State of the Market Address:

State of the Market Address:

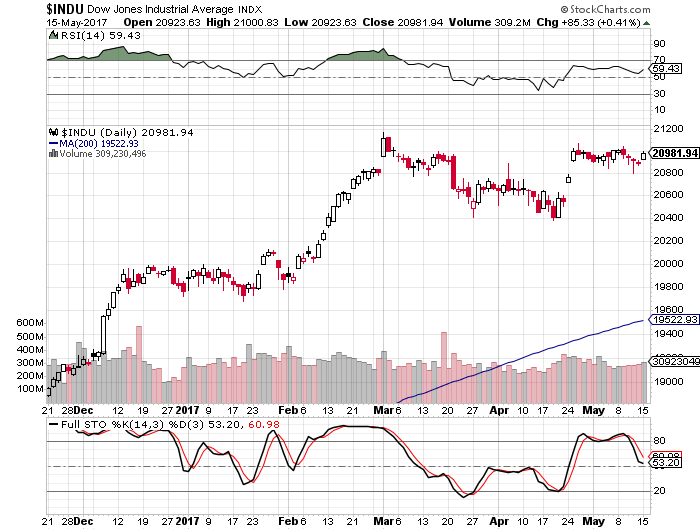

- The Dow remains just below 21,000.

- Shiller’s Adjusted S&P P/E ratio is now at 29.52 Arguably the second highest level in history (if we adjust for 2000 distortions) and right behind 1929 top at 29.55.

- Weekly RSI at 68.43 – remains at overbought levels. Daily RSI is at 59.43 – neutral.

- Prior years corrections terminated at around 200 day moving average. Located at around 17,500 today (on weekly).

- Weekly stochastics at 81.00 – overbought. Daily at 53.20- neutral.

- NYSE McClellan Oscillator is at +3. Neutral.

- VIX/VXX remain near their historic lows. Commercial VIX long interest was slightly higher this week Now at 84K contracts net long.

- Last week’s CTO Reports suggest that commercials (smart money) are shifting their positioning to net short. In fact, short interest further increased as compared to last week. For instance, the Dow is 4X, the S&P is at 2X, Russell 2000 is at 3X and the Nasdaq is at 5X short. That is a significant short position against the market.

In summary: For the time being and long-term, the market remains in a clear bull trend. Yet, a number of longer-term indicators suggest the market might experience a substantial correction ahead. Plus, the “smart money” is positioning for some sort of a sell-off.

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please Click Here.

ATTENTION!!! Please note, we have moved most of our free editorial content to our new website MarketSpartans.com Please Click Here to view it.