The Dow is down 10% or so from its all time high a few weeks ago and most investors are literally losing their minds. So much so that quite a few bullish investors are proclaiming that we have already witnessed a historic crash. Most often followed by “now is the time to buy the dip”.

Here are my favorites……..

- Brainless Traders Are Putting Your Retirement At Risk

- Cramer blames this week’s crazy market on a ‘group of complete morons’ out speculating

This week’s crazy market swings are largely due to a band of uninformed investors who got caught speculating, CNBC’s Jim Cramersaid Thursday. “A group of complete morons” who traded little-known, leveraged products that bet on volatility is “blowing up” everything, Cramer said on “Squawk on the Street.” Cramer has been particularly critical of the VelocityShares Daily Inverse VIX Short-Term exchange-traded note, which is traded under the symbol XIV, and those who put money into it.

Well, there you go ladies and gentlemen. The mystery of today’s apocalyptic 10% stock market “crash” has been solved. Forget historic overvaluation, massive leverage, record setting bullish sentiment, etc… It is all the fault of idiotic bears and volatility traders.

The reality, of course, is entirely different.

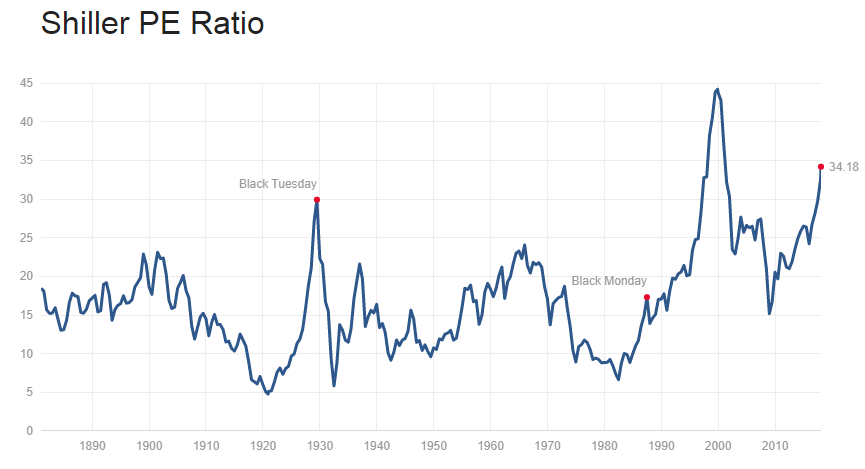

As we have suggested here for months, the stock market has never been more expensive and bullish animal spirits have never been higher. And it all has been financed with a massive infusion of debt in the form of QE and zero interest rates.

As we have suggested here for months, the stock market has never been more expensive and bullish animal spirits have never been higher. And it all has been financed with a massive infusion of debt in the form of QE and zero interest rates.

So much so that for the stock market to return to its median P/E level of around 15 stocks would have to crash 50-60% from today’s levels. And that’s without taking into consideration the impact on earnings.

In other words, bulls can blame moronic bears, volatility traders or the Pope himself, but they haven’t seen a crash yet. They will, but I wouldn’t want to discourage them from BTFD now.

If you would like to find out what the stock market will do next based on our Timing and Mathematical work, please Click Here