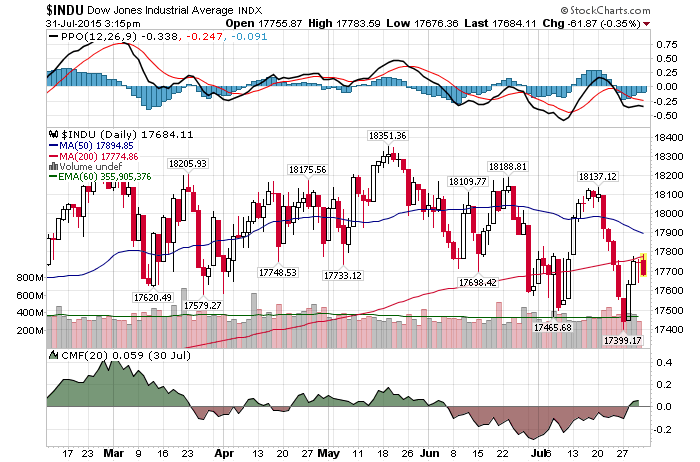

7/31/2015 – A negative day with Dow Jones down 55 points (-0.31%) and the Nasdaq down 1 point (-0.01%)

Instead of complaining about today’s valuation levels, allow me to illustrate to you just how accurate our timing and mathematical work can be. Not always, but often enough. If you would like to find out what the market will do next, please Click Here.

Long story short, in my weekly update to my subscribers I have suggested that the market was about to bottom on July 28th (+/- 1 trading day) and then bounce. Prior to Monday’s opening I have indicated that we were about to put in a bottom at the open and then reverse (see below). At 17,425 (+/- 25 points).

We did just that 15 minutes into trading. I personally reversed my short position into a long position just 20 Dow points shy of the actual bottom at 17,399 ( in the final analysis our forecast missed by 1 point – outside of our range). Again, if you would like to find out what the market will do next, please Click Here.

MONDAY, JULY 27TH, 2015 – INTRADAY UPDATES.

(XXXX – Information not available in a free public forum).

PRE-MARKET: An incredibly important update to layer on top of our weekly update. I have spent the weekend re-calculating everything. Here are my findings.

- My original elliptical termination date of XXXX is still valid or just as valid as our XXXX date. We are dealing with a margin of error there. Meaning, once we bounce of off proposed bottom here, we should ………XXXX.

- My July 28th (+/- 1 trading day) TIME turning point is likely to arrive TODAY. In fact, I will put the probability of that happening at 75%.

- My extremely short-term work (which is more prone to error) suggests that we will see a short-term bottom here about 3 hours into trading or about 12:30 PM EST.

WHERE? My primary candidate right now or the best mathematical point is located at 17,425 (+/- 25 points). It is a strong, but a dirty point. Meaning, it can literally be anywhere within that range.

Elliptical support is at around 17,250 today. So, if you reverse into a long position, as I personally plan to do, you risk or opportunity cost should be around 200 Dow points. My advice, in terms of long-term or short-term investors remains intact here. ………. XXXX…………..., then………

My plan: I will attempt to reverse into a long position for this proposed bounce into…. XXXX. I will be running short-term calculations extensively throughout the day, in an attempt to identify the exact bottom, and I will let you know exactly when and where I am pulling the trigger.

Stay tuned. I should be commenting extensively today.

Finally, I will simply reverse from 100% short to 100% long DIA. Plus, get some call options with the profit I have just generated (very small allocation – as described in our weekly update). I will allocate 20% such profit to the “in the money November 2015 DIA call options”. If this doesn’t make sense, see weekly update TRADING section.

****CRITICAL – PRE-MARKET 2: It appears we might open right into our target of 17,425. My thinking is, the market will bounce and then come back to test this level again to slightly lower about 2.5-3 hours into trading. With that said, if we slam right into 17,425 or lower at the open, I will execute the trade above. In case the market decides to start its bounce right thereafter. I will do that as soon as a down move stops and the market begins to bounce. I will not pull the trigger for as long as the market sells-off. Even if it goes below 17,400. Stay tuned.

9:45 AM EST: I executed all of my buy/sell orders when we hit 17,425 and DIA equivalent. I am now 100% long + some call options. I will outline all trades in our daily update.

10:15 AM EST Thus far, we have tested price support. However, my short-term TIME cycle has not arrived yet. It will in about 1.5-2 hours. That suggests we might re-test the lows at that point. That might be the last opportunity (if it arrives) to trade right at the proposed bottom if you haven’t. However, as indicated below….I have already reversed.

11:45 AM EST: My short term TIME turning point arrives over the next 60 minutes. It would be a good place to set in a small double bottom. At the same time, we don’t have to. The bottom can already be in as of this morning. If all of the above and below is true, this might be the last opportunity to reverse and/or go long.

July 27th, 2015: 1:50 PM EST: Considering market action thus far, I have a secondary short-term TIME turning point arriving in the first 60 minutes of trading tomorrow. It is likely we will stay at suppressed levels until then. A double bottom at around 17,399 is likely. Then, our proposed bounce should start.

I think the forecast/trading above and subsequent market action speaks for itself. Just pull up the Dow chart and compare. Also, the Nasdaq bottomed 50 minutes into its trading section the following day. Just as indicated in our 1:50 PM update.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. July 31st, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

My Outrageous Mistake: How We Missed Monday’s Bottom By 1 Point On The Dow Google