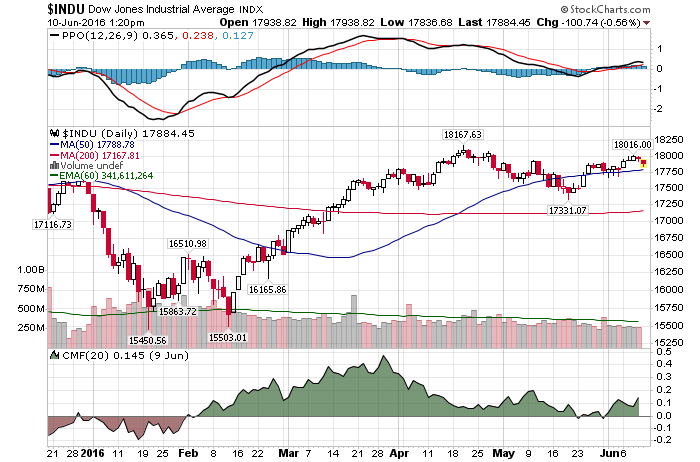

6/10/2016 – A negative day with the Dow Jones down 118 points (-0.66%) and the Nasdaq down 64 points (-1.29%)

The Dow closed today just about where it was on April 1st and well below its lower top achieved on April 20th at 18,168. But you wouldn’t even consider this tight trading range if you have been following mainstream financial media. According to them, new all time highs and a massive breakout rally are just around the corner.

Perhaps.

Here is what’s troubling about all of this. While CNBC’s talking heads continue on with their perpetual pom pom waving exercise, some of the best investors of our time went on to increase their already massive short positions. Icahn, Soros, Rogers, Druckenmiller, etc….. I wrote about this before Icahn, Soros, Rogers, Faber, Druckenmiller All Warned…..No One Paid Attention

Let’s take a look at the latest.

Worried about the outlook for the global economy and concerned that large market shifts may be at hand, the billionaire hedge-fund founder and philanthropist recently directed a series of big, bearish investments, according to people close to the matter.

“I don’t think you can have near zero interest rates for much longer without having these bubbles explode on you,” Icahn did say. “You also need fiscal stimulus from Congress”

“Global yields lowest in 500 years of recorded history,” Gross, 72, wrote Thursday on the Janus Capital Group Inc. Twitter site. “$10 trillion of neg. rate bonds. This is a supernova that will explode one day.”

- Rogers: Jim Rogers’s Shocking Interview

If you participate in financial markets the interview below is a MUST watch. Not only does Jim Rogers talks about a ton of outstanding investment ideas, what the future holds, politics and macroeconomic data, for the first time he acknowledges that war will be the likely outcome of today’s macroeconomic/financial imbalances.

- For God’s sake, even Goldman Sachs is bearish: There’s an elevated risk of a big market selloff

“With the S&P 500 close to all-time highs, stretched valuations and a lack of growth, drawdown risk appears elevated.”

Now, here a billion dollar question. Can all of the above be interpreted as bullish?

At least one man thinks so. Tom Lee: The best investment decisions are characterized by 1 word

One of the lessons I learned over the past 24 years as a research analyst (first job was Kidder Peabody), is the best investment decisions are ‘uncomfortable,‘” Lee said in a note to clients on Friday.

And there is you have it ladies and gentlemen. You can follow the likes of Soros, Icahn, Gross, Rogers, Druckenmiller –OR- you can stand alongside Mr. Lee. An analyst who believes the market will rally. Pushing 10%+ higher by the end of the year because most investors might be “uncomfortable” in going long here.

The choice, as always, is yours. Invest accordingly.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. June 10th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!