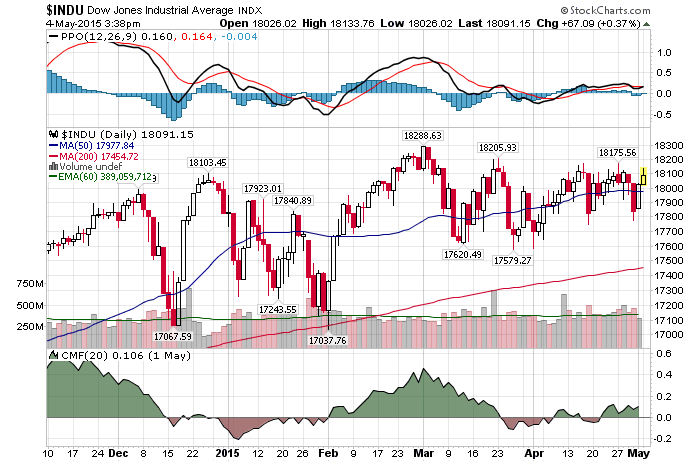

5/4/2015 – A positive day with the Dow Jones up 46 points (0.26%) and the Nasdaq up 11 points (+0.23%).

The overall US Equities market continues to trade within a tight trading range. Arguably, since July 17th of 2014. And while most investors remain ovewhelmingly bullish, quite a few mega investors are sounding an alarm bell. Who is right? Let take a closer look

Bullish Case: Third Point’s Dan Loeb

We remain constructive on the US for three reasons: 1) economic data should improve in the next few quarters; 2) the Fed does not seem to be in any rush to move early and a June rate hike seems unlikely; and 3) while investors are focused solely on the first rate raise, we think the overall path higher will be gradual, in contrast to previous rate shifts. These factors should create an environment where growth improves and monetary policy stays flexible, which is generally good for equities (higher multiples notwithstanding). We may follow last year’s playbook and ignore the old adage to “sell in May and go away.

This is probably one of the better bullish cases that I have seen in quite a long time. Simply put, it makes sense.

Bearish Case: Carl Icahn (Icahn: Junk bonds now ‘even more dangerous’ than stock market)

Money keeps pouring into high-yield bond funds, even though that market is “ridiculously high,” Icahn said. “When they start coming down, there is going to be a great run to the exits,” he added. High-yield is the best performer in U.S. fixed-income returns in the year so far. The billionaire activist investor said he’s “very concerned” about the stock market, and he’s hedged in preparation for a correction. Below are a few other nuggets from his appearance on the show.

That is fairly self-explanatory. So, who is right?

I would have to side with Mr. Icahn, but not for the reasons you might think. When we look at the fundamental variables described above (the FED, interest rates, liquidity, earnings, P/E, growth, etc….), they do not really matter. Don’t get me wrong, they do matter, but not when it comes to timing major turns in the stock market.

As my book Timed Value shows, the market traces out an exact mathematical structure as it moves in 4-Dimensional (or higher) space. What does that mean? It simply means that the market will turn around and initiate its sell-off when the TIME & PRICE are right. Not when fundamental data turns. That is to say, my data is not showing anything positive.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. May 4th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!