I have very little respect for Peter Schiff. His predictions and timing in the past have been notoriously wrong. Plus, from what I have heard his clients are losing a lot of money. With that said, his call for Gold $5,000 (see the article below) might actually hold water. Believe it or not, his prediction somewhat matches our forecast.

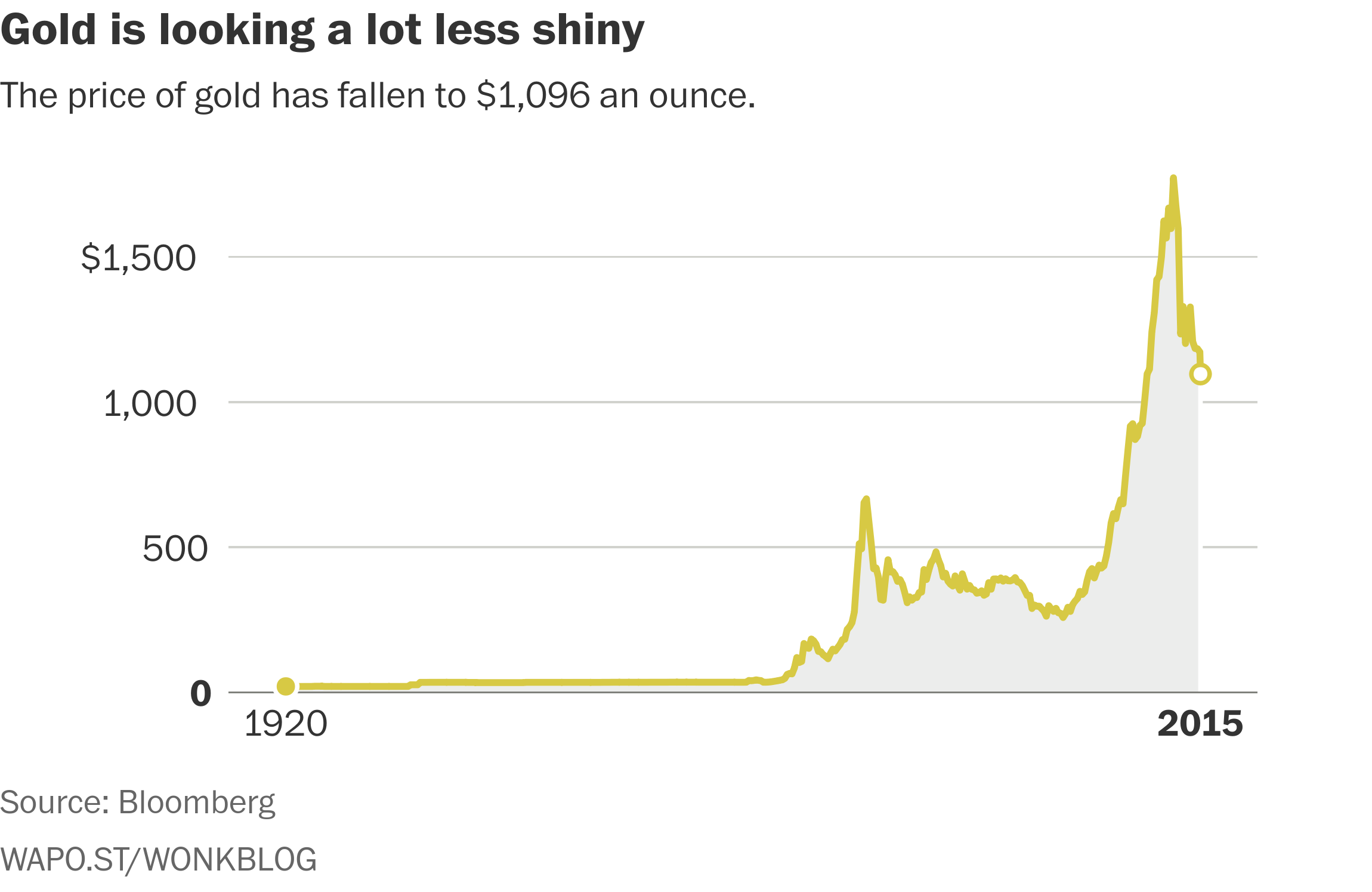

The macroeconomic setup for gold today is very similar to what we have experienced back in 2007 when the gold price ran up from $600 an ounce to over $1,800 an ounce over a 5 year period of time. Are we in for a repeat? I believe so.

As per our mathematical and timing work we are about to enter a sever bear market that will last between 2014-2017. With the US Economy in deep recession, the FED will be looking at any possible avenue to re-inflate the markets and flood the system with more liquidity. Not tighten. As you can imagine, collapsing equity markets and loose monetary policy by the FED are great drivers for Gold. As such, we wouldn’t be surprised to see Gold between $4,000-5,000 over the next 3-5 years.

Just as a quick note. Stay away from Crazy Perma Bears (like Peter Schiff) who expect an outright stock market collapse and the DOW 1,000. Based on our timing and mathematical work it’s not going to happen. Not even close. If you would be interested in learning exactly when the bear market will start (to the day) and its subsequent internal composition, please CLICK HERE

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Click here to subscribe to my mailing list

Is Gold Really Going To $5,000? My Answer Will Shock You Google

Market Watch Writes: Peter Schiff: Reckless Fed may push gold to $5,000

SAN FRANCISCO (MarketWatch) — Peter Schiff, chief executive officer of Euro Pacific Capital, has been known to make forecasts outside the mainstream, and his long-running belief that gold has the potential to hit $5,000 an ounce is no exception. Prices, after all, are struggling to get a grip on $1,300.

We caught up with Schiff to ask him how gold, a big disappointment for commodities investors last year, gets back its groove. Last year, gold futures GCM4 +0.79% and heavyweight ETF SPDR Gold Trust GLD +0.59% lost 28%, breaking at least eight years of annual gains.

First off, Schiff’s gold forecast isn’t brand new. The author of “The Real Crash — America’s Coming Bankruptcy” has talked about the possibility of gold hitting $5,000 or higher since at least 2011, when prices for the metal topped $1,900 in intraday trading.

Schiff reiterated his call on the potential for $5,000 gold and beyond during a heated debate with Paul Krake of View from the Peak onCNBC’s “Futures Now” episodeposted on April 15.

In an email interview with MarketWatch this week, he offered his thoughts on exactly why he expects gold prices to continue to climb and under what circumstances, what it would take to change his bullish outlook on gold and whether prices for the metal have already hit bottom this year.

Here’s MarketWatch’s full email interview with Schiff that concluded Wednesday:

Q: Before this year began, what were your expectations for gold prices and how does that compare with the metal’s performance year to date?

Schiff: I thought that the selloff in 2013 was completely out of touch with reality, so I expected the price to rise this year. In this, I was virtually alone in the financial community. Just about every major investment house had predicted even more losses for gold in 2014.

So far this year, gold is the best-performing asset class, but I think the pullback we have seen over the last few weeks is just another indication of how much negative sentiment remains. Ultimately however, the fundamentals will prevail. The Fed will keep printing [dollars] and gold will keep rising.

Q: In a recent interview with CNBC, you said the Federal Reserve’s quantitative-easing program will push gold to $5,000 an ounce. Could you explain that a bit further? What’s your time frame for that forecast? [Watch: Gold bear takes on bug: ‘You’re miles off base’]

I believe the consensus expectation that the U.S. recovery is real and that the Fed will end its [quantitative-easing] program and normalize interest rates is wrong.

Over the past few years the Fed had become [a] serial mover of goal posts, delaying the decision to end stimulus more than anyone would have predicted. When the Fed has to admit that its forecast of a sustained recovery is wrong, it will come to the aid of a faltering economy with even more QE. When that happens, gold will rally.

Last year’s selloff was based [on] the expectation that a strong recovery will lead to tighter monetary policy, which would then undercut the reason for buying and holding gold. That is a false assumption.

Q: Could you offer your thoughts on other factors you see as most influential to the gold market this year, including China?

A renewed weakness in the dollar and strength in oiland other commodities will add to gold’s appeal during 2014. Also, any major geopolitical concerns, particularly if there is a deterioration of the situation in Ukraine, will add to gold’s appeal. I also expect renewed physical demand from emerging markets like India and China.

The World Gold Council recently forecast that Chinese gold demand will rise 20% by 2017 from the current level of 1,132 metric tons a year.

Q: What might alter your bullish outlook on gold?

Gold would certainly be hurt if the Fed surprised the markets by actually ending QE and tightening policy. But that is very unlikely to actually occur.

Q: What would you say to investors who are discouraged by gold’s performance so far this year? (Futures are prices up around 7% year to date, but only partially making up for last year’s plunge.)

FactSet

FactSetEnlarge Image

Be patient. Many investors in the 90’s believed that gold was a dead asset class. But in the 10 years from 2001 to 2011, gold increased almost 900%. The moves come in waves.

Q: With prices currently under $1,300 an ounce, have prices hit bottom for this year? Is gold a bargain at these levels — is it a good time to buy now? Please explain.

Most likely prices have bottomed, as too many speculators are looking for lower prices. The fundamental case for gold has also never been stronger. From a gold short seller’s perspective, this will prove to be the equivalent of a perfect storm. Their losses will be severe. [Read about gold contrarians saying it’s time to start buying.]