By now most bears are a laughing stock of the investment community. After all, nothing can possibly stop this stock market advance. Even though valuations find themselves at historic all time highs.

By now most bears are a laughing stock of the investment community. After all, nothing can possibly stop this stock market advance. Even though valuations find themselves at historic all time highs.

I mean, seriously, even President Trump himself has acknowledged that this market is one directional by taking complete ownership of it. What can possibly go wrong – right?

Well, here are a few reasons you might want to consider.

3 reasons a stock-market correction is coming in late summer or early fall

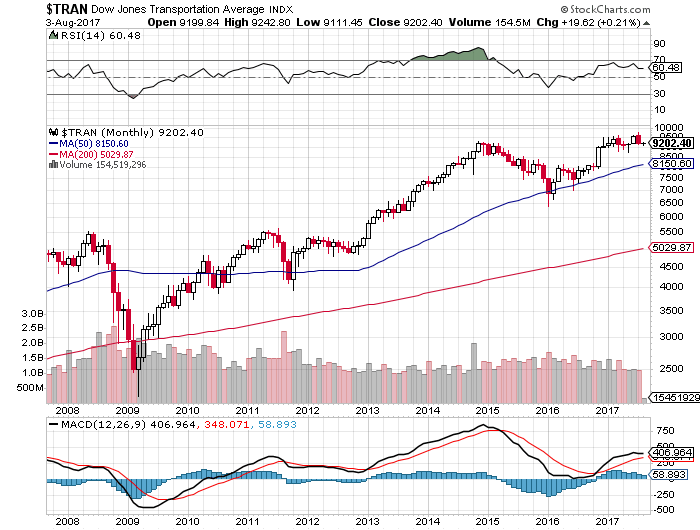

1. The Transports are diverging from the Industrials. (Chart Above)

The Dow Jones Transportation Average DJT, +0.30% is down almost 6% from its mid-July all-time high through Wednesday. That’s no catastrophe, but it’s a striking divergence from the records being clocked by the other major averages. It’s also a warning flag, since Dow Theory holds that the Transports must confirm the Dow Industrials’ move to all-time highs for the bull to continue.

Known as the Dow Theory non-confirmation. Take a look at the chart above. Not only are the Transports not confirming, they have put in a long-term double top formation. Unable to breakout above 2014 highs. This is a very weak formation and something definitely doesn’t smell right here.

2. Earnings aren’t giving stocks the pop they used to.

So far, the second-quarter earnings season has been very good. As of last Friday, 73% of the companies in the S&P 500 that have reported earnings beat Wall Street’s earnings and revenue estimates, according to FactSet. Blended earnings growth is a solid 9.1%.

3. Washington faces big gridlock.

Anyone who thought that Republican control of the White House and both houses of Congress would end Washington gridlock and make the federal government function smoothly must have been smoking something. After the health-care fiasco, how can anyone expect this fractured Congress to do anything big?

We have been discussing this for some time now. It can be argued that the stock market is pricing in a massive tax cut and deregulation. Hence the rally we saw off of November 2016 lows. Yet, and as we have seen thus far, all of that might be nothing but a big pipe dream as President Trump has been unable to get anything of significance passed.

Tax cuts? To be honest I would be surprised if they can get the debt ceiling raised. A major bloodbath associated with Washington’s gridlock might indeed be on the way.Invest accordingly.

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please Click Here.