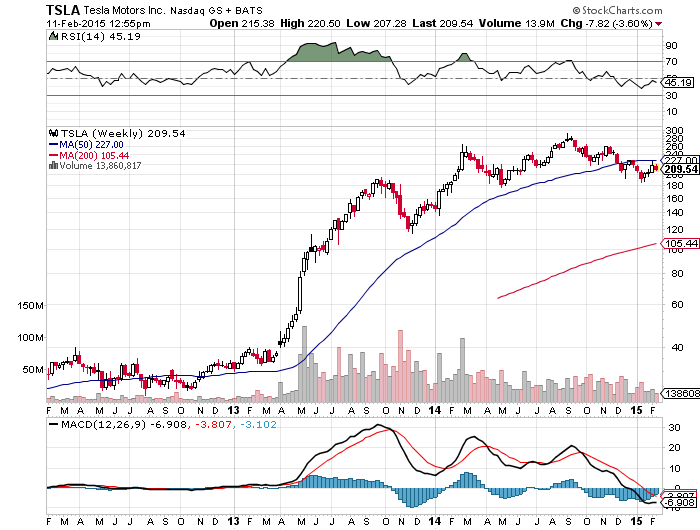

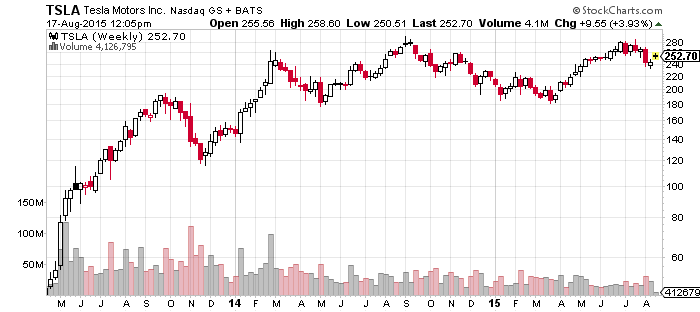

Blah, blah, blah……and I am well position to die at some point over the next 50-75 years. Don’t believe the hype and don’t be fooled by the big boys. This is what DISTRIBUTION looks like.

Here is the real story behind Tesla (TSLA) Tesla Motors Raises Offering to About 2.7 Million Shares Overpriced, over hyped, losing money, needs additional capital, etc… Such stocks tend to get decimated to the tune of 50-90% in bear markets. Which is coming.