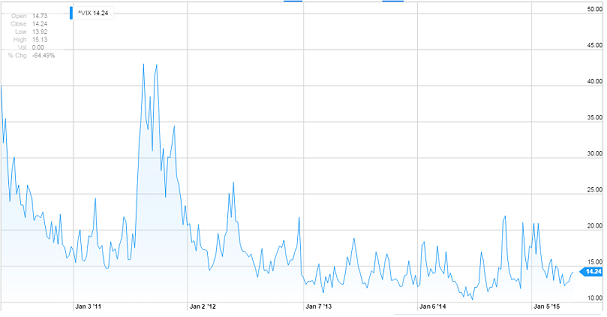

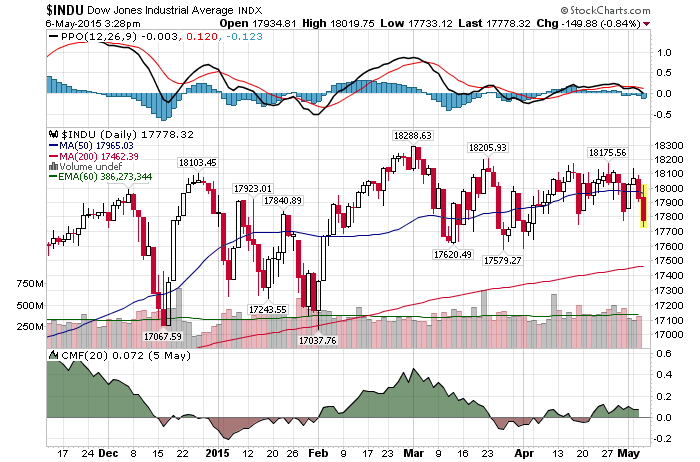

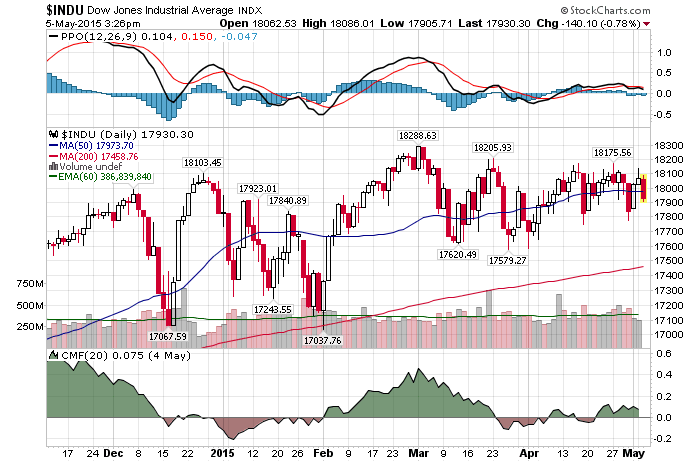

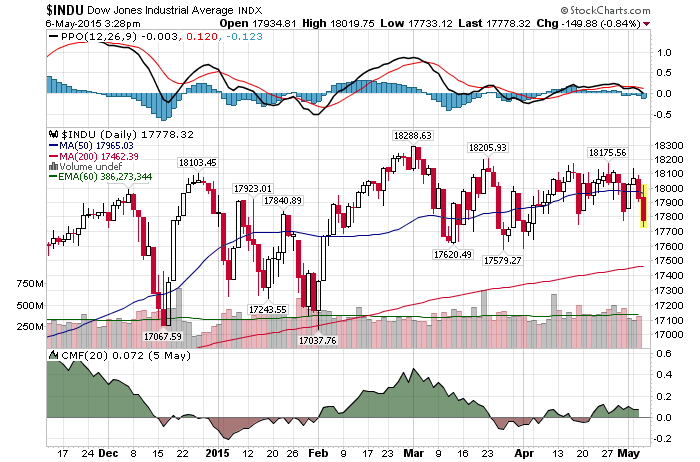

5/6/2015 – Another down day with the Dow Jones down 85 points (-0.48%) and the Nasdaq down 20 points (-0.40%).

A massive and rather rapid stock market decline is coming later on this year. And while we won’t have a crash, considering the amount of margin debt out there, quite a few people will get wiped out. If you would like to find out exactly when this move will develop, to the day, please Click Here.

For now, most investors continue to play chicken with the FED. And they will pay dearly for it. I am not sure if the FED can be any more clear here. They WILL raise rates and soon. Plus, when even Janet Yellen suggests that stocks are too expensive….Fed’s Yellen says equity valuations high, warns of ‘potential dangers’…..well, you deserve to lose a lot of money if you maintain a net bullish position going forward.

At the same time, maybe the bulls are right. According to quite a few market pundits, the party in the equity markets hasn’t even started yet. Case and point.

I cannot stop shaking my head in disbelief. To save you some time, here is what was said:

“This is an extraordinary buying opportunity, buy any and all dips, with zero interest rates the price of equities could be infinite, this bull market will continue, valuation don’t matter anymore, etc….”

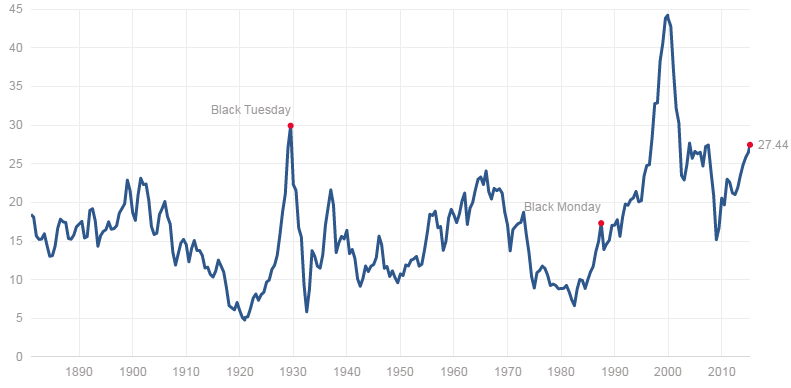

Valuations don’t matter……infinite run ups are just around the corner …..buy now. That sounds familiar. If I didn’t hear the exact same thing at 2007 and 2000 tops, well, call me a fool.

Again, the underlying assumption in both cases is the same. We are in such a unique monetary easing environment that there is no way in hell the markets can go down. Maybe so, but here is the major point that most investors miss. Today’s market environment becomes a matter of psychological setup as opposed to a fundamental background.

When everyone and their day trading grandmother believe that we are in such a bullish environment, the market is getting ready to reverse. Why? Well, it’s rather simple, everyone has already bought into the long side of the market. Contrary to the opinion of the market pundits above, I would argue that the only opportunity here is on the short side (or in cash).

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. May 6th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

As The Dow Goes Negative For The Year, The Worst Is Yet To Come Google