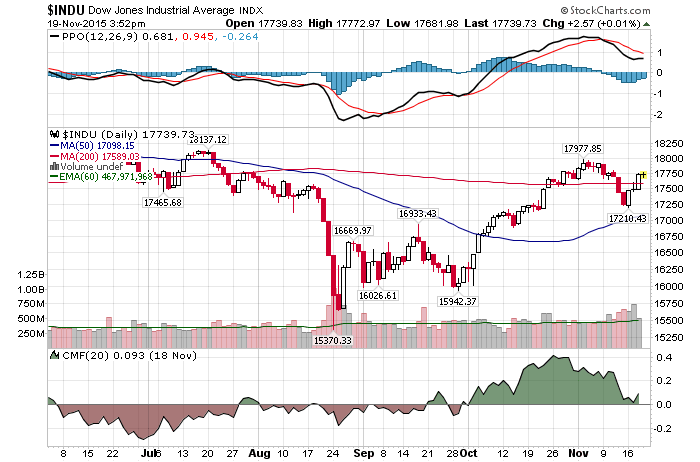

5/12/2016 – A mixed day with the Dow Jones up 11 points (+0.06%) and the Nasdaq down 24 points (-0.50%)

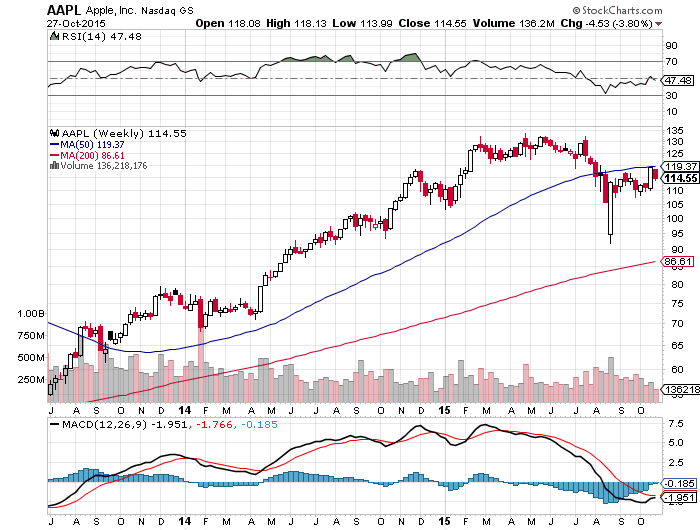

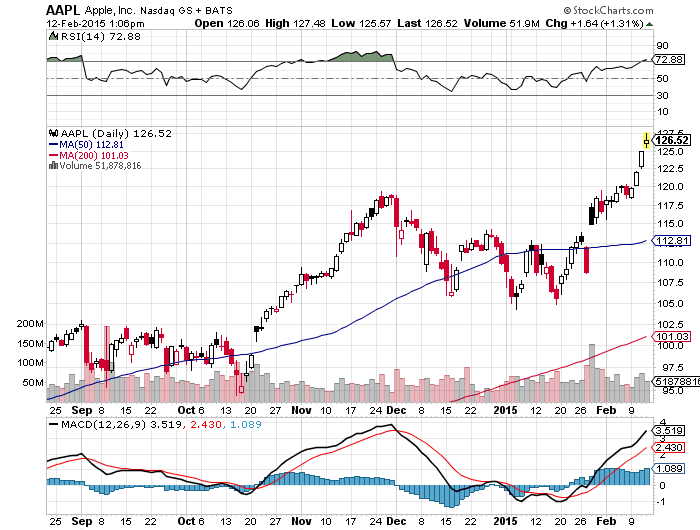

Just prior to Apple’s (AAPL) earnings, a few weeks ago, I have suggested that Apple’s stock price was building a perfect wedge pattern. Here is that article/chart Apple (AAPL) Hits An Important Technical Juncture – What Will It Do Next?

![]()

And that is where it gets interesting.

Earlier today Apple’s stock price took out an important wedge support level located at around $92 a share. Not by very much, by about $2.50, but the break was important enough. It suggests, once the stock price follows through, that Apple’s stock price has quite a bit more downside ahead. To the tune of $40-50 per share if we take typical wedge pattern characteristics into consideration.

Impossible?

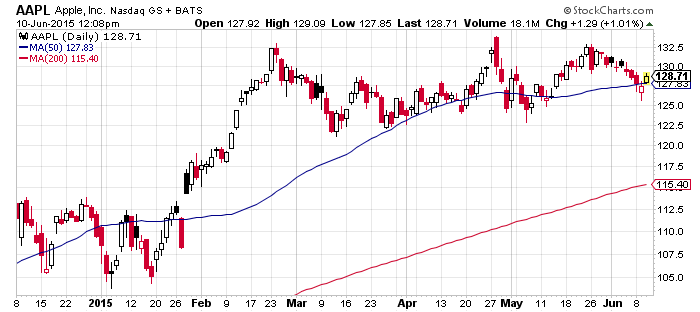

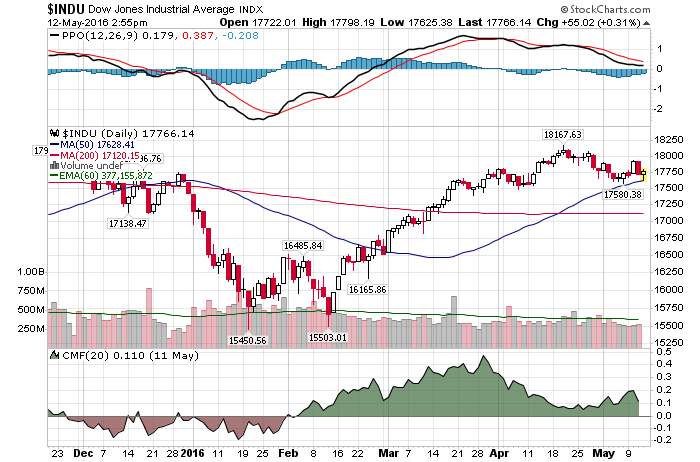

About a year ago, Twitter (TWTR) had a very similar setup. I wrote about it here Why Twitter (TWTR) Should Go On Your “Stocks To Short” List and here Twitter (TWTR) Is Breaking Down. Is Social Media On Death’s Door?

Here is that chart. Please note, once Twitter broke below wedge support, something Apple did today, it proceeded to collapse over 50%.![]()

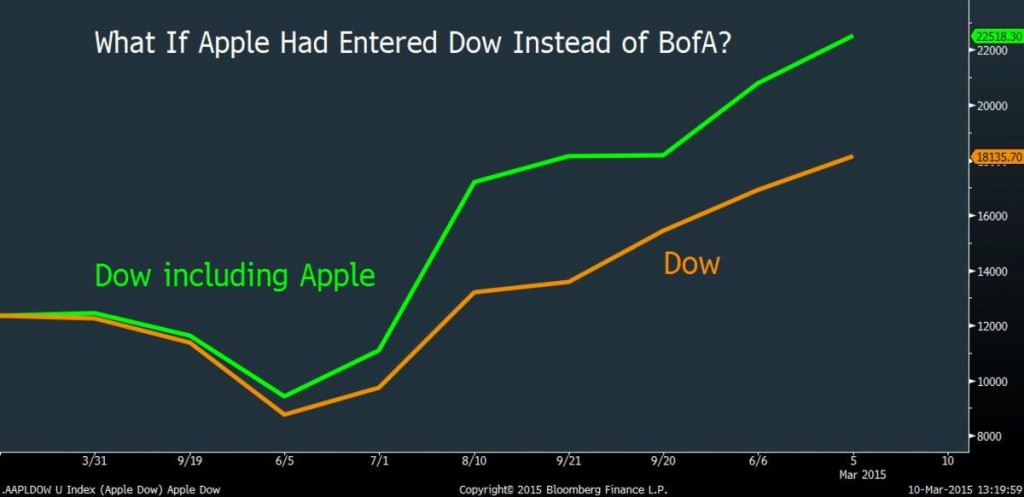

And this is where it gets even more interesting. No one cares about Twitter and everyone cares about Apple. You can say that Apple’s (AAPL) stock price is the existential representation of the overall bull market from 2009 lows. And as I have said so many times before, as goes the Apple, the market will follow.

Can today’s technical breakdown be repaired?

Most certainly, but I must be honest, recent price action doesn’t look good for Apple’s stock price. Nor for the overall market.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. May 12th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!