With most Corporates about to report Carl Icahn believes earnings are overinflated by at least 20%. Watch the video below. Plus, he reaffirms his view that the stock market is overpriced and most likely in a bubble.

I have been saying the same thing for quite a while now. For instance, Is Today’s “Real” Stock Market P/E Ratio Above 30? -OR- BlackRock: Most Of Corporate Earnings Growth (If Any) Is Accounting Driven

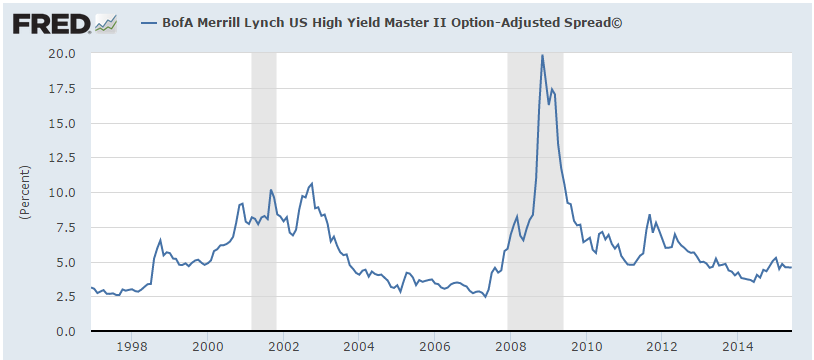

I have said it before and I will say it again. Today’s distortions are so great that the FED’s Ponzi Finance makes Bernie Madoff look like a boy scout. But its more than that. Everyone is playing the same accounting game. Whether it is through low interest rates, share buybacks or outright accounting gimmicks.

While impossible to calculate, I would say that a more normalized environment would add 5 to 10 points to today’s P/E ratios. By the way, Shiller’s Adjusted P/E Ratio is still at 24. Turning an already expensive market into “are you freaking kidding me overpriced accident” waiting to happen.

Interesting times ahead, that’s for sure.