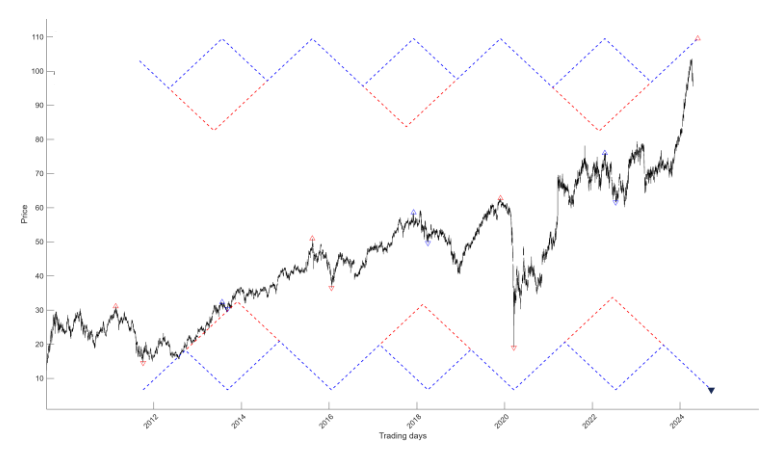

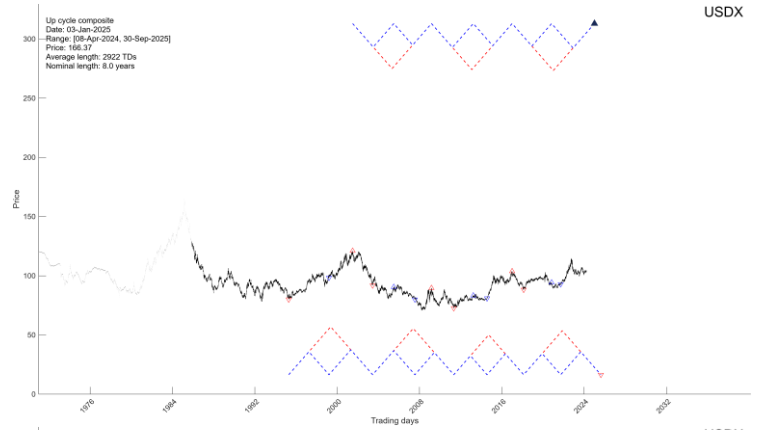

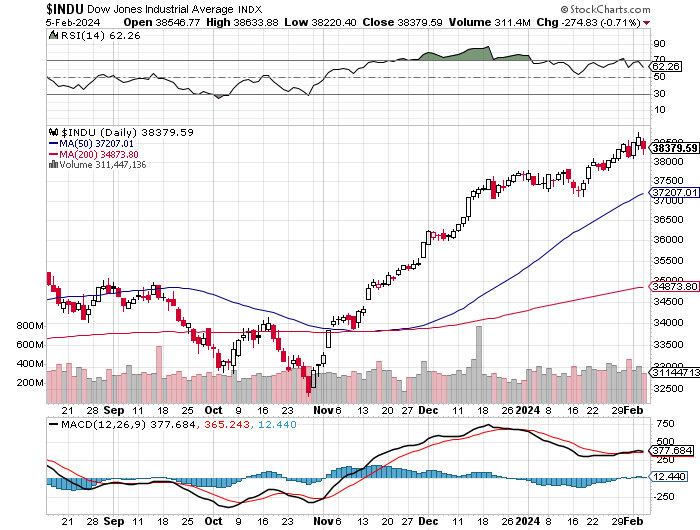

The overall stock market continues to behave as anticipated. If you would like to find out when the stock market will top out, in both price and time, please Click Here.

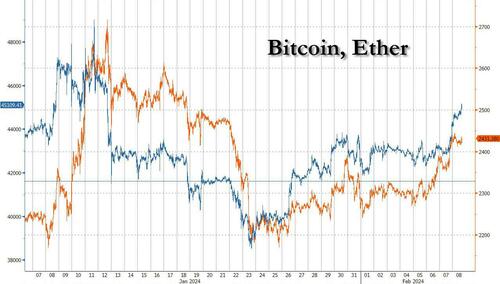

So, picture this: two weeks ago, the crypto world was as confused as a chameleon in a bag of Skittles. Why, you ask? Well, turns out the launch of the long-awaited Bitcoin ETFs triggered a crypto-sell-a-thon of epic proportions. But fear not, dear reader, for we’ve unearthed the culprit behind this digital debacle: none other than the bankrupt FTX, playing a real-life game of “Dump the Assets” with the GBTC Bitcoin Trust.

But hold onto your hats, because amidst the chaos, a glimmer of hope emerged. GBTC outflows slowed down faster than a sloth on a sugar rush, while inflows into new spot Bitcoin ETFs surged like a kid in a candy store. And guess who’s leading the pack? The Fidelity FBTC ETF, raking in a whopping $130 million! That’s more cash than you can shake a blockchain at!

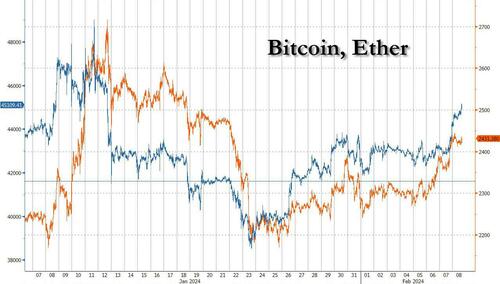

But wait, it gets even better! Bloomberg, the Wall Street oracle, is now singing the praises of ETFs, dubbing them the “chosen ones” with steady inflows. And lo and behold, this morning, Bitcoin strutted its stuff, topping $45,000 for the first time in ages! It’s like watching a digital phoenix rise from the ashes, fueled by the financial fervor of investors with more risk appetite than a goat at a buffet.

And get this: Bitcoin’s dance to the top wasn’t a solo act. It had its trusty sidekick, Ethereum, by its side. Sure, Ether hit a multi-year high of $2700 in January, but then it hit a snag. But fear not, crypto enthusiasts, for Ether is like that sneaky neighbor who always throws the best parties when you least expect it. Standard Chartered predicts it’ll hit $4,000 by May, all thanks to the SEC’s tantalizing promise of Ethereum ETFs.

So, dear reader, buckle up and enjoy the wild ride that is the crypto market. It’s a world where chaos reigns supreme, but every tumble and turn brings with it a hint of hilarity and a sprinkle of hope. After all, in the land of Bitcoin and Ethereum, anything is possible—even if it involves more drama than a soap opera on steroids!

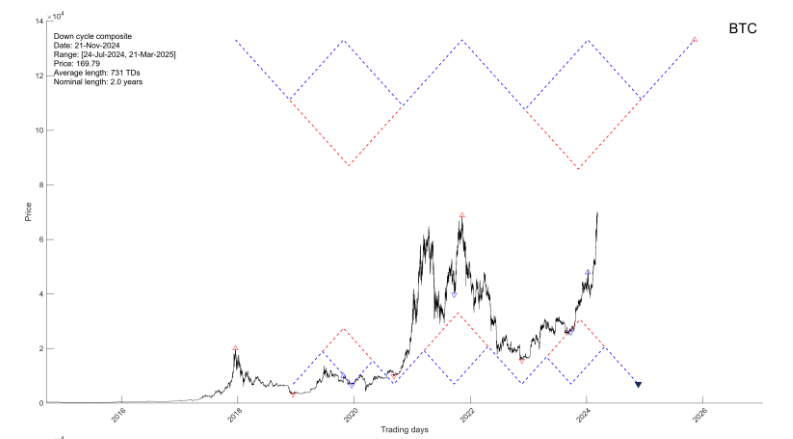

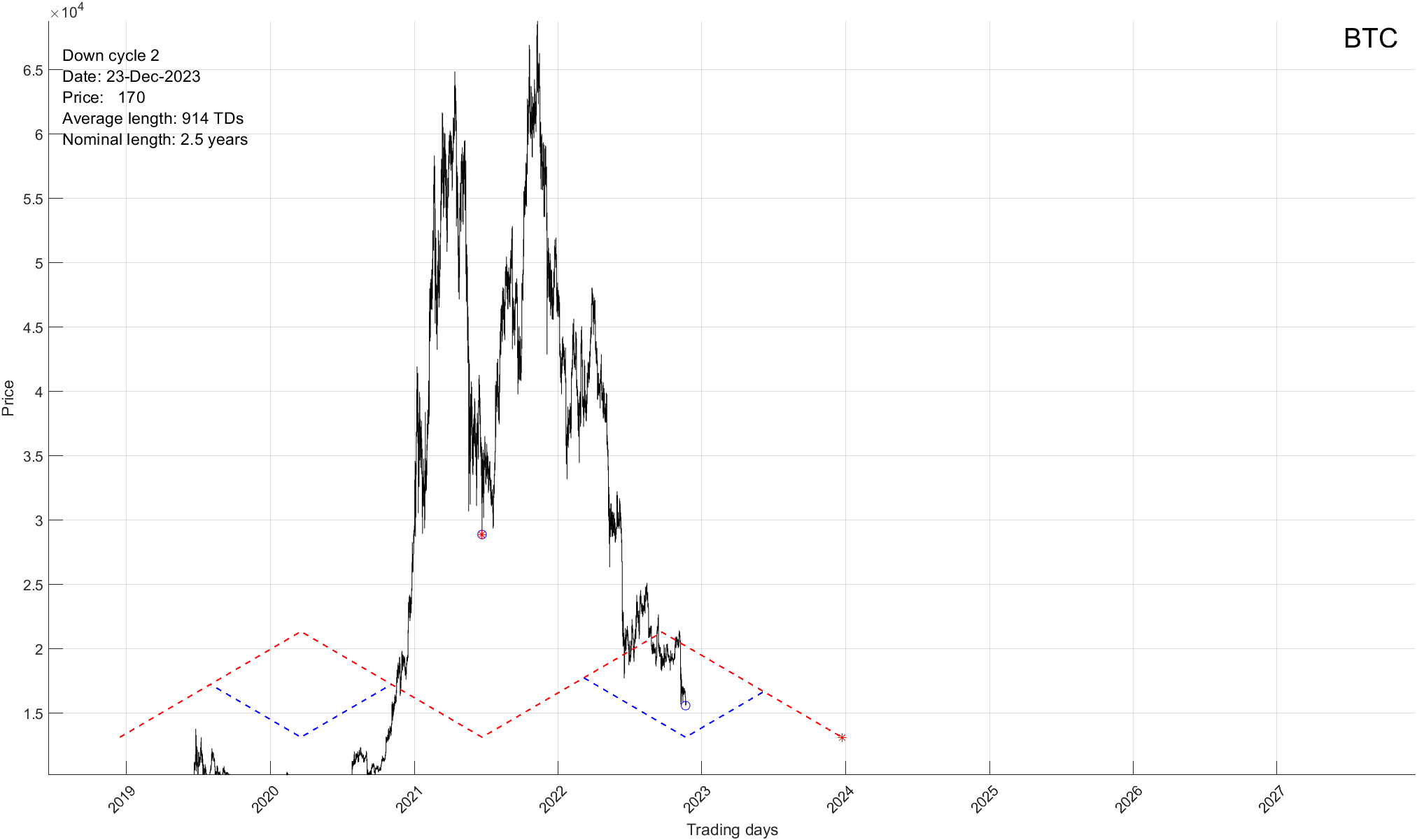

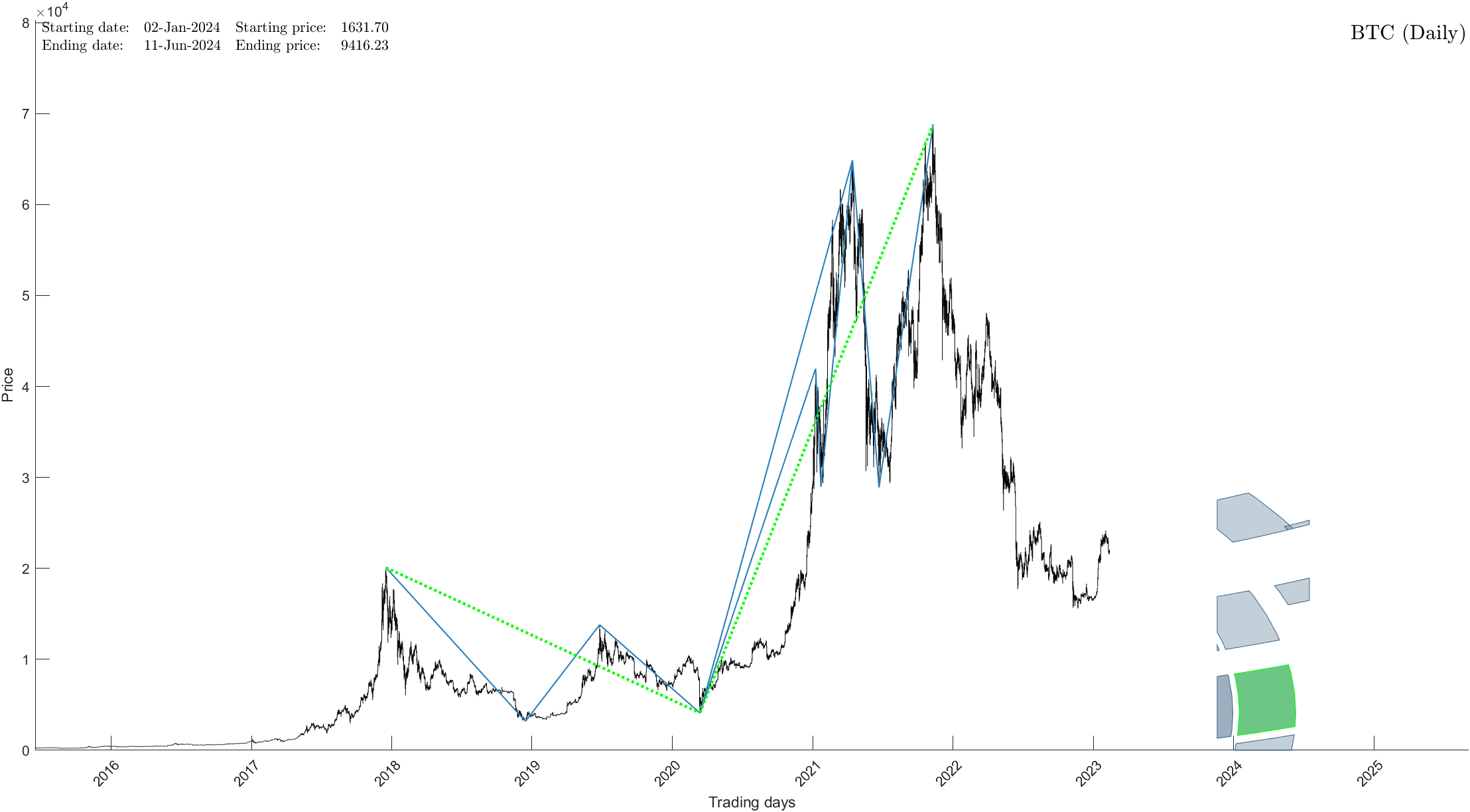

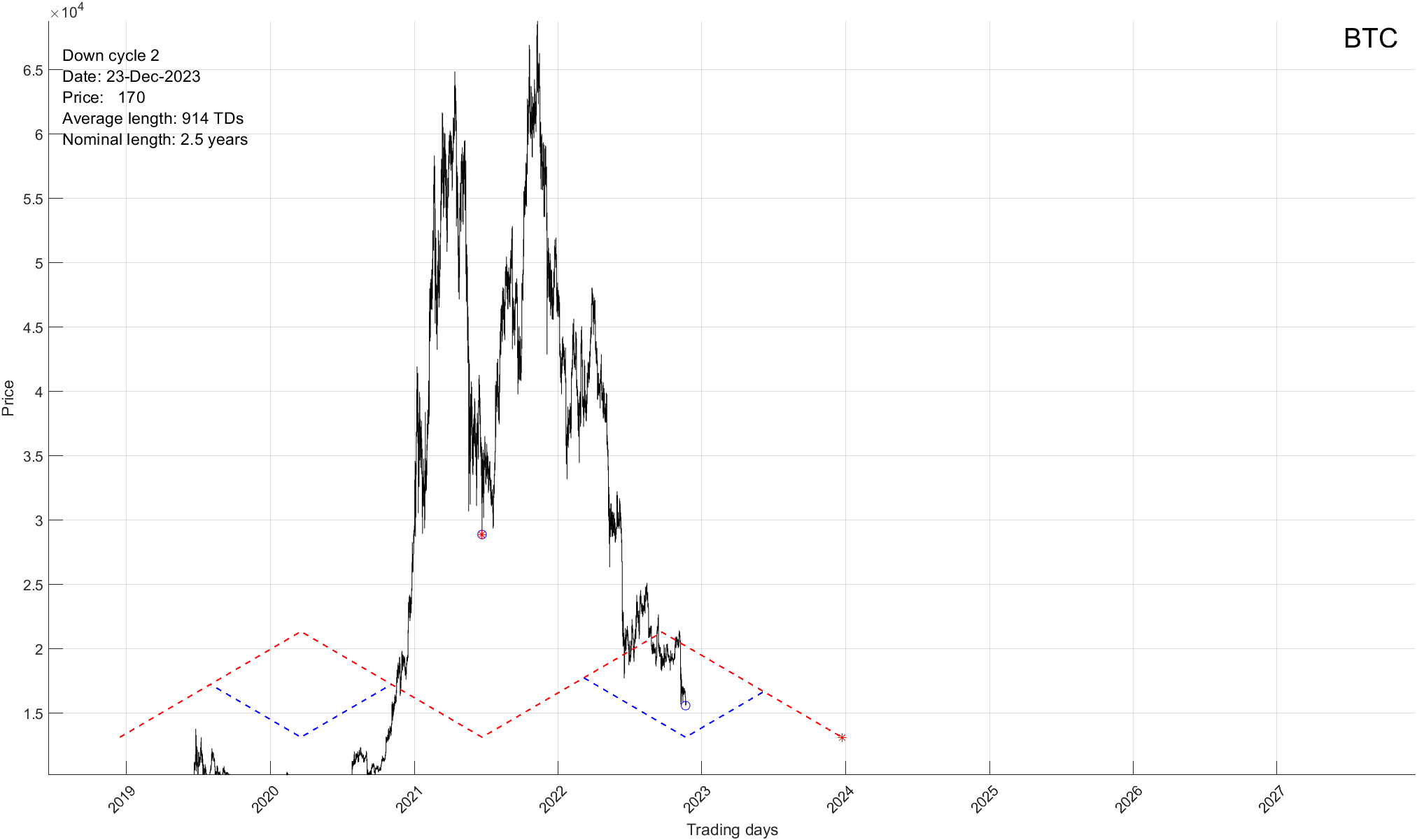

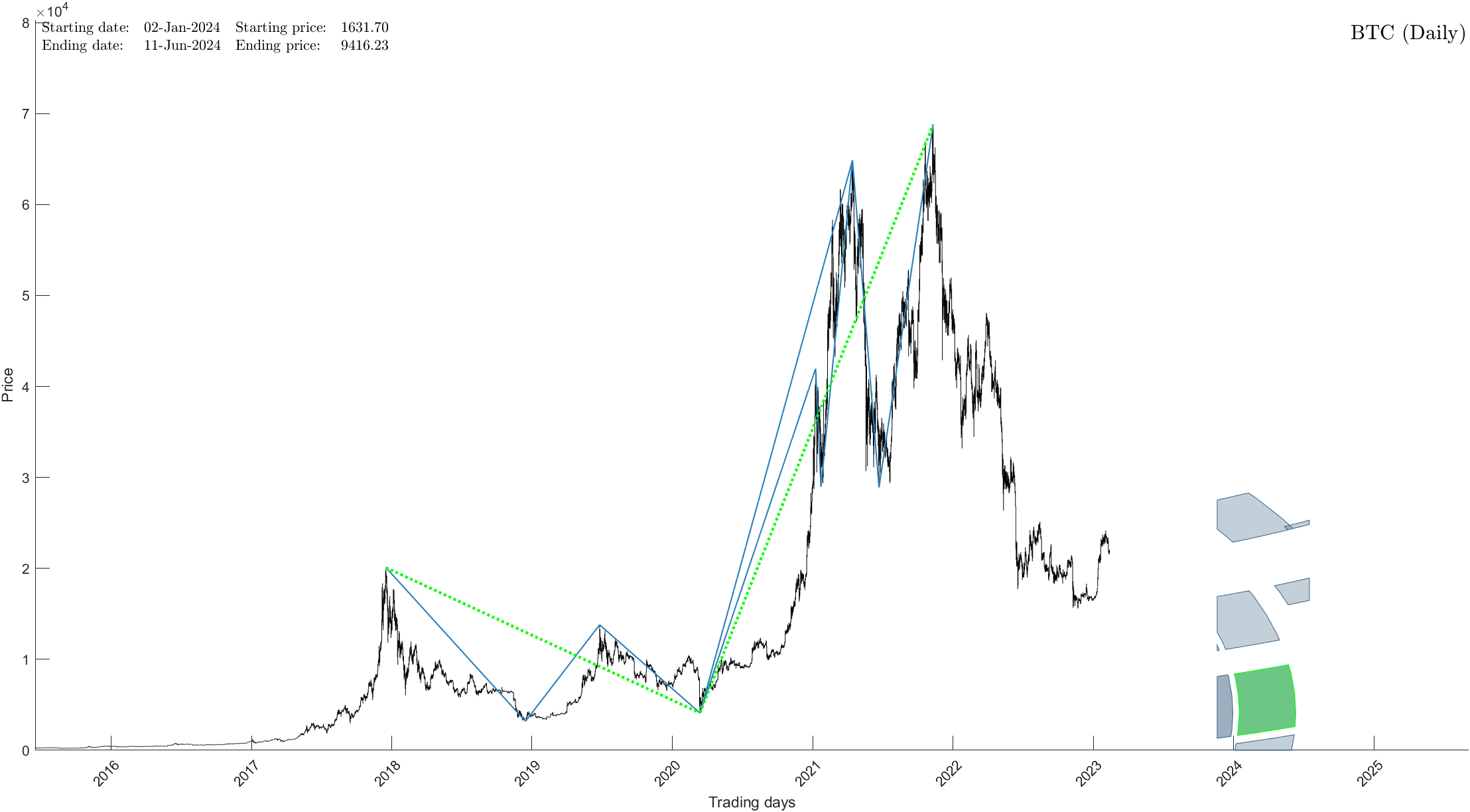

Having said the above, it pays to know exactly what Bitcoin will do going forward. If you would recall, back in February of 2023 we confirmed 2022 bottom and have suggested that BTC would stage a significant bounce, most likely into the 40K range to close prior gap downs.

Yet, the rest of the forecast is where it gets interesting. According to our mathematical time and price calculations BTC hasn’t yet put in a major bottom. Not only that, it is quite a bit lower.

In other words, while the fools are once again projecting Bitcoin to hit $100K and above, you might want to hold off. If you would like to find out what BTC will do next, in both price and time, please Click Here.