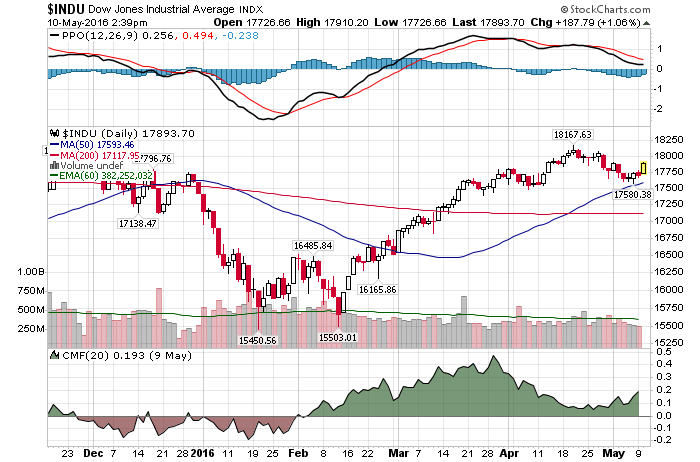

5/10/2016 – A positive day with the Dow Jones up 222 points (+1.26%) and the Nasdaq up 60 points (+1.26%)

When it comes to investing it pays to follow the “smart money” or ultra successful investors with a great track record. With that in mind, consider the following……

That means that the value of Icahn’ s short positions—or financial assets that his funds have borrowed rather than bought—is worth 149% more than the value of his long positions.

Carl Icahn is no longer talking. He is quite literally putting money where his mouth is. And doing so in a big way with 149% net short position. I will tell you this. I would be quite uncomfortable betting against Mr. Icahn here.

Legendary hedge fund manager Stan Druckenmiller laid out a gloomy message for the market at the Sohn Conference last week. The Duquesne Capital founder said that the “bull market has exhausted itself” after eight years of a “radical monetary experiment. The Federal Reserve’s monetary policy over the last eight years has led to “unproductive” and “reckless” corporate behavior, Druckenmiller said. The doves keep asking ‘where is the evidence of mal-investment?’ Druckemiller said. He proceded to show a chart of US non-financials’ year-on-year change in net debt versus operating cash flow, as measured by earnings before interest, tax, depreciation and amortization (Ebitda).

Mr. Druckenmiller has been very vocal over the last few months, warning investors that we are at the end of this crazy FED induced expansionary cycle. A cycle that will implode on itself. I would have to agree with his assessment

“The other day I was watching the stock open up, and it went up on share volumes of a few thousand shares. I mean, every trade was a tick up. That’s not the way it should operate in an honestly or intelligently run exchange. But that’s the thing, all those guys sold their dark pools and their order flow and the positioning on the floors of the servers to the high frequency traders. And it’s made a couple of guys that I’m friendly with very rich because they are high-frequency traders. But don’t respect the activity, and I’m severely critical of it. And I don’t mind saying so, either.”

If you have been investing for 10+ years you know that today’s markets are highly distorted. You might not be able to prove it, nor really explain how it works, but the market is indeed being heavily manipulated. As Steve Wynn explains in the article above. Now, most investors would assume that this brings stability, but they would be wrong. On the contrary, such distortions cause massive volatility spikes when the proverbial “s#&*” hits the fan.

Soros, Rogers and quite a few other successful money managers have expressed similar points of view. The question becomes, have they all suddenly gone insane or are they seeing the exact same thing I have discussed on this blog for over a year?

I will let you decide.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. May 10th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!