According to Bank of America investors are exiting the market in droves.

According to Bank of America investors are exiting the market in droves.

Bank of America: We are witnessing a stock market ‘exodus’

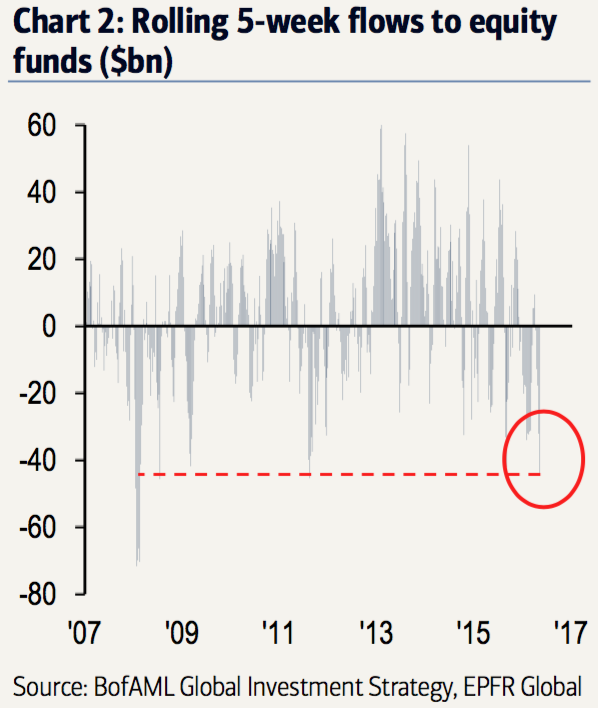

Investors pulled a whopping $44 billion out of the stock market in the past five weeks. BAML’s Michael Hartnett, who characterized this as an “equity exodus,” noted that this was the largest redemption over a 5-week period since August 2011.

So where is that money going?

In the past week, $3.5 billion went into bond funds and $1.0 billion went into precious metals funds, which offer exposure to gold. There was also $10.9 billion poured into money market funds, the largest inflow in 13 weeks.

Here is another interesting fact. As of last week commercials (smart money) have increased their net long VIX exposure to an all time high. As per out weekly COT reports.

And that’s just the start Goldman Sachs downgrades stocks

With stocks selling near historic high valuations levels and considering today’s fundamental backdrop, it is a literal miracle that the stock market is trading where it is today.

As you can imagine, I can keep going with the bearish premise. And there lies the problem.

Everyone is too bearish. Or are they?

The setup above can fire off in one of two ways. We either get a major sell-off in capital markets or the market is able to rally higher, to climb the proverbial wall of worry.

If you would like to find out what it will actually do, based on our timing and mathematical work, please Click Here.