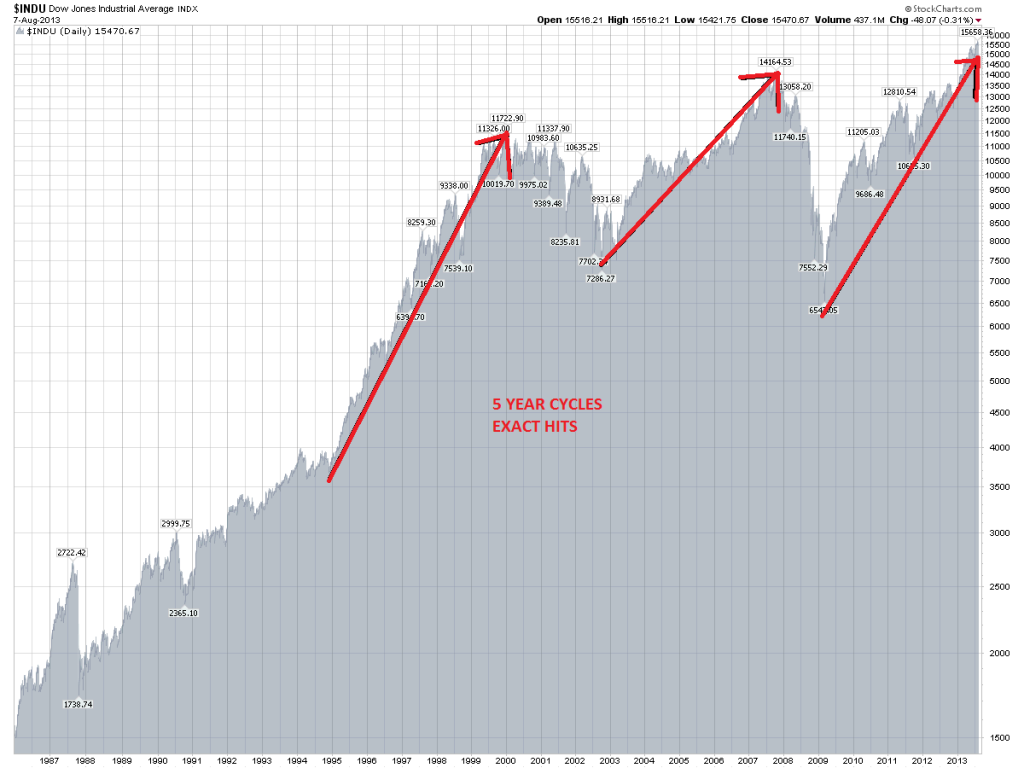

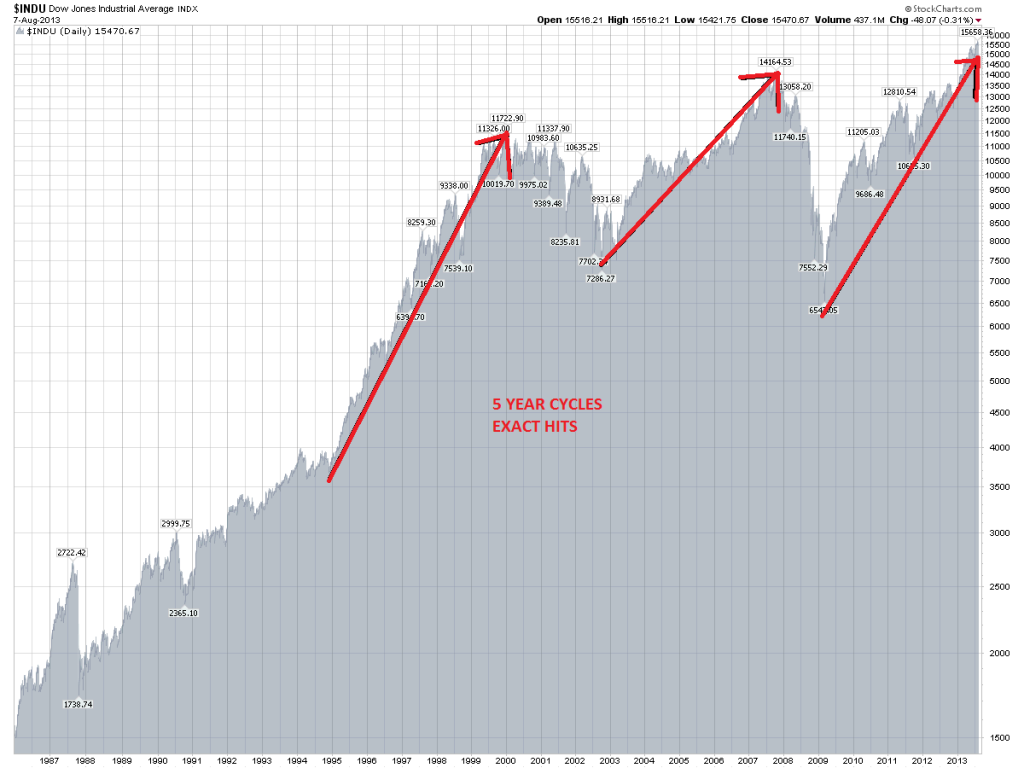

There is a prominent 5 Year stock market cycle that oscillates between the bull and the bear markets. While the cycle does show up as a bear cycle at various points, for the most part this cycle is more clearly identifiable during the bull stage. Let’s take a quick look. More importantly, let’s see what does this cycle can tell us about the future. (We are looking at the DOW)

- 1982-1987 From 1982 bear market bottom to pre crash 1987 the cycle lasted exactly 263 week and moved up 1977 points. That is exactly 5 Years + 10 trading days.

- 1994-2000 From 1994 bottom on 11/23/1994 to 01/14/2000 the market advanced 8296 points in exactly 1298 trading days. So, this cycle lasted 5 Years +32 trading days.

- 2002-2007 From 2002 bottom on 10/10/2002 to 10/11/2007 top the market advanced 7209 points in exactly 1259 trading days or EXACTLY 5 years.

- 2009-2013/14 From 2009 bottom on 03/06/2009 to 9/18/2013 (or march 2014) the market advanced 9241 points in 1144 days (so far).

AMAZING, isn’t it? I mean we are talking about exact hits. Bottom to top. If you go back and study the market before 1982 you will find the same cycle showing up again and again. The slight deviation by a few trading days at the end of each cycle is caused by other cycles arriving around the same time. Just by knowing this one 5 year cycle you can predict what the market will do and beat 95% of the pros.

Now, let me warn you. This cycle is not as easy as just timing the 5 year period of time. There is something behind the scenes that causes this cycle to happen. As of right now, I cannot discuss what causes this in the public forum, but the chart above doesn’t lie. Just more prove that the market can be predicted to the day.

I confirm that another 5 year cycle has indeed started at March 2009 bottom. It is due to complete in March of 2014. However, my other work is showing that the DOW has probably already topped in September of 2013. There is a lot of interference right now.

As such, this leads me to believe that the DOW will oscillate here over the next few months until some sort of a top is set in March of 2014 (maybe a little bit higher or lower than September 2013 top). Thereafter, the market should resume its bear market and go down hard into the 2016/17 lows.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

The Secret 5 Year Stock Market Cycle and What It Is Predicting For 2014

The Secret 5 Year Stock Market Cycle and What It Is Predicting For 2014